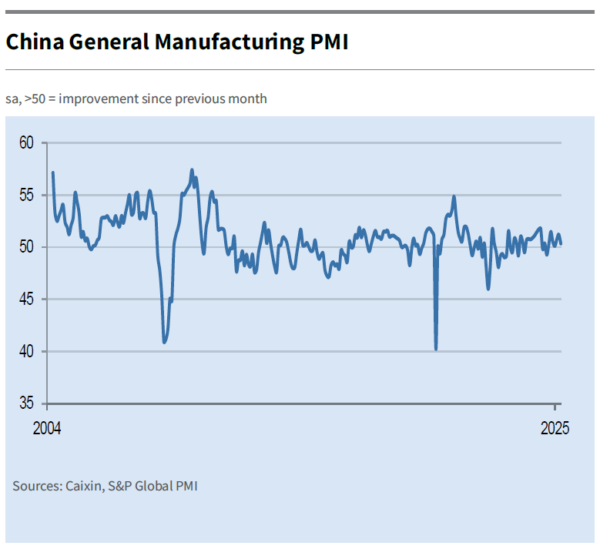

China’s factory activity slumped sharply in April as official NBS Manufacturing PMI dropped from 50.5 to 49.0, its lowest level since December 2023 and below expectations of 49.9. Non-manufacturing PMI also weakened from 50.8 to 50.4.

The decline points to early signs of strain from escalating trade tensions, with NBS citing “sharp changes in the external environment” as a key driver.

Private-sector data painted a similarly cautious picture. Caixin Manufacturing PMI dropped to 50.4, its lowest in three months and just narrowly remaining in expansion.

Caixin’s Senior Economist Wang Zhe noted that while production and demand grew modestly, the pace has slowed and forward-looking optimism weakened significantly—plunging to the third-lowest level ever recorded. Trade-related uncertainty was a key concern for firms, weighing heavily on sentiment despite hopes for more policy support.

The April PMIs point to early-stage fallout from the China-US tariff standoff. Businesses are already reporting shrinking employment, delayed logistics, and inventory drawdowns. With both consumer and business confidence faltering, the government faces growing pressure to deploy stimulus measures. Unless domestic demand recovers and external risks subside, China’s economy could face more headwinds in Q2 and beyond.