EUR/USD

Current level – 1.1875

The uptrend for the currency pair is currently slowing down and the first obstacle is the resistance at around 1.1890. However, the trend seems ready to reverse and the expectations are for a breakout in this area and an attack of the next resistance at around 1.1955. The first daily support the bulls can expect at around 1.1853. If it fails to withstand the bearish pressure, the next one is at 1.1824 – a key area for the evolving movement. Today, no events are expected in the economic calendar that could significantly increase volatility.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1890 | 1.1970 | 1.1853 | 1.1705 |

| 1.1955 | 1.2070 | 1.1772 | 1.1600 |

USD/JPY

Current level – 109.19

The U.S. dollar continues to lose ground against the Japanese yen after the upward move from the end of last week was limited to just below the resistance level at 109.85. A successful breach of the support at 109.55 could boost the sell-off and pave the way for the currency pair towards a test of the next significant support zone at around 109.00. A consolidation of the range movement between 109.00 – 110.75, coming from the higher time frames, is also not excluded.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 109.33 | 110.13 | 109.04 | 108.55 |

| 109.77 | 110.37 | 108.70 | 108.10 |

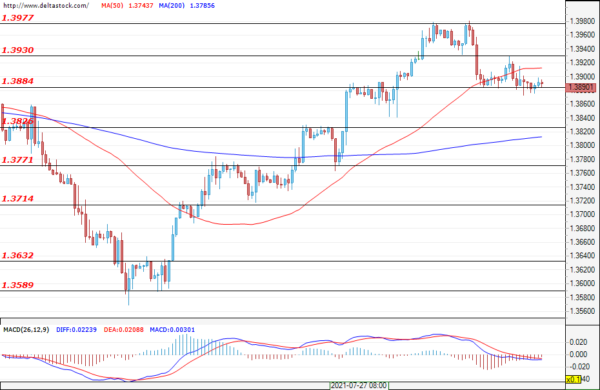

GBP/USD

Current level – 1.3890

The cable slowed its growth and there was a breach in the uptrend after the pair failed to reach a new peak following a test of the support at 1.3884. The market may need more time before it could move forward, but a breach of the 1.3884 support, and a deeper correction towards 1.3826, is also a possible scenario.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3930 | 1.4060 | 1.3884 | 1.3771 |

| 1.3977 | 1.4115 | 1.3826 | 1.3714 |