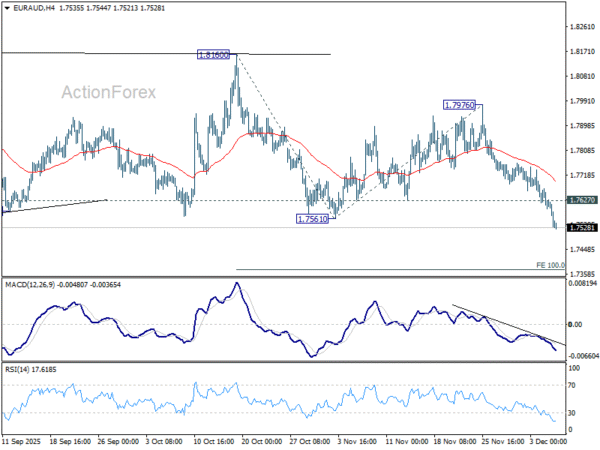

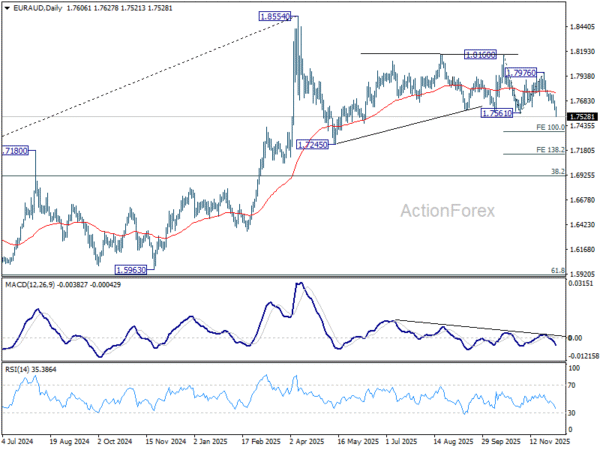

EUR/AUD’s steep decline and solid break of 1.7561 support confirms resumption of fall from 1.8160. More importantly the whole pattern from 1.8554 should now be in its third leg. Initial bias stays on the downside this week for 100% projection of 1.8160 to 1.7561 from 1.7976 at 1.7377. Firm break there will pave the way to 138.2% projection at 17148. On the upside, above 1.7627 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

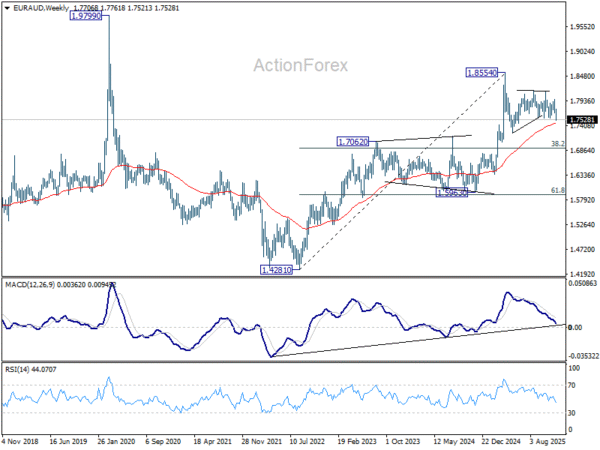

In the bigger picture, as long as 55 W EMA (now at 1.7449) holds, price actions from 1.8554 could still be a correction to rise from 1.5963 only. However, sustained break of the EMA will argue that it’s already correcting the whole up trend from 1.4281 (2022 low). In this case, deeper decline would be seen to 38.2% retracement of 1.4281 to 1.8554 at 1.6922.

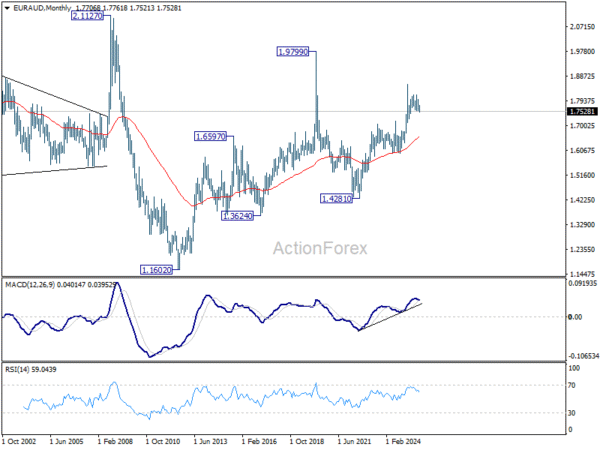

In the longer term picture, rise from 1.4281 is seen as the second leg of the pattern from 1.9799 (2020 high), which is part of the pattern from 2.1127 (2008 high). As long as 55 M EMA (now at 1.6579) holds, this second leg could still extend higher.