Dollar turns slightly softer, broadly, as Middle East tensions escalated after Iran’s strike against US forces in Iraq. But loss is so far limited after President Donald Trump’s refrained response. Markets generally calmed down for now, awaiting Trump’s statement later in US morning. Yen and Canadian Dollar are the strongest ones as supported by risk aversion and strength in oil prices. WTI crude oil hit as high as 65.38 while Gold breaks 1600 handle.

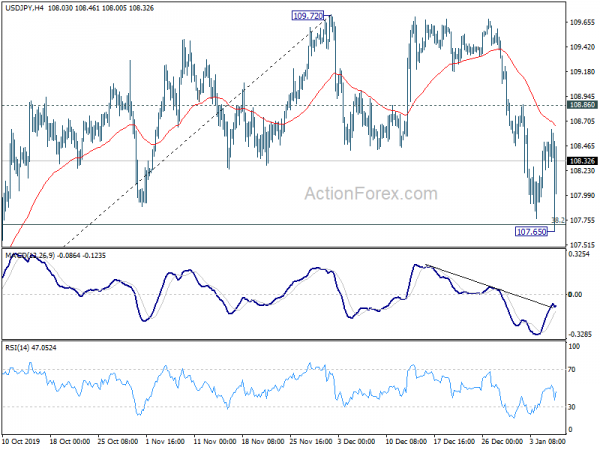

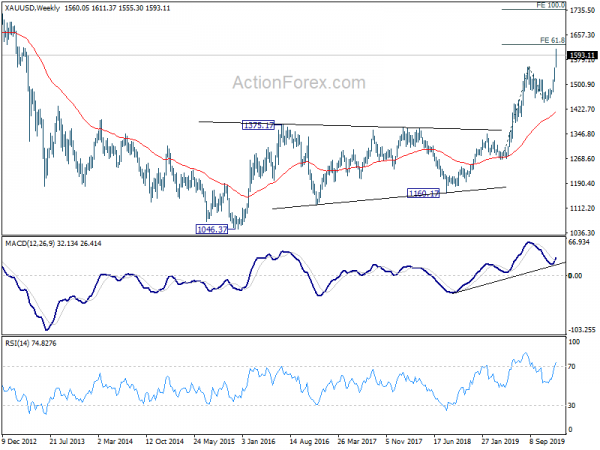

Technically, gold is on track to 1625 projection level but we’d looking for topping signal there. WTI crude oil continues to feel heavy inside 63.04/66.49 resistance zone, which we expect to hold. USD/JPY spiked lower to 107.65 but quickly recovered. As long as 107.65 holds, we’d expect another rebound to retest 109.27 resistance after situation stabilizes.

In Asia, Nikkei is currently down -1.25%. Hong Kong HSI is down -0.76%. China Shanghai SSE is down -0.57%. Singapore Strait Times is down -0.81%. Japan 10-year JGB yield is up 0.0078 at -0.002. Overnight, DOW dropped -0.42%. S&P 500 dropped -0.28%. NASDAQ dropped just -0.03%. 10-year yield rose 0.016 to 1.827.

Gold breaks 1600 as Iran retaliates, resistance at 1625

Gold spikes to as high as 1611.37 after Iran launched a missile attack on US led forces in Iraq. The US military confirmed that a dozen ballistic missiles were fired from Iran against at least two Iraqi facilities. Iran’s state TV also said the Revolutionary Guards Corps confirmed they fired the missiles to retaliate for last week’s killing of Qassem Soleimani. Iran also warned US allies including Israel not to allow more attacks from their territories.

Gold’s uptrend is on track to 61.8% projection of 1266.26 to 1557.04 from 1445.59 at 1625.29. At this point, we’d still expect upside to be limited there on overbought condition. Also, rise from 1445.59 is seen as the fifth leg of the five-wave sequence from 1160.17. Medium term correction should be seen after topping. Break of 1555.30 support should indicate topping. However, sustained break of 1625.29 will pave the way to 100% projection at 1736.37.

Trump said all is well with Iran retaliation

Trump said all is well with Iran retaliation

US President Donald Trump’s response to the strikes were relatively refrained. He just said in a tweet that “All is well! Missiles launched from Iran at two military bases located in Iraq. Assessment of casualties & damages taking place now. So far, so good! We have the most powerful and well equipped military anywhere in the world, by far! I will be making a statement tomorrow morning.”

Iran said strikes were proportionate and in self-defense

Iranian Foreign Minister Javad Zarif said that the strike against US force were “proportionate” and in “self-defense”. He added Iran does not seek escalation of war, but will defend against aggression. Hesameddin Ashena, advisor to President Hassan Rouhani, also warned that any retaliation by the US could lead to regional war.

On the data front

Japan labor cash earnings dropped -0.2% yoy in November, matched expectation. Australia building permits rose 11.8% mom in November, well above expectation of 2.1% mom.

Looking ahead, Germany factory orders and Eurozone confidence indicators will be featured in European session. US will release ADP employment later in the day.

USD/JPY Daily Outlook

Daily Pivots: (S1) 108.29; (P) 108.46; (R1) 108.66; More..

USD/JPY’s fall to 107.65 invalidates our bullish view and intraday bias is turned neutral first. At this point, we’re still seeing price actions from 109.72 as consolidation pattern. Downside should be contained by 38.2% retracement of 104.45 to 109.72 at 107.70. On the upside, break of 108.86 minor resistance will turn bias to the upside for retesting 109.72 high. However, sustained break of 107.70 will pave the way to 106.48 cluster support (61.8% retracement at 106.46).

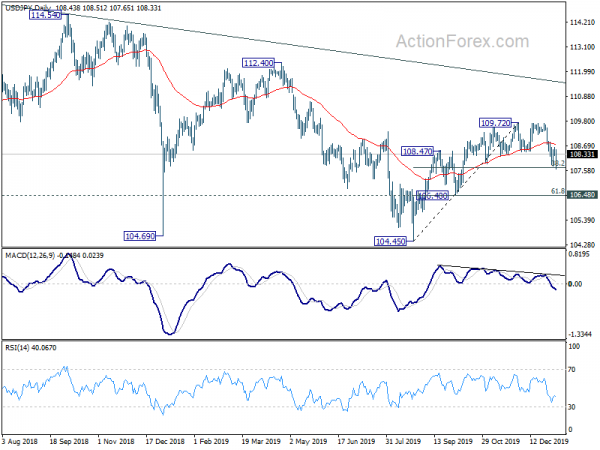

In the bigger picture, USD/JPY is staying in long term falling channel that started at 118.65 (Dec. 2016). Recovery from 104.45 also failed to sustain above 55 week EMA (now at 109.02). Overall outlook remains bearish and fall from 118.65 is in favor to extend through 104.45 low. This will now stay as the favored case as long as 109.72 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Nov | -0.20% | -0.20% | 0.00% | |

| 0:30 | AUD | Building Permits M/M Nov | 11.80% | 2.10% | -8.10% | -7.90% |

| 5:00 | JPY | Consumer Confidencex Dec | 39.6 | 38.7 | ||

| 7:00 | EUR | Germany Factory Orders M/M Nov | 0.10% | -0.40% | ||

| 7:45 | EUR | France Trade Balance (EUR) Nov | -5.0B | -4.7B | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Dec | 101.4 | 101.3 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Dec | -9 | -9.2 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Dec | -8.1 | -8.1 | ||

| 10:00 | EUR | Eurozone Services Sentiment Dec | 9.5 | 9.3 | ||

| 10:00 | EUR | Eurozone Business Climate Dec | -0.16 | -0.23 | ||

| 13:15 | USD | ADP Employment Change Dec | 150K | 67K | ||

| 15:30 | USD | Crude Oil Inventories | -11.5M |