Key Highlights

- GBP/USD climbed towards 1.3240 before correcting lower.

- A major bullish trend line is forming with support near 1.3150 on the 4-hours chart.

- Gold price struggled to recover above $1,900 and it is showing negative signs.

- The US Retail Sales (to be released today) could increase 0.5% in Oct 2020 (MoM), down from +1.9%.

GBP/USD Technical Analysis

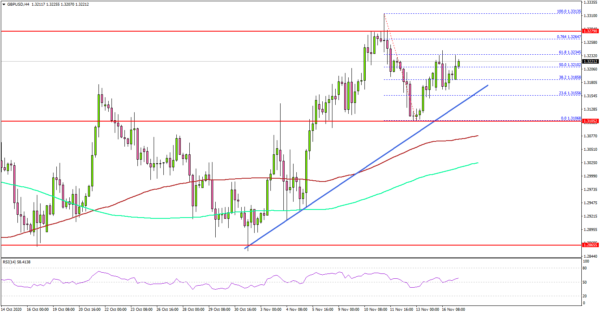

This past week, the British Pound climbed above 1.3300 before correcting lower against the US Dollar. GBP/USD found support near 1.3100 and it is currently struggling to climb above 1.3250.

Looking at the 4-hours chart, the pair found a strong support near the 1.3100 zone (the last breakout zone). The pair also remained well above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

A low was formed near 1.3106 and the pair climbed above 1.3180. The pair even broke the 50% Fib retracement level of the downward move from the 1.3313 high to 1.3106 low.

However, the pair seems to be struggling near the 1.3240-1.3250 zone. It is close to the 61.8% Fib retracement level of the downward move from the 1.3313 high to 1.3106 low. A successful break and close above the 1.3250 level could clear the path for a fresh increase above the 1.3300 zone.

On the downside, there is a major bullish trend line forming with support near 1.3150 on the same chart. If there is a downside break below the trend line, the pair could revisit the 1.3100 support.

Any further losses may perhaps open the doors for a drop towards the 1.3070 support or the 100 simple moving average (red, 4-hours).

Overall, GBP/USD must stay above 1.3100 for a fresh increase towards or above 1.3300. Similarly, EUR/USD must stay above 1.1750 to start a fresh upward move.

Upcoming Economic Releases

- US Retail Sales Oct 2020 (MoM) – Forecast +0.5%, versus +1.9% previous.

- US Industrial Production Oct 2020 (MoM) – Forecast +1.0%, versus -0.6% previous.