EUR/USD

Current level – 1.1796

After the positive data regarding the U.S. labour market, the euro ended the last trading day with losses which were limited to the support at 1.1776. The pullback is developing according to expectations and bears aren’t looking that much aggressive in their run compared to their first one towards 1.1900. It’s desirable for the market to form a local range above 1.1776. That would signal the bulls’ lasting presence on the market and their readiness to tackle and breach the level of 1.1900. The next resistance above that zone is 1.2000. Key support here is the level around 1.1700, however drops towards 1.1580 are possible. During the upcoming week, the most notable events – the Eurozone GDP change rate (09:00 GMT) and U.S. retail sales (12:30 GMT)– are scheduled for Friday.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1900 | 1.2080 | 1.1776 | 1.1580 |

| 1.2080 | 1.2200 | 1.1694 | 1.1460 |

USD/JPY

Current level – 105.76

In the past week there was a lack of activity in the pair and trading remained limited between the zones of 105.56 and 106.15. The market stands at a turning point, with bearish sentiments being inclined towards a potential re-test of the 104.22 lows. The formed range gives opportunity to shift sentiment, but a breach of 105.56 is needed in order to confirm the bearish bias for a new test of 104.22. In a scenario where bulls bolster their ranks and overtake 106.15, the market would have the potential to retrace the entire move that started from 107.18.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 106.15 | 106.72 | 105.56 | 104.20 |

| 106.72 | 107.18 | 104.88 | 103.10 |

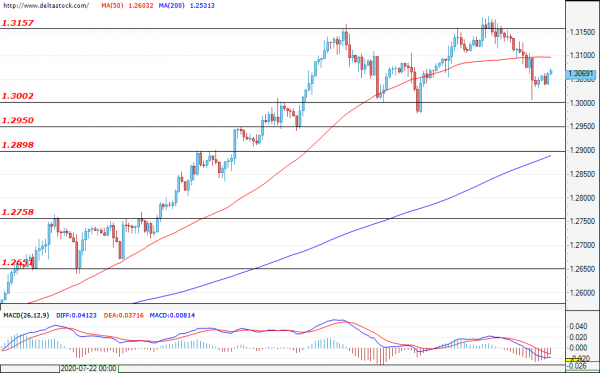

GBP/USD

Current level – 1.3069

The pullback is still in place after a second failed attempt to breach 1.3160. The support for the buyers around 1.3000 proved to be reliable and, for the moment, it’s holding the market. The formation of a small consolidation area around 1.3100 would signal buyers’ intent and readiness to test and potentially breach 1.31600. Key support for the buyers is the level of1.2950. News coming from the UK that could impact the pair are due to be announced on Tuesday at 06:00 GMT (UK claimant count) and Wednesday at 06:00 GMT (UK GDP Change rate). The recent rally was caused by a deteriorating U.S. dollar rather than a strengthening sterling, and for that reason news affecting the Greenback would have a larger effect on the pair.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3160 | 1.3200 | 1.3002 | 1.2898 |

| 1.3160 | 1.3300 | 1.2950 | 1.2758 |