Commodity currencies are trading as the weaker ones for today so far, as risk markets turn softer. Major European indexes are in slight red,. while US futures point to lower open. Yen is currently the stronger ones, followed by Swiss Franc and then Dollar. But overall, major pairs and crosses are still generally stuck in range.

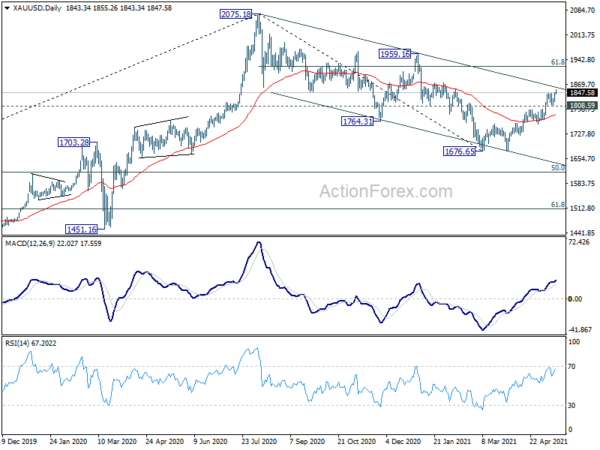

Technically, we’d pay some attention to the developments in Gold. It’s now in proximity to medium term falling channel. Sustained break there should confirm completion of the correction from 2075.18. In this case, rise from 1676.65 would likely accelerate upward. And that could be a prelude to downside breakout in Dollar. Though, rejection by the channel resistance would promote near term bearish reversal, and help lift Dollar for a rebound.

In Europe, at the time of writing, FTSE is down -0.56%. DAX is down -0.24%. CAC is down -0.39%. Germany 10-year yield is up 0.022 at -0.104. Earlier in Asia, Nikkei dropped -0.92%. Hong Kong HSI rose 0.59%. China Shanghai SSE rose 0.78%. Singapore Strait Times rose 0.81%. Japan 10-year JGB yield dropped -0.0049 to 0.080.

US Empire state manufacturing dropped to 24.3, both price indexes hit record highs

US Empire State Manufacturing general business condition dropped to 24.3 in May, down from 26.3, above expectation of 24.0.

Looking at some details, new orders rose from 26.9 to 28.9. Shipments rose from 25.0 to 29.7. Delivery time dropped from 28.1 to 23.6. Inventories dropped from 11.6 to 7.1. Price paid rose form 74.7 to 83.5. Prices received also rose from 34.9 to 37.1. Number of employees dropped slightly from 13.9 to 13.6. Average employee workweek rose notably from 12.7 to 18.7.

New York Fed noted that “manufacturing activity grew at a sturdy pace”. “Both price indexes reached record highs”.

EU and US to hold China’s trade-distorting policies to account

EU said they will temporarily suspend the increase of its rebalancing measures on the US 232 steel and aluminum tariffs, imposed during the era of former US President Donald Trump. EU said, “this gives us space to find joint solutions to this dispute and tackle global excess capacity”.

In the joint statement, EU Executive Vice President Dombrovskis, US Trade Representative Katherine Tai and Secretary of Commerce Gina Raimondo, said, “as the United States and EU Member States are allies and partners, sharing similar national security interests as democratic, market economies, they can partner to promote high standards, address shared concerns, and hold countries like China that support trade-distorting policies to account.”

China industrial production rose 9.8% yoy in Apr, retail sales rose 17.7% yoy

China industrial production rose 9.8% yoy in April, slowed from 14.1% yoy, matched expectations. Fixed asset investment rose 19.9% ytd yoy, slowed from 25.6%, above expectation of 19.0%. Retail sales slowed to 17.7% yoy, down from 34.2% yoy, missed expectation of 24.9% yoy.

The National Bureau of Statistics said that the economy showed “steady improvement” in April, but the foundation was “not solid” as new problems are emerging. Recovery also remains “uneven”. It expected the economy to operate within a reasonable range.

Suggested reading on China: China’s Growth Slowed Across the Board in April

GBP/USD Mid-Day Outlook

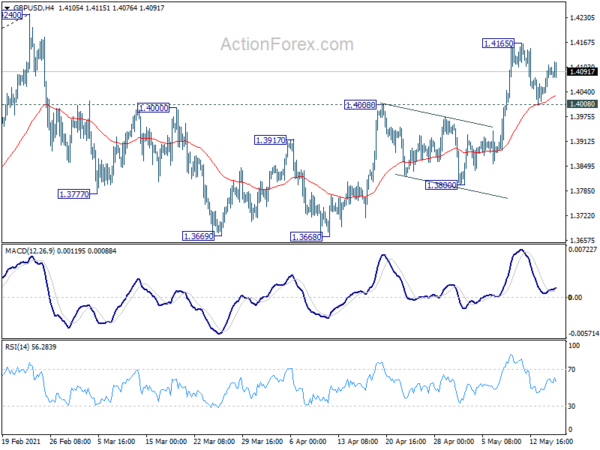

Daily Pivots: (S1) 1.4052; (P) 1.4082; (R1) 1.4127; More…

GBP/USD is staying in consolidation from 1.4165 and intraday bias remains neutral first. Further rise is expected with 1.4008 resistance turned support intact. On the upside, break of 1.4165 will resume the rise from 1.3668 to retest 1.4240 high. On the downside, however, firm break of 1.4008 will delay the bullish case and extend the corrective pattern from 1.4240 with another falling leg.

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Apr | 3.60% | 3.10% | 1.00% | 1.20% |

| 02:00 | CNY | Retail Sales Y/Y Apr | 17.70% | 24.90% | 34.20% | |

| 02:00 | CNY | Industrial Production Y/Y Apr | 9.80% | 9.80% | 14.10% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Apr | 19.90% | 19.00% | 25.60% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Apr F | 120.80% | 65.00% | 65.10% | |

| 06:30 | CHF | Producer and Import Prices M/M Apr | 0.70% | 0.20% | 0.60% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Apr | 1.80% | -0.20% | ||

| 12:15 | CAD | Housing Starts Y/Y Apr | 269K | 250.0K | 335.2K | |

| 12:30 | USD | Empire State Manufacturing May | 24.3 | 24.0 | 26.3 | |

| 14:00 | USD | NAHB Housing Market Index May | 83 | 83 |