Canadian Dollar is trading as the worst performing one today and slightly weaker than expected retail sales data provide little help. Persistent weakness in oil price is weighing down the loonie, together with overall negative sentiment. Overnight development is unchanged that Dollar, Yen and Swiss Franc are the strongest while commodity currencies are the weakest. Sterling is under performing both Euro and Franc too.

In Europe, at the time of writing, FTSE is down -0.11%. DAX is down -0.35%. CAC is down -0.20%. Germany 10-year yield is down -0.0032 at -0.490. Earlier in Asia, Nikkei dropped -0.98%. Hong Kong HSI dropped -1.84%. China Shanghai SSE dropped -1.10%. Singapore Strait Times rose 0.51%. Japan 10-year JGB yield dropped -0.0048 to 0.012.

Fed Kaplan might need to adjust view on tapering due to Delta

Dallas Fed President Robert Kaplan said the the economic impact from the Delta variant is “unfolding rapidly”. “So far it’s not having a material effect” on consumer activity, he added. But, “it is having an effect in delaying return to office, it’s affecting the ability to hire workers because of fear of infection,” and may be affecting production output.

Kaplan previously said he would like to start tapering asset purchases in October. But he might now need to adjust he views “somewhat” due to Delta.

Canada retail sales rose 4.2% mom in Jun, missed expectations

Canada retail sales rose 4.2% mom to CAD 56.2B in June, below expectation of 5.0% mom. Sales increased in 8 of 11 subsectors, representing 69.5% of retail trade. Core retail sales, excluding gasoline stations and motor vehicles and parts dealers, rose 4.6% mom. For Q2 as a whole, sales dropped -0.7% qoq. In the advance estimate, sales is expected to drop -1.7% mom in July.

UK retail sales dropped -2.5% mom in Jul, ex-fuel sales dropped -2.4% mom

UK retail sales dropped -2.5% mom in July, well below expectation of 0.4% mom. Ex-fuel sales dropped -2.4% mom. Over the last 12 months, retail sales rose 2.4% yoy, below expectation of 6.4% yoy. Ex-fuel sales rose 1.8% yoy.

Retail sales volumes over the last three months were up 11.1% on a year earlier.

UK Gfk consumer confidence dropped to -8

UK Gfk consumer confidence dropped slightly from -7 to -8 in August, below expectation of -6. “Against a backdrop of cooling headline inflation and soaring house prices, the U.K. consumer confidence index is stable at minus 8 this August,” Joe Staton, GfK’s client strategy director, said.

“Expectations for our personal financial situation for the coming 12 months are holding up and this positivity bodes well for the economy going forward this year and next,” Staton said. The index measuring changes in personal finances over the past 12 months is up one point at 0.

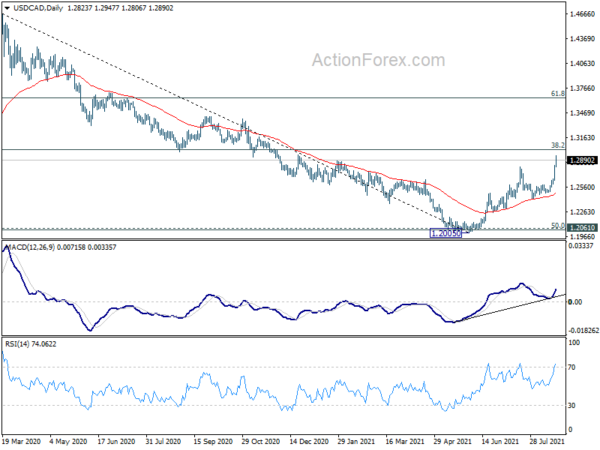

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2709; (P) 1.2770; (R1) 1.2890; More…

Intraday bias in USD/CAD remains on the upside at this point. Current rise from 1.2005 should target for 1.3022 fibonacci level next. On the downside, below 1.2813 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It should have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650 and above. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Aug | -8 | -6 | -7 | |

| 23:30 | JPY | National CPI Core Y/Y Jul | -0.20% | -0.40% | 0.20% | |

| 06:00 | GBP | Retail Sales M/M Jul | -2.50% | 0.40% | 0.50% | 0.20% |

| 06:00 | GBP | Retail Sales Y/Y Jul | 2.40% | 6.40% | 9.70% | 9.20% |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Jul | -2.40% | 0.30% | 0.00% | |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Jul | 1.80% | 7.40% | 6.80% | |

| 06:00 | EUR | Germany PPI M/M Jul | 1.90% | 0.80% | 1.30% | |

| 06:00 | EUR | Germany PPI Y/Y Jul | 10.40% | 8.40% | 8.50% | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Jul | 9.6B | 23.2B | 22.0B | 20.7B |

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.40% | 1.30% | 0.60% | |

| 12:30 | CAD | Retail Sales M/M Jun | 4.20% | 5.00% | -2.10% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Jun | 4.70% | 4.90% | -2.00% |