Dollar rebound continues in Asian session today and trades generally high. Weakness in more notable in Aussie and Euro, as both turn soft in crosses. Overall risk sentiment is slightly negative, with particular deep selloff in Hong Kong stocks, but Nikkei remains resilient. The economic calendar is very light today and movements in the currencies would likely follow broader markets. Nevertheless, inflation data from US, Canada and UK could lift volatility later in the week.

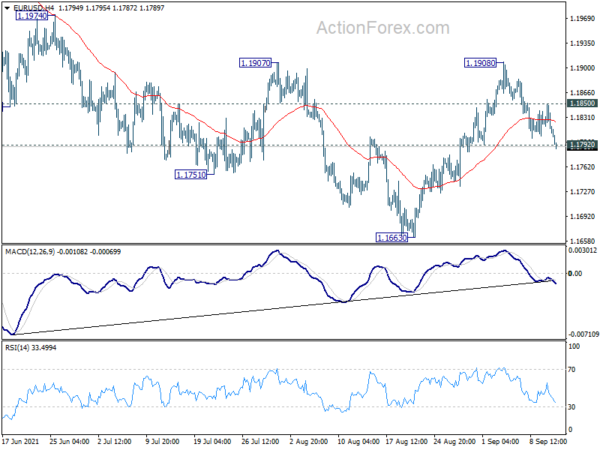

Technically, EUR/USD’s break of 1.1792 support suggests rebound from 1.1663 has completed after rejection by 1.1907 structural resistance. We’d pay attention to whether the development is more of a release of Dollar strength or Euro weakness, or both. Break of 129.57 support in EUR/JPY would bring deeper fall back to 127.91 low. On the other hand, USD/JPY might try to rise back towards 110.79 resistance, even if sideway trading continues. We’ll keep an eye on the interactions between the three.

In Asia, at the time of writing, Nikkei is down -0.34%. Hong Kong HSI is down -2.38%. China Shanghai SSE is down -0.38%. Singapore Strait Times is down -1.06%. Japan 10-year JGB yield is up 0.0025 at 0.048.

Fed Harker: I’d like to start tapering soon to buy ourselves option

Philadelphia Fed President Patrick Harker said in a Nikkei interview that he’d like to start tapering asset purchases. He sees “elevated risk” of inflation running higher.

He said, “my baseline forecast is still to have inflation around 4% this year, ending this year, and then starting to fall back to 2% over the years 2022 and 2023. However, I do see elevated risk that inflation could run higher”.

“I’d like to start the taper process soon, so that we can finish the tapering process, so if we need to increase the policy rate, we have the room to do that. And I think we need to buy ourselves that option,” he added.

SNB Zurbruegg: Negative interest rates still needed due to the situation globally

SNB Vice President Fritz Zurbruegg said in a Sonntagszeitung interview over the weekend, “at the moment we need the negative interest rates due to the situation globally.” He warned, “if we were to hike interest rates now, the franc would appreciation markedly, economic growth would slow and joblessness would increase.” He also noted that the pickup in inflation in Switzerland is “temporary”. In the medium term, “we expect it to stay low,” he said.

President Thomas Jordan remains on leave on medical grounds and there is no return date yet. Zurbregg said finding a successor for Jordan “isn’t a topic”. “Thomas Jordan will take up his post again.”

Japan corporate goods price ticked down to 5.5% yoy, wholesale inflation will remain under upward pressure

Japan’s corporate goods price index slowed slightly to 5.5% yoy in August. But it was close to July’s 5.6% yoy, which was the highest reading since September 2008. Also, at 105.8, the index marked the highest level since 1982.

Shigeru Shimizu, head of the BoJ’s price statistics division, said, “as the global economy continues to recover thanks to progress in vaccinations, domestic wholesale inflation will remain under upward pressure, though there’s uncertainty over the outlook due to a resurgence in infections.”

NZIER revised up inflation forecast, NZD to remain elevated for coming years

In NZIER’s September survey, consensus forecast for 2021/22 GDP was revised down from 5.0% to 4.5%. But 2022/23 GDP forecast for 2022/23 was revised up from 3.7% to 4.5%. The revision likely reflects the impact of the current COVID-19 outbreak. GDP is forecast to grow 2.3% in 2023/24 (revised down from 2.6%), then pick up to 2.7% in 2024/25.

Inflation forecasts were revised up sharply from 2.1% to 3.5% in 2021/22, up from 1.9% to 2.0% in 2022/23. It’s unchanged at 2.2% in 2023/24 and expected to be steady at 2.2% in 2024/25. NZIER said, “Capacity pressures continue to build up across the New Zealand economy, as acute labour shortages and COVID-related supply chain disruptions drive up cost pressures further. Solid demand has made it easier for businesses to pass these costs onto customers by raising prices.”

The NZD outlook is mixed with trade-weighted index revised lower in the near term. However, NZIER said, “expectations are for the currency to remain elevated over the coming years,” as RBNZ rate hike expectations improved yield attractiveness.

New Zealand ANZ business confidence rose to -6.8, showing resilience

In the preliminary September read, New Zealand ANZ Business confidence rose to -6.8, up from August’s -14.2. Own Activity outlook dropped to 18.2, down from 19.2. Looking at some more details, export intentions dropped from 7.4 to 5.7. Investment intentions dropped from 14.4 to 12.2. Employment intentions dropped from 17.0 to 14.7. Inflation expectations ticked lower from 3.05 to 2.97.

ANZ said the report showed “resilience” despite lockdown in Auckland, with most forward-looking activity indicators holding up well. ANZ said, “We examined a split between Auckland and the rest of the country but the differences were very small.”

“Overall, the preliminary ANZ Business Outlook results suggest that firms can see light at the end of the tunnel, even in Auckland. We can do this, it said”.

Eyes on CPI from US, Canada and UK

Focuses will turn back to economic data this week. In particular, US, Canada, and UK will release CPI, which might not start to show plateauing in the surge in inflation. In additional, US retail sales and regional Fed surveys, UK employment and retail sales, Australia employment, and a bunch of data from China will be closely watched. Here are some highlights for the week:

- Monday: Japan BSI manufacturing index, PPI.

- Tuesday: Australia house price index, NAB business confidence; UK employment; Swiss PPI; US CPI; Canada manufacturing sales.

- Wednesday: New Zealand current account; Japan machine orders, tertiary industry index; China retail sales, industrial production, fixed asset investment; UK PI, PPI; Eurozone industrial production; Canada CPI; US Empire state manufacturing, import prices, industrial production.

- Thursday; New Zealand GDP, Australia employment; Japan trade balance; Eurozone trade balance; Canada housing starts, ADP employment wholesale sales; US retail sales Philly Fed survey, jobless claims, business inventories.

- Friday: New Zealand BusinessNZ manufacturing; UK retail sales; Eurozone current account CPI final; US U of Michigan sentiment.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1797; (P) 1.1824; (R1) 1.1838; More…

EUR/USD’s break of 1.1792 support argues that rebound from 1.1663 has completed at 1.1908, after rejection by 1.1907 key structural resistance. The development also dampened our original bullish view. Intraday bias is back on the downside for retesting 1.1663 support. Break there will extend the whole pattern from 1.2348 towards 1.1602 key support level. On the upside, above 1.1850 minor resistance will turn bias back to the upside for another test on 1.1907/8 resistance.

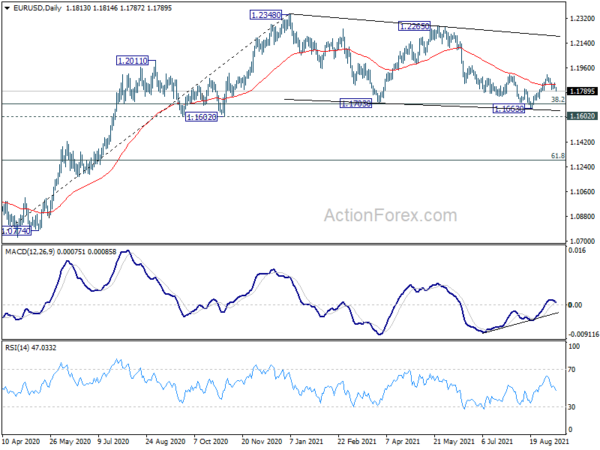

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Aug | 5.50% | 5.60% | 5.60% | |

| 23:50 | JPY | BSI Large Manufacturing Conditions Index Q3 | 7 | -0.9 | -1.4 | |

| 18:00 | USD | Monthly Budget Statement (USD) Aug | -260.5B | -302.1B |