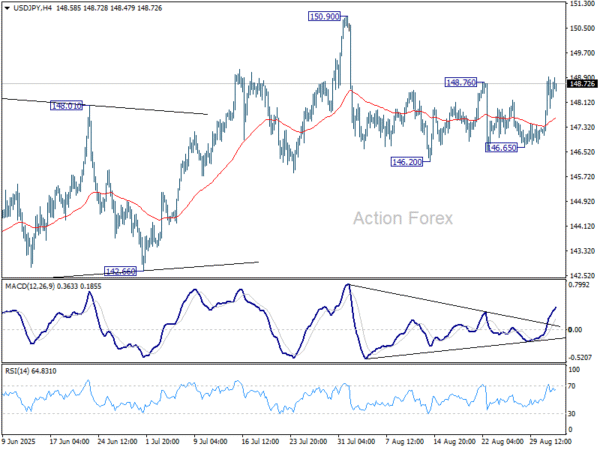

Daily Pivots: (S1) 147.28; (P) 148.11; (R1) 149.17; More…

Intraday bias in USD/JPY remains mildly on the upside at this point. Pullback from 150.90 could have completed after drawing support from 55 D EMA (now at 147.06). Further rise would be seen to 150.90, and then 151.22 fibonacci level. Firm break there will carry larger bullish implication. On the downside, however, break of 146.65 support will resume the decline from 150.90 through 146.20 instead.

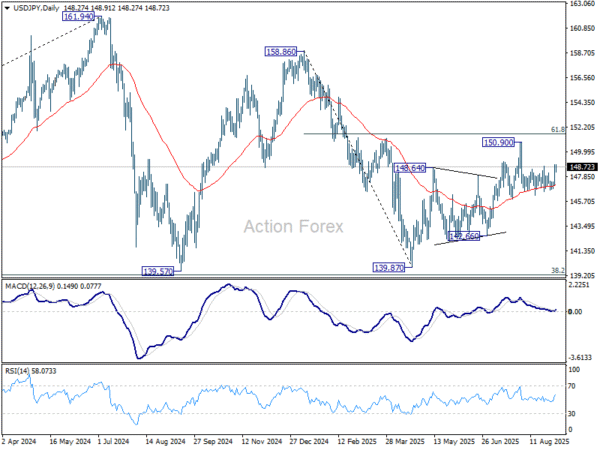

In the bigger picture, price actions from 161.94 (2024 high) are seen as a corrective pattern to rise from 102.58 (2021 low). Decisive break of 61.8% retracement of 158.86 to 139.87 at 151.22 will argue that it has already completed with three waves at 139.87. Larger up trend might then be ready to resume through 161.94 high. In case the corrective pattern extends with another fall, strong support is expected from 38.2% retracement of 102.58 to 161.94 at 139.26 to bring rebound.