The forex markets are generally steady in Asian session today. Risk sentiments firmed up mildly in Asia with gains seen in major indices. In particular, China’s Shanghai SSE is back above 2900 handle with around 0.9% gain. The moves are reflect in strength in Australian, New Zealand and Canadian Dollars. Meanwhile, Swiss Franc and Yen are the softest for today so far.

Nevertheless, technically, the retreats in Yen and Swiss Franc are nothing more than part of near term consolidations only. In particular, USD/JPY and EUR/JPY are still on track to retest recent low at 109.02 and 122.08 respectively, despite losing some downside momentum. Notable recovery was seen in EUR/CHF and USD/CHF yesterday, probably as relief reaction to European elections. But the recovery quickly lost steam. There is no confirmation of reversal in both Franc pairs. Judging from theses, risk aversion is still ready to come back any time.

In Asia, Nikkei is currently up 0.45%. Hong Kong HSI is up 0.49%. China Shanghai SSE is up 0.89%. But Singapore Strait Times is down -0.19%. Japan 10-year JGB yield is down -0.009 at -0.075.

Japan Motegi: Trade deal in August just Trump’s hopes, two sides still narrowing the gap

Japan Economy Minister Toshimitsu Motegi said today that Trump’s comment regarding a trade deal in August just reflects his own hope for quick progress in the negotiations. For now, the two sides are still working on “narrowing the gap”.

Motegi told reporters, “When you look at the exact wording of his comments, you can see that the president was voicing his hopes of swift progress in talks toward something that is mutually beneficial.” He also reiterated the differences between US and Japan, and no timetable had yet be set for more meetings. He noted, “we’ve agreed that we’ll strive to narrow the gap, including through possibly holding working-level talks.”

Trump said on Monday, after meeting Japanese Prime Minister Shinzo Abe in Japan, that he expected the two countries to be “announcing some things, probably in August, that will be very good for both countries” on trade.

Canada kicks start process to ratify USMCA

Canadian Foreign Minister Chrystia Freeland formally introduced a Ways and Means motion in the House of Commons yesterday, to kick start ratification process of USMCA. She noted the lifting of US steel and aluminum tariffs on Canadian imports, as announced on May 17, has paved the way for formal approval of the new North American trade agreement.

However, Freeland also emphasized, “the entry into force of this agreement does not depend solely on Canada… Insofar as possible, we intend to move in tandem with the United States.” Prime Minister Justin Trudeau indicated last week he’s eager to ratify the deal. Freeland also said the government is “full steam ahead”. But She didn’t indicate whether the government would push to get it done before parliament goes into recess, in four weeks.

On the data front

Japan corporate service price index rose 0.9% yoy in April, below expectation of 1.1% yoy. Swiss will release Q1 GDP in European session. German Gfk consumer sentiment, import price will be featured. Eurozone will release M3 and confidence indicators. UK will release BBA mortgage approval. Later in the day, US will release house price indices. But main focus will be on Conference Board consumer confidence.

USD/JPY Daily Outlook

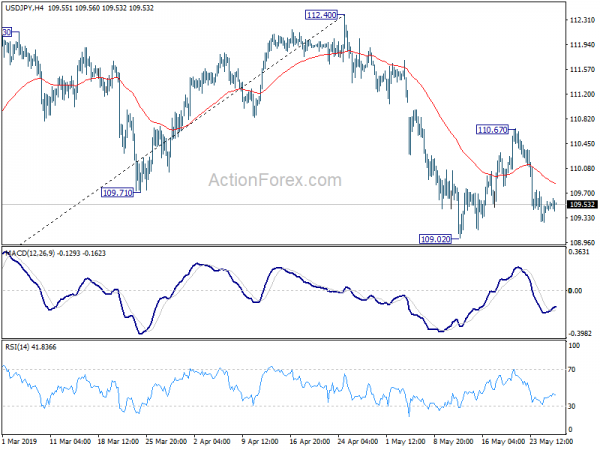

Daily Pivots: (S1) 109.35; (P) 109.46; (R1) 109.65; More…

A temporary low is likely in pace as USD/JPY recovered ahead of 109.02 low. Intraday bias is turned neutral first. But outlook remains bearish as fall from 112.40 is expected to resume sooner or later. On the downside, break of 109.02 will target 61.8% retracement of 104.69 to 112.40 at 107.63 next. On the upside, in case of stronger recovery, upside should be limited below 110.67 resistance to bring fall resumption eventually.

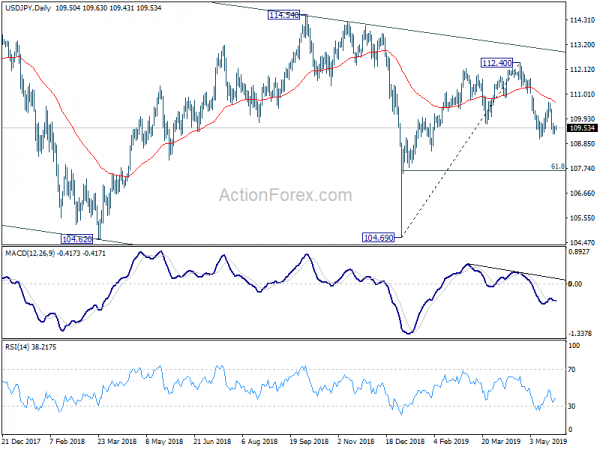

In the bigger picture, USD/JPY is staying inside falling channel from 118.65. Current development suggests that rebound from 104.69 is only a corrective move. And fall from 118.65 is not completed yet. Decisive break of 104.69 will extend the down trend towards 98.97 support (2016 low). For now, we’d expect strong support above there to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Apr | 0.90% | 1.10% | 1.10% | |

| 5:45 | CHF | GDP Q/Q Q1 | 0.40% | 0.20% | ||

| 6:00 | EUR | German Import Price Index M/M Apr | 0.50% | 0.00% | ||

| 6:00 | EUR | German GfK Consumer Confidence Jun | 10.4 | 10.4 | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Apr | 4.40% | 4.50% | ||

| 8:30 | GBP | BBA Loans for House Purchase Apr | 39450 | 39980 | ||

| 9:00 | EUR | Eurozone Business Climate Indicator May | 0.4 | 0.42 | ||

| 9:00 | EUR | Eurozone Economic Confidence May | 103.9 | 104 | ||

| 9:00 | EUR | Eurozone Industrial Confidence May | -4.2 | -4.1 | ||

| 9:00 | EUR | Eurozone Services Confidence May | 11 | 11.5 | ||

| 9:00 | EUR | Eurozone Consumer Confidence May F | -6.5 | -6.5 | ||

| 13:00 | USD | House Price Index M/M Mar | 0.20% | 0.30% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Mar | 2.55% | 3.00% | ||

| 14:00 | USD | Consumer Confidence Index May | 130 | 129.2 |