Dollar trades notably lower in early US session despite stronger than expected headline NFP number. The rise in unemployment rate and slower than expected wage growth could be the factors. But it’s more likely just continuing this week’s pull back after NFP risk is cleared. Yen is following as the second weakest one for today. Meanwhile, Aussie and Kiwi are trading as the strongest, followed by Euro.

Non-farm payroll report showed 213k growth in June, above expectation of 190k. Prior month’s figure was revised up from 223k to 244k. Unemployment rate rose to 4.0%, up from 3.8%. But that’s mainly thanks to rise in participation rate from 62.7% to 62.9%. Wage growth was a miss though as average hourly earnings rose 0.2% mom versus expectation of 0.3% mom. Also from the US, trade deficit narrowed slightly to USD -43.1B in May.

From Canada, the employment market rose 31.8k in June, above expectation of 24.0k. Unemployment rate rose to 6.0%, up from 5.8%. Also, that’s due to rise in participation rate from 65.3% to 65.5%. Trade deficit widened to CAD -2.8B in May.

Released earlier today, Swiss foreign currency reserves rose to CHF 749B in June. German industrial production rose 2.6% mom in May. Japan leading index rose to 106.9 in May. Japan household spending dropped -3.9% yoy in May, labor cash earnings rose 2.1% yoy.

Chinese Premier Li: Trade war is never a solution

In response to the start of US section 301 tariffs on USD 34B in Chinese import, Chinese Foreign Ministry spokesman Lu Kang said in a daily media briefing that “after the United States unfairly raised tariffs against China, China immediately put into effect raised tariffs on some U.S. goods.” Lu also reiterated that “On the specifics of the trade issue, from the start China’s position has been very clear and consistent. The United States at all levels is very clear on China’s position,”

Commenting on the issue, Chinese Premier Li Keqiang said in Bulgaria that trade war is “never a solution” and there will be no winner. And, “it benefits no one and it would undermine the multilateral free trade process,” he said. “If one insists on waging a trade war it would hurt others and themselves.” He reiterated that China is committed to further opening up its markets. But, “if any party resorts to increase of tariffs, china would take measures in response to protect china development interests and safeguard multilateral trade regime and rules.”

Trump threatens tariffs on USD 500B of Chinese goods

US Section 301 tariffs on USD 34B of Chinese imports takes effect today. Ahead of that, Trump raised his threat again and warned of tariffs on up to USD 500B of Chinese goods. He told reports that “you have another 16 (billion dollars) in two weeks, and then, as you know, we have $200 billion in abeyance and then after the $200 billion, we have $300 billion in abeyance. Ok? So we have 50 plus 200 plus almost 300.”

Japan cabinet revised down fiscal 2018 growth forecast

Japan Cabinet Office presented new economic projections at the Council on Economic Fiscal Policy today.

For current fiscal 2018, the economy is projected to grow 1.5% in real term. That’s a downgrade from prior projection of 1.8%, down at the start of the year. In nominal terms, the economy is projected to grow 1.7%, sharply lower from prior forecast of 2.5%, due partly to slowdown in property investment.

The office forecasts the economy to grow 1.5% in the fiscal-2019, in price adjusted real terms. That’s after adjustment to the planned sales tax hike in October 2019. In nominal term, GDP is projected to grow 2.8%.

For the current fiscal 2018, overall CPI is projected to be at 1.1%, unchanged from prior estimate. Overall price CPI is forecast to rise 1.5% in fiscal 2019. With adjustment on the sales tax hike, overall CPI is projected to slow to 1.0%.

EUR/USD Mid-Day Outlook

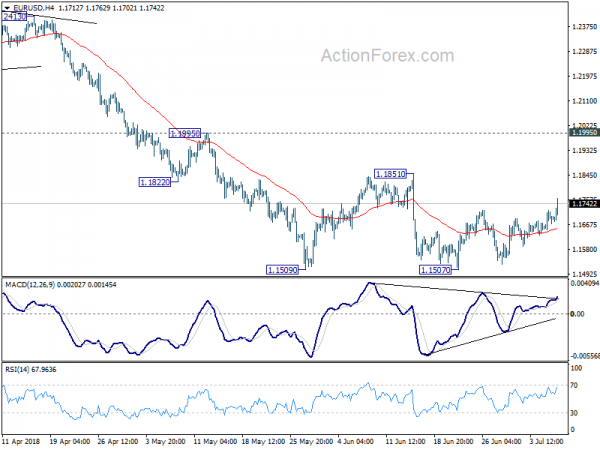

Daily Pivots: (S1) 1.1654; (P) 1.1687 (R1) 1.1726; More…..

EUR/USD”s rebound extends to as high as 1.1762 so far today. Intraday bias is mildly on the upside for further rise. Still, price actions from 1.1507 are seen as a correction. Hence, upside should be limited by 1.1851 resistance to bring fall resumption eventually. The larger decline from 1.2555 is expected to resume sooner or later. Firm break of 1.1507 will target 50% retracement of 1.0339 to 1.2555 at 1.1447 and then 61.8% retracement at 1.1186.

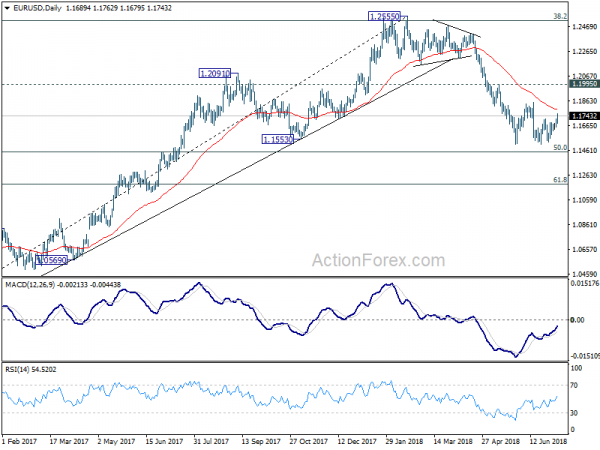

In the bigger picture, EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Household Spending Y/Y May | -3.90% | -1.50% | -1.30% | |

| 00:00 | JPY | Labor Cash Earnings Y/Y May | 2.10% | 0.90% | 0.80% | 0.60% |

| 05:00 | JPY | Leading Index CI May P | 106.90% | 106.50% | 106.20% | |

| 06:00 | EUR | German Industrial Production M/M May | 2.60% | 0.30% | -1.00% | -1.30% |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jun | 749B | 741B | ||

| 12:30 | CAD | Net Change in Employment Jun | 31.8K | 24.0K | -7.5K | |

| 12:30 | CAD | Unemployment Rate Jun | 6.00% | 5.80% | 5.80% | |

| 12:30 | CAD | International Merchandise Trade (CAD) May | -2.8B | -3.6B | -1.9B | |

| 12:30 | USD | Change in Non-farm Payrolls Jun | 213K | 190K | 223K | 244K |

| 12:30 | USD | Unemployment Rate Jun | 4.00% | 3.80% | 3.80% | |

| 12:30 | USD | Average Hourly Earnings M/M Jun | 0.20% | 0.30% | 0.30% | |

| 12:30 | USD | Trade Balance May | -43.1B | -47.0B | -46.2B | -46.1B |

| 14:00 | CAD | Ivey PMI Jun | 64.8 | 62.5 | ||

| 14:30 | USD | Natural Gas Storage | 76B | 66B |