Sterling surges broadly today on rumors that Northern Ireland’s DUP has privately agreed to conditional support to Prime Minister Theresa May’s Brexit deal. The Pound is also the strongest one for the week. While there are still a lot of uncertainties surrounding Brexit outcome, at least, the threat of no-deal Brexit is eased. However, we’d doubt if the rumored condition of time limit on Irish backstop would get agreement from Brexit hardliners and the EU. Canadian Dollar, second strongest for today, follows oil price higher, as US threatens to sanction Venezuela.

Staying in the currency markets, Yen is trading as the weakest one for today, following strong risk appetite in Asia. Tech stocks led the way higher while investors shrug off conflicting comments from the US regarding trade negotiation with China. On the one hand, Commerce Secretary Wilbur Ross said the two countries are “miles and miles” away on a trade deal. But White House economic adviser Larry Kudlow said Trump is optimistic. Dollar follows as the second weakest. Euro is mixed after some knee-jerk actions follow ECB meeting yesterday.

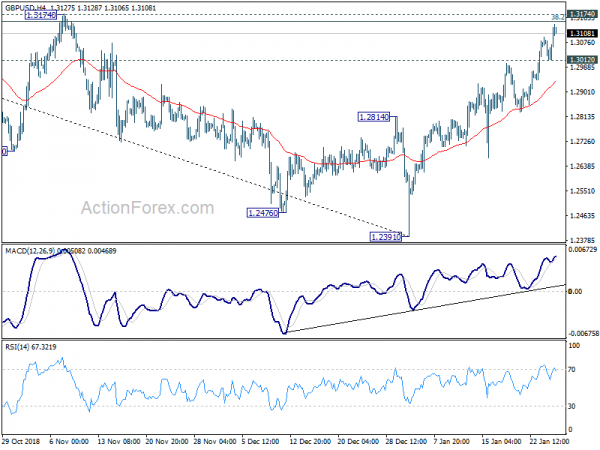

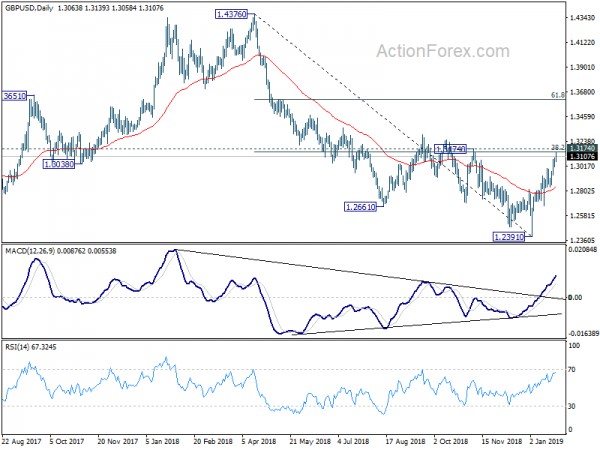

Technically, GBP/USD is now close to structural resistance at 1.3174, which is close to 1.3149 fibonacci level. We’d expect strong resistance in this zone to complete the rebound from 1.2391. But we’ll see how it goes. EUR/GBP breached 0.8620 key support today. For now, we’d also look for strong support at current level to bring rebound. However, sustained break of 0.8620 will resume larger fall from 0.9305 (2017 high).

In other markets, Nikkei closed up 0.97%. Hong Kong HSI is up 1.48%. China Shanghai SSE is up 0.79%. Singapore Strait Times is up 0.57%. Japan 10-year JGB yield is down -0.0082 at 0.002. Overnight, DOW dropped -0.09%. S&P 500 rose 0.14%. Tech stocks shone as NASDAQ rose 0.68%. 10-year yield dropped -0.043 to 2.712. 2.7 is now a level to defend.

Sterling jumps on rumor that DUP offer conditional support to May’s Brexit deal

Sterling surges broadly again on hope that UK Prime Minister Theresa May inches closer to getting enough support for an amended Brexit deal. The Sun reported that North Ireland’s DUP is having delicate deliberations with May. And it’s privately agreed that DUP will support the Brexit plan if there is a time-limit of the Irish backstop. That came on DUP’s concern that pro-Remain Tories and Labour are pushing for a significantly softer Brexit.

However, it should first be noted that such a time-limit is likely not enough to win over Brexit hardliners. ERG chair Jacob Rees-Mogg is clear in his demand for complete removal. More importantly, EU’s Chief Brexit negotiator Michel Barnier has blunted rejected the idea of time limit already. He said yesterday that “we have to maintain the credibility of this reassurance … it cannot be time-limited… It’s not just about Ireland.”

Trump requesting down payment for border wall, and preparing declaration of national emergency

Both Trump’s and Democrat’s proposal to end the historical shutdown in the US were blocked in the Senate yesterday. White House spokeswoman Sarah Huckabee Sanders said afterwards that “the three-week CR would only work if there is a large down payment on the wall.” That is, Trump is offering to reopen the government temporarily for three weeks, with certain down-payment for the USD 5.7B border wall.

Senate Minority Leader Chuck Schumer said after meting Senate Majority Leader Mitch McConnell that “Senate Democrats have made clear to Leader McConnell and Republicans that they will not support funding for the wall, prorated or otherwise.” House Speaker Nancy Pelosi also criticized that Trump demand for down payment is “not a reasonable agreement”. The House Democrats plan to offer a proposal today on border security, without the wall.

Separately, CNN reported that Trump is preparing a draft to declare national emergency And more than USD 7B in potential funds is already identified for the border wall. According to CNN, in the draft, it’s said “the massive amount of aliens who unlawfully enter the United States each day is a direct threat to the safety and security of our nation and constitutes a national emergency.” And, “Now, therefore, I, Donald J. Trump, by the authority vested in me by the Constitution and the laws of the United States of America, including the National Emergencies Act (50 U.S.C 1601, et seq.), hereby declare that a national emergency exists at the southern border of the United States.”

ECB stood pat, noted risks to outlook moved to the downside

The ECB meeting evolved as we had expected: more dovish, downgraded assessment on economy, leaving unchanged the forward guidance on interest rates. the central bank has acknowledged that the uncertainties in the global economy have intensified and can persist for quite an extended time. No change was made in the monetary policy, leaving the main refi rate, the marginal lending rate and the deposit rate unchanged at 0.00%, 0.25% and -0.40% respectively.

CB noted that “the risks surrounding the Euro area growth outlook have moved to the downside”. This is the first time since April 2017 that the central bank admitted that risks are to the downside. Over the past 21 months, ECB had been describing risks as “broadly balanced”, while suggesting the balance is “moving to the downside”. The uncertainties ECB has identified are “geopolitical factors and the threat of protectionism, vulnerabilities in emerging markets and financial market volatility”. These have been unchanged from previous meetings.

More in ECB Turns Dovish amid Heightened Global Uncertainties

Suggested readings on ECB:

- ECB Stands Still But Draghi Continues To ‘Nudge’ Markets

- ECB Recap: Economic Risks To The Downside, EUR/USD Risks To The Upside?

- ECB Review: Downside Growth Risks But Rate Hike Still on Track

- ECB President Mario Draghi press conference live stream

On the data front

Japan Tokyo CPI core accelerated to 1.1% yoy in January, beat expectation of 0.9% yoy. German Ifo Business Climate will be the main focus today. UK will release BBA mortgage approvals and CBI reported sales. US calendar is empty.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3018; (P) 1.3057; (R1) 1.3101; More….

GBP/USD’s rally continues today and reaches as high as 1.3139 so far. Intraday bias stays on the upside for 1.3149/74 resistance zone (38.2% retracement of 1.4376 to 1.2391 at 1.3149). At this point, we’d still expect strong resistance from there to limit upside, at least on first attempt. On the downside, below 1.3012 minor support will turn intraday bias back to the downside for 1.2814 resistance turned support first. However, firm break of 1.3149/74 will pave the way to 61.8% retracement at 1.3618.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend from 2.1161 (2007 high). And this will remain the preferred case as long as 1.3174 structural resistance holds. GBP/USD should target a test on 1.1946 first. Decisive break there will confirm our bearish view. However, sustained break of 1.3174 will invalidate this case and turn outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Jan | 1.10% | 0.90% | 0.90% | |

| 9:00 | EUR | German IFO Business Climate Jan | 100.6 | 101 | ||

| 9:00 | EUR | German IFO Expectations Jan | 97 | 97.3 | ||

| 9:00 | EUR | German IFO Current Assessment Jan | 104.2 | 104.7 | ||

| 9:30 | GBP | BBA Loans for House Purchase Dec | 39.0K | 39.4K | ||

| 11:00 | GBP | CBI Reported Sales Jan | 2 | -13 |