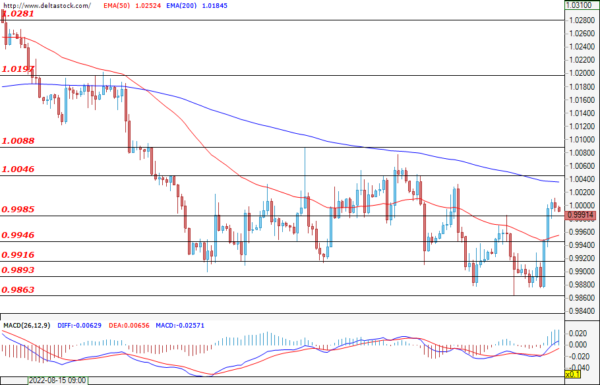

EUR/USD

The single European currency recovered some of its recent losses against the dollar and the price breached the resistance at 0.9985. If the bullish attack continues, then a successful violation on the next target at 1.0046, followed by a breach of the important zone at 1.0088, could easily continue the recovery and strengthen the positive expectations for the future path of the pair. If the bears prevail and manage to violate the zone at 0.9985, which is now acting as support, then they could easily lead the EUR/USD towards a test of the lower level at 0.9916. Important news for investors today will be the expected European Central Bank interest rate decision at 12:15 GMT, as well as the data оn the U.S. initial jobless claims later at 12:30 GMT.

USD/JPY

The historic appreciation of the dollar against the yen continued yesterday, and after the test of the important zone at 144.94, the price consolidated around the current level of 144.24. If the positive sentiment remains unchanged, then a new attack on the high at 145.00 could be the most probable scenario. A successful breach here could easily lead to new gains and could head the USD/JPY towards levels at around 146.60. The first support for the bears could be found at 143.05. A potential deeper correction is expected to remain limited to 140.64.

GBP/USD

The bearish momentum faded, and after the unsuccessful test of the low at 1.1441, the Cable appreciated. During the early hours of today`s trading, the price is hovering above the zone at 1.1497, and if the bulls prevail, then a successful attempt for a violation of the higher resistance at 1.1600 could easily head the pair towards the local high at 1.1711 and could lead to a change in the current sentiment of the market participants. If the bears instead re-enter the market, their first target would be the mentioned level at 1.1497. A breach of the lower zone at 1.1441 could mark the current move as corrective and could lead to a continuation of the pound sell-off against the dollar.

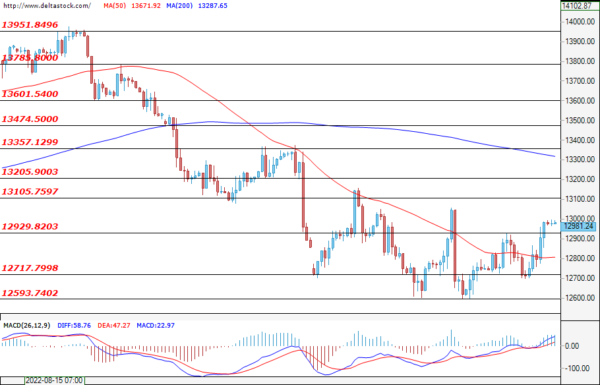

EUGERMANY40

The support zone at 12717 successfully withheld the bearish attack and the German index recovered some of its recent losses. The price breached the close resistance at 12929, and at the time of writing the analysis, it has consolidated around the psychological level at 13000. A violation of the next target at 13105, followed by a breach of 13205, could easily lead to a rally and could pave the way for a test of the important zone at 13357. If the bears re-enter and manage to overcome the support at 19929, then a test of the lower zone at 12717 could be a highly probable scenario, but only a successful attempt and а breach of the low at 12593 could strengthen the negative expectations for the future path of the EUGERMANY40 and could deepen the depreciation towards 12400.

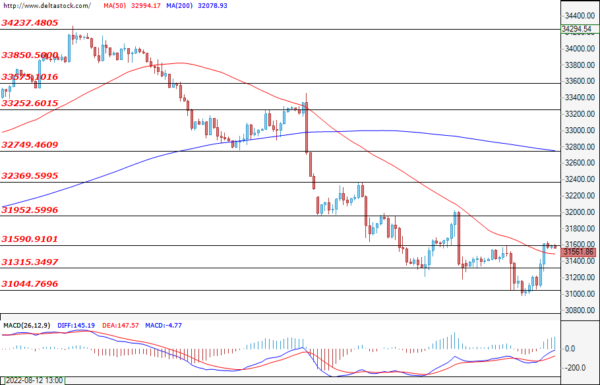

US30

As with the other world leading indices, the US30 also appreciated, and during the early hours of today, the price is holding positions around the resistance zone at 31590. A confirmed breach for the bulls, followed by a violation of the upper target at 31952, could lead to a continuation of the recovery and could head the index for a test of the major zone at 32369. Worse-than-expected data in the U.S. for its initial jobless claims (today; 12:30 GMT) could help the bears prevail. Their first support can be found at the zone of 31315. A successful violation of the lower target at 31044 could deepen the decline and could easily lead to future losses for the index.