Following another record close in US overnight, Asian markets open generally higher and stay firm. Commodity currencies continue to extend this week’s rebound. While Yen and Swiss Franc remain soft, Dollar pull back seems to be slowing slightly. Nevertheless, Dollar selling could come back any time if Gold could make 1800 a base to stage another rise.

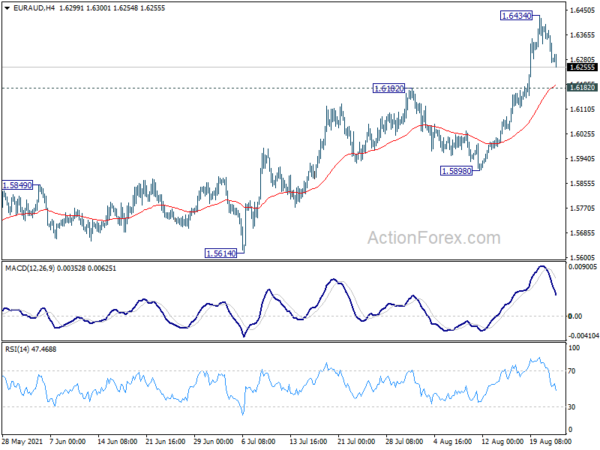

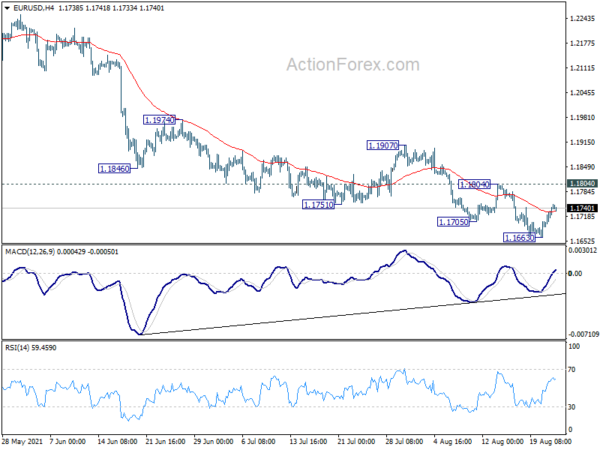

Technically, we’d maintain that some levels in Dollar pairs need to be taken out to confirm that it has topped. The levels include 1.1804 resistance in EUR/USD, 109.10 support in USD/JPY and 0.9098 support in USD/CHF. At the same time, we’d also look at 0.7288 support turned resistance in AUD/USD, and 1.6182 resistance turned support in EUR/AUD, to gauge the strength of rebound in Aussie and other commodity currencies.

In Asia, at the time of writing, Nikkei is up 0.98%. Hong Kong HSI is up 1.60%. China Shanghai SSE is up 0.90%. Singapore Strait Times is up 0.73%. Japan 10-year JGB yield is up 0.0012. Overnight, DOW rose 0.61%. S&P 500 rose 0.85%. NASDAQ rose 1.55%. 10-year yield dropped -0.005 to 1.255.

NASDAQ hit new record after full FDA approval to Pfizer-BioNTech vaccine

Major US stock indexes closed higher after the Food and Drug Administration (FDA) granted full approval to the Pfizer-BioNTech’s COVID-19 vaccines. Pfizer shares also rose 2.4% while BioNTech stock rose 9.5%. Another vaccine maker Moderna also rose 7.5%. Both S&P 500 and NASDAQ closed at new record highs.

The notable support from 55 day EMA in NASDAQ once again reaffirmed its near term bullishness. The index should be on track to 61.8% projection of 10822.57 to 14175.11 from 13002.53 at 15704.4, probably later this week. Sustained break there could prompt some upside acceleration to next target at 100% projection at 16355.1. In any case, outlook will stay bullish as long as 14423.2 support holds, even with an initial rejection by 15k handle.

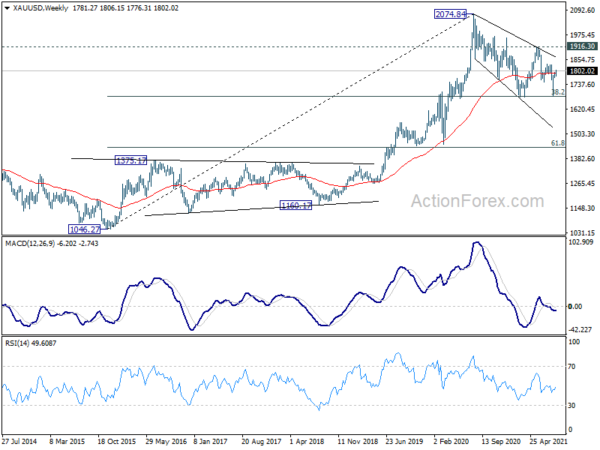

Gold back above 1800 as rebound resumed

Gold’s rebound from 1682.60 resumed last week and it’s now trading slightly above 1800 handle. From a bigger picture, it’s possible that gold has once again drew enough support from long term fibonacci level of 38.2% retracement of 1046.27 to 2074.84 at 1681.92 to form a bottom.

However, we’d prefer to see, firstly, sustained trading above 1800 psychological level. Secondly, Gold will need to break through 1832.47 near term resistance. In that case, stronger rise could be seen at least to retest 1916.30 medium term resistance next. However, break of 1774.14 support will suggest that the rebound has completed and bring another test on 1681.92 fibonacci level again.

New Zealand retail sales rose 3.3% qoq in Q2, above expectations

New Zealand retail sales volume rose 3.3% qoq in Q2, above expectation of 2.0% qoq. 11 of 15 industries reported growth, and the largest increases were in electrical and electronic goods retailing (up 6.9%), food and beverage services (up 5.6%), motor vehicle and parts retailing (up 3.1%), pharmaceutical and other store-based retailing (up 7.5%), and accommodation (up 11.4%).

“Most retail industries saw increases in spending, with rises across all regions. Spending on big ticket items such as electrical goods, housewares, and vehicles was a priority for many consumers during this June quarter,” retail trade manager Sue Chapman said.

Looking ahead

Germany will release Q2 GDP final in European session. US will release new home sales later in the day.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1709; (P) 1.1729; (R1) 1.1766; More…

Intraday bias in EUR/USD remains neutral at this point. Another fall cannot be ruled out yet. But we’d continue to look for strong support from 1.1602/1703 key support zone to bring rebound. On the upside, above 1.1804 resistance will turn bias back to the upside for 1.1907 resistance first. However, sustained break of 1.1602/1703 will carry larger bearish implication and pave the way to 1.1289 fibonacci support.

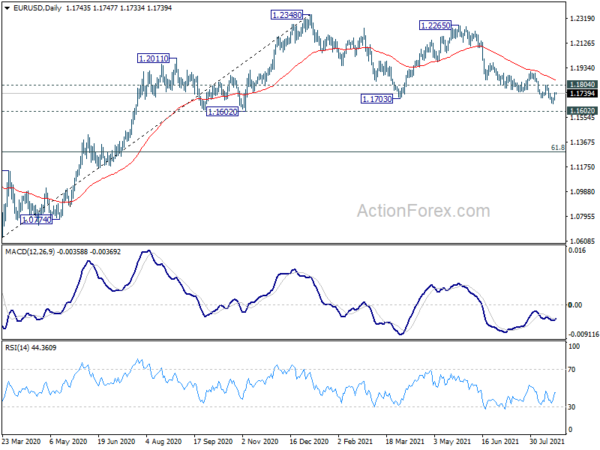

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q2 | 3.30% | 2.00% | 2.50% | 2.80% |

| 22:45 | NZD | Core Retail Sales Q/Q Q2 | 3.40% | 1.90% | 3.20% | 3.50% |

| 06:00 | EUR | Germany GDP Q/Q Q2 F | 1.50% | 1.50% | ||

| 14:00 | USD | New Home Sales M/M Jul | 698K | 676K |