Risk appetite was rather strong in Asian session today. Nikkei closed up 0.88% at 22799.64. At the time of writing, Hong Kong HSI is up 2.05%, China Shanghai SSE is up 1.70% and Singapore Strait Times is up 0.63%. The rally in stocks is partly due to record close in NASDAQ and S&P 500 on Friday. Also, the markets responded positively to the PBoC’s measures to pause Yuan’s decline. In short, China’s central bank reintroduced measures that acts counter-cyclical to market forces to keep Yuan from falling too quickly. Yuan hit the highest level in more than two weeks earlier today but there is no follow through buying.

The currency markets are mixed though. Yen is trading as the strongest one despite strong rally in equities. Canadian Dollar follows as the second strongest. Meanwhile, Dollar regains some ground and is trading as the third strongest. Euro, on the other hand, is paring back some of the last week’s gains. Australian and New Zealand Dollar follow as the second weakest. Though, it should be noted that except USD/JPY and CAD/CHF, all major pairs are bounded in Friday’s range, indicating lack of clear direction.

Technically, dollar index should be in medium term correction now. More upside is in favor in EUR/USD as long as 1.1529 minor support holds. Similarly, more decline is expected in USD/CHF as long as 0.9889 minor resistance holds. But the greenback is staying in established range against Sterling, Australian and Canadian Dollar. It’s yet to be seen which side the Dollar is taking. Meanwhile, today’s retreat in USD/JPY is putting focus back to 110.74 support and break will invalidate near term bullishness.

Japan PM Abe seeks fresh three year term

Japanese Prime Minister Shinzo Abe declared his candidacy for leadership of the Liberal Democratic Party on Sunday. The party leadership contest will be held on September 20, as a two horse race between Abe and former defence chief Shigeru Ishiba.

The re-election should be an easy win for Abe as he’s got support from give of the LDP’s seven intraparty factions, which encompass around 70% of its members. A win will give Abe another three year term and he’s then on track to become the country’s longest-serving Prime Minister.

Abe told a press conference that “I have decided to lead Japan as the LDP leader and the prime minister for three more years, and with this determination, I will run for the leadership election next month.” He added that “as we prepare to welcome a historic turning point, what kind of country we want to create will be a contentious issue,” and, “I am determined to steer Japan in a new era.”

Mexico and US in final hours of bilateral NAFTA talks

The bilateral US-Mexico NAFTA talk is still dragging on. But Mexican Economy Minister Ildefonso Guajardo said on Sunday that “we’re practically in the final hours of this negotiation.” Nonetheless, at a lunch break of the meeting, Guajardo said he cannot declare victory yet.

Trump also expressed optimism as he tweeted that “A big Trade Agreement with Mexico could be happening soon!” And, “Our relationship with Mexico is getting closer by the hour. Some really good people within both the new and old government, and all working closely together”.

Canada is expected to return to the supposed trilateral talks after the US and Mexico complete their negotiations. The three way talks will run well into September and possibly beyond. The US Congress needs 90 days notice to vote on a new NAFTA. The final approval of the deal on Mexico side will be on Lopez Obrador’s hands, as he’s due to take office on December 1.

US PCE, Canada GDP and China PMIs to watch in a slow week

Looking ahead, this last week of August is relatively light. US PCE is a major focus. Fed Chair Jerome Powell was clear in his speech that “if the strong growth in income and jobs continues” further rate hikes are appropriate. But that was in the context of no acceleration in inflation above 2%. With no sign of slowdown in the job market, the key to Fed’s path beyond neutral rate lies in when and whether inflation will pick up.

Canada GDP is another focus. For now, we’re still leaning towards an October BoC hike but there are speculations of a September hike. We’ll see if GDP supports which one. China’s PMIs will probably reveal how businesses are affected by the escalating trade war with the US.

Here are some highlights for the week:

- Monday: German Ifo business climate

- Tuesday: Eurozone M3 money supply; US trade balance, whole sale inventories, S&P Case-Shiller house price, consumer confidence

- Wednesday: Japan consumer confidence; German Gfk consumer sentiment; French GDP; Canada current account; US GDP revision, pending home sales

- Thursday: New Zealand building permit ANZ business confidence; Australia building approvals, private capital expenditure; Japan retail sales; German CPI, import price, unemployment; UK mortgage approvals; Canada GDP, US personal income and spending, jobless claims

- Friday: Japan Tokyo CPI, unemployment rate, industrial production, housing starts; China PMIs; German retail sales; Eurozone CPI, unemployment rate; Canada RMPI and IPPI, US Chicago PMI

EUR/USD Daily Outlook

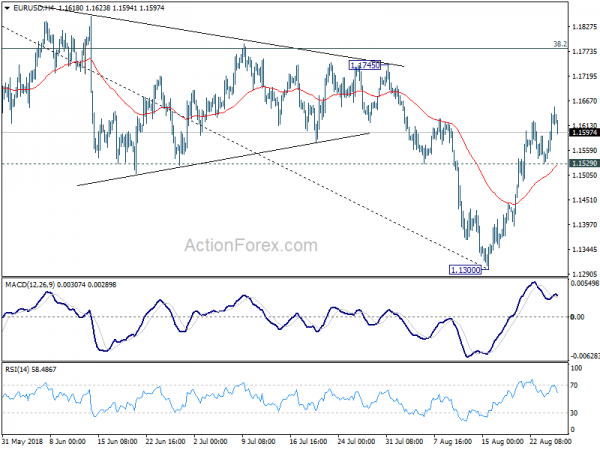

Daily Pivots: (S1) 1.1560; (P) 1.1599; (R1) 1.1664; More…..

Intraday bias in EUR/USD remains on the upside with 1.1529 minor support intact. Rebound from 1.1300 is in favor to extend to 38.2% retracement of 1.2555 to 1.1300 at 1.1779. We’d expect upside to be limited there, at least on initial attempt, to bring near term reversal. On the downside, below 1.1529 minor support will turn bias back to the downside for retesting 1.1300 low. But after all, consolidation from 1.1300 will extend for a while before completion.

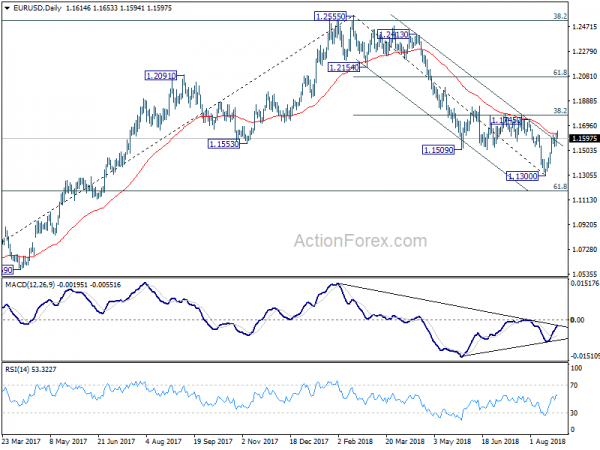

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | German IFO Business Climate Aug | 102 | 101.7 | ||

| 08:00 | EUR | German IFO Current Assessment Aug | 105.5 | 105.3 | ||

| 08:00 | EUR | German IFO Expectations Aug | 98.5 | 98.2 |