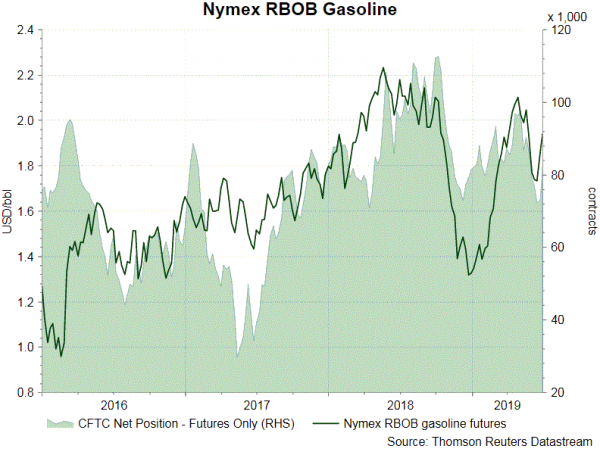

According to the CFTC Commitments of Traders report for the week ended June 25, NET LENGTH for crude oil futures rose +15 716 contracts to 378 803 for the week. Speculative long positions fell -5 808 contracts but shorts declined -21 524 contracts. We expect NET LENGTH to rise further in the coming week. For refined oil products, NET LENGTH for gasoline jumped +9 148 contracts to 82 272, while NET SHORT for heating oil dropped -5 967 contracts to 12 335 for the week. NET SHORT for natural gas futures soared +25 863 contracts to 163 162 contracts for the week.

NET LENGTH of gold and silver futures jumped again last week. NET LENGTH for gold futures surged +32 231 contracts to 236 554. Speculative long positions surged +23 475 contracts, while shorts declined -8 756. Gold price jumped to a fresh 6-month high on on speculations that global central banks might be resuming the monetary easing cycle. For silver futures, speculative long positions gained +4 298 contracts while shorts plunged -11 751. NET LENGTH for silver futures soared +16 049 contracts to 30 565. Silver price jumped to the highest level since early April during the week. For PGMs, NET LENGTH of Nymex platinum futures added +16 contracts to 1 986 while that for palladium increased +644 contracts to 10 849.

NET LENGTH of gold and silver futures jumped again last week. NET LENGTH for gold futures surged +32 231 contracts to 236 554. Speculative long positions surged +23 475 contracts, while shorts declined -8 756. Gold price jumped to a fresh 6-month high on on speculations that global central banks might be resuming the monetary easing cycle. For silver futures, speculative long positions gained +4 298 contracts while shorts plunged -11 751. NET LENGTH for silver futures soared +16 049 contracts to 30 565. Silver price jumped to the highest level since early April during the week. For PGMs, NET LENGTH of Nymex platinum futures added +16 contracts to 1 986 while that for palladium increased +644 contracts to 10 849.