Commodity currencies remain generally weak today on mixed market sentiments. On the other hand, Yen, Swiss Franc and Dollar are the strongest. Euro remains soft too, but recovery in crosses, in particular against Sterling, is limiting its downside for the moment. Gold also stabilizes back in prior range after initial selloff. With US markets on holiday, trading could be relatively subdued for the rest of the day.

Technically, EUR/GBP’s recovery ahead of 0.8861 key support is a signal that selloff is past its climax for now. However, EUR/CHF’s fall is extending lower and it’s now pressing important near term support at 1.0737. Decisive break there could prompt downside acceleration to 1.0658 support. On the other hand, GBP/JPY is also pressing 140.31 support and firm break could prompt downside acceleration too. We’ll see which way the markets would play out, and the reaction to EUR/GBP.

In Europe, currently, FTSE is down -0.16%. DAX is up 0.20%. CAC is down -0.09%. Germany 10-year yield is up 0.0154 to -0.525. Earlier in Asia, Nikkei dropped -0.97%. Hong Kong HSI rose 1.01%. China Shanghai SSE rose 0.84%. Singapore Strait Times dropped -0.48%. Japan 10-yaer JGB yield rose 0.0127 to 0.049.

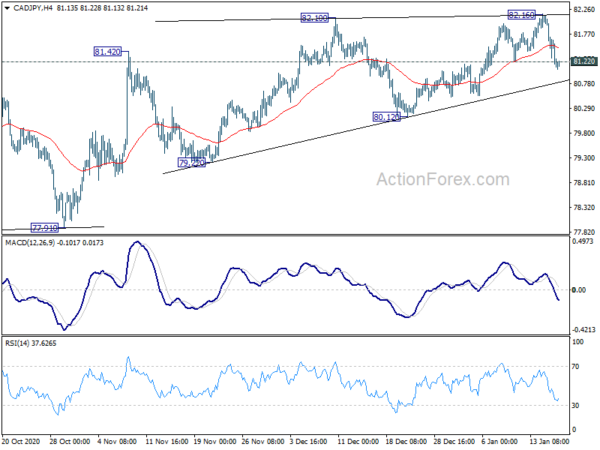

CAD/JPY completed terminal triangle, heading back to 80 first

Released from Canada, housing starts dropped to 228k in December, slightly below expectation of 230k. Foreign securities purchases jumped to CAD 11.78B in November, well above expectation of CAD 5.05B.

Canadian Dollar is under some selling pressure today, CAD/JPY’s break of 81.22 support suggests that a short term top was formed at 82.16. More importantly, the cross could have also completed a terminal triangle, in five wave started from 77.91. Deeper fall would be seen back to 80.12 support first. Firm break there would indicate near term bearish reversal. That is, whole rebound form 73.80 has completed, on bearish divergence condition in daily MACD.

Bundebanks: Restrictions won’t set the economy recovery too far back

German’s Bundesbank said in the monthly report that data up to November suggested there was “no significant setback” in the economy in Q4 despite pandemic restrictions. Business confidence also “brightened” strongly in December. The “encouraging signals give reason to hope that the restrictions that were extended and tightened at the beginning of the new year will not set the economic recovery too far back ”

Though, it also warned, “if the infection rate does not subside significantly and the current restrictions on economic activity last longer or are further tightened, a noticeable setback could nonetheless occur.”

China GDP grew 6.5% in Q4, but Dec data mixed

China’s GDP grew 6.5% yoy in Q4, accelerated from prior quarter’s 4.9% yoy, beat expectation of 6.1% yoy. Overall, GDP grew 2.3% in 2020, making it the only major economy that avoided a contraction, due to the coronavirus pandemic that started with outbreak in Wuhan.

December data were mixed. Industrial production grew 7.3% yoy, accelerated from 7.0% yoy, beat expectation of 6.9% yoy. Fixed asset investment grew 2.9% ytd yoy, below expectation of 3.2% ytd yoy. Retail sales grew only 4.6% yoy, slowed from 5.0% yoy, missed expectation of 5.50% yoy.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3539; (P) 1.3618; (R1) 1.3665; More…

Sideway consolidation continues in GBP/USD and intraday bias stays neutral for the moment. With 1.3428 support intact, further rise is still in favor. On the upside, firm break of 1.3702 will resume larger up rise form 1.1409 to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956. However, break of 1.3428 support will turn bias to the downside, for deeper correction to 1.3134 support.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. On the downside, break of 1.2675 support is needed to indicate completion of the rise. Otherwise, outlook will stays cautiously bullish in case of pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:01 | GBP | Rightmove House Price Index M/M Jan | -0.90% | -0.60% | ||

| 2:00 | CNY | Retail Sales Y/Y Dec | 4.60% | 5.50% | 5.00% | |

| 2:00 | CNY | Industrial Production Y/Y Dec | 7.30% | 6.90% | 7.00% | |

| 2:00 | CNY | Fixed Asset Investment YTD Y/Y Dec | 2.90% | 3.20% | 2.60% | |

| 2:00 | CNY | GDP Y/Y Q4 | 6.50% | 6.10% | 4.90% | |

| 4:30 | JPY | Industrial Production M/M Nov F | -0.50% | 0.00% | 0.00% | |

| 13:15 | CAD | Housing Starts Y/Y Dec | 228K | 230K | 246K | 261K |

| 13:30 | CAD | Foreign Securities Purchases (CAD) Nov | 11.78B | 5.05B | 6.92B | 6.93B |