Yen recovered much ground as US stocks tumbled steeply overnight. Meanwhile, Dollar remains generally firm, as partly supported by resilient treasury yields. Selling in Euro and Sterling slowed a little bit while commodity currencies are turning softer. ISM manufacturing and PCE inflation will come into spotlight today. But overall directions in the currency markets will remain largely driven by stocks and yields.

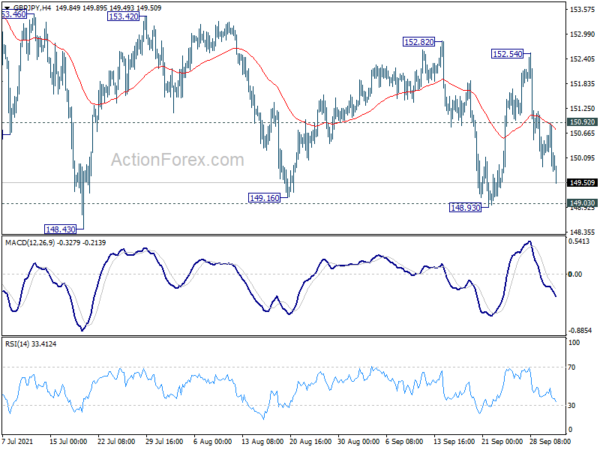

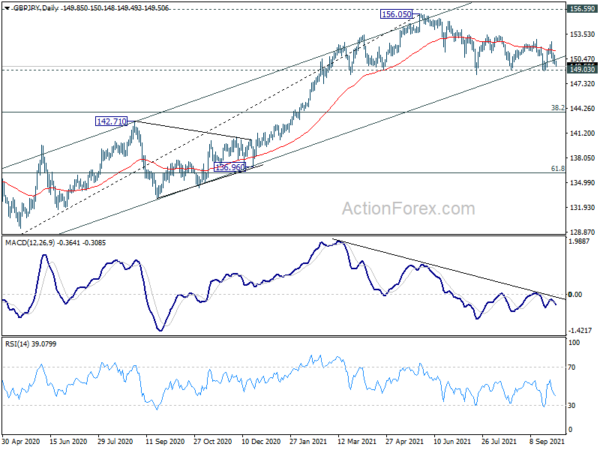

Technically, Yen crosses will be the focuses today. In particular, GBP/JPY and EUR/JPY are heading back to127.91 and 148.93 support respectively. Sustained break there could reaffirm overnight risk-off developments in stock markets. That, if happens could set the tone for the initial part of October.

In Asia, at the time of writing, Nikkei is down sharply by -2.52%. Japan 10-year JGB yield is down -0.017 at 0.053. Singapore Strait Times is down -1.15%. China and Hong Kong are on holiday. Overnight, DOW dropped -1.59%. S&P 500 dropped -1.19%. NASDAQ dropped -0.44%. 10-year yield dropped -0.012 to 1.529.

BoJ opinions: No significant change in the situation in Japan

In the Summary of Opinions of BoJ’s September 21-22 meeting, it’s noted, “since there is no significant change in the situation in Japan where economic activity, such as of firms, has been supported by accommodative financial conditions, it is appropriate for the Bank to maintain the current monetary policy measures”.

One opinion also noted, “although financial markets have been stable on the whole, it is necessary to be vigilant in closely monitoring economic and financial developments, including the impact of developments in the Chinese real estate sector on global financial markets, and be ready to respond promptly if necessary.”

Japan Tankan large manufacturing index rose to 18, highest since 2018

Japan’s Tankan large manufacturing index rose from 14 to 18 in Q3, above expectation of 13. That’s the highest level since 2018. Large manufacturing outlook rose from 13 to 14, below expectation of 15. Non-manufacturing index rose from 1 to 2, above expectation of 0. Non-manufacturing outlook was unchanged at 3, below expectation of 5.

Large companies expected to expand capital investment by 10.1% in the fiscal year started April, risen from prior indication of 9.6%. Inflation is expected to be 0.7% a year from now, slightly higher than 0.6% as expected in prior survey.

Japan PMI manufacturing finalized at 51.5

Japan PMI Manufacturing was finalized at 51.5 in September, down from August’s 52.7. Markit noted renewed reductions in production and incoming business. Cost burdens has the sharpest rise in 13 years amid supply chain disruption. Businesses confidence, however, strengthened for the first time in three months.

Also released, unemployment rate was unchanged at 2.8% in August.

Australia AiG manufacturing dropped to 51.2, recovery all-but-stalled

Australia AiG Performance of Manufacturing Index dropped from 51.6 to 51.2 in September. Looking at some details, production rose 2.9 to 53.1. Employment dropped from -4.3 to 47.1. New orders dropped -5.1 to 52.0. Exports rose 6.8 to 51.9.

Ai Group Chief Executive Innes Willox said: “The recovery in the manufacturing sector over the past year all-but-stalled in September as the impacts of lockdowns and border closures constrained activity in the two largest states…. Manufacturers are hoping that the prospect of restrictions being wound back will see a strong lift in performance over coming months.”

Looking ahead

Germany retail sales, Eurozone PMI manufacturing final and CPI flash, UK PMI manufacturing final and Swiss PMI will be released. Later in the day, Canada will release GDP and PMI manufacturing. US will release persona income and spending, ISM manufacturing and construction spending.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 149.47; (P) 150.22; (R1) 150.62; More…

Intraday bias in GBP/JPY remains on the downside for retesting 149.03 key support level. Firm break there will carry larger bearish implications. Deeper fall would be seen towards 143.78 medium term fibonacci level. On the upside, above 150.92 minor resistance will turn bias back to the upside for 152.54 resistance instead.

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). As long as 149.03 support holds, such rise would still resume at a later stage. However, sustained break of 149.03 support will indicate rejection by 156.59. Fall from 156.05 would at least be correcting the whole rise from 123.94 (2020 low). Deeper fall would be seen back 38.2% retracement of 123.94 to 156.05 at 143.78 first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q3 | 18 | 13 | 14 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q3 | 14 | 15 | 13 | |

| 23:50 | JPY | Tankan Non-Manufacturing Index Q3 | 2 | 0 | 1 | |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q3 | 3 | 5 | 3 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q3 | 10.10% | 9.10% | 9.60% | |

| 23:30 | JPY | Unemployment Rate Aug | 2.80% | 2.90% | 2.80% | |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 00:30 | JPY | Manufacturing PMI Sep F | 51.5 | 51.2 | 51.2 | |

| 05:00 | JPY | Consumer Confidence Index Sep | 38.9 | 36.7 | ||

| 06:00 | EUR | Germany Retail Sales M/M Aug | 1.60% | -5.10% | ||

| 07:30 | CHF | SVME PMI Sep | 65.6 | 67.7 | ||

| 07:45 | EUR | Italy Manufacturing PMI Sep | 60.1 | 60.9 | ||

| 07:50 | EUR | France Manufacturing PMI Sep F | 55.2 | 55.2 | ||

| 07:55 | EUR | Germany Manufacturing PMI Sep F | 58.5 | 58.5 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Sep F | 58.7 | 58.7 | ||

| 08:30 | GBP | Manufacturing PMI Sep F | 56.3 | 56.3 | ||

| 09:00 | EUR | Eurozone CPI Y/Y Sep P | 3.30% | 3.00% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep P | 1.80% | 1.60% | ||

| 12:30 | CAD | GDP M/M Jul | -0.20% | 0.70% | ||

| 12:30 | USD | Personal Income M/M Aug | 0.20% | 1.10% | ||

| 12:30 | USD | Personal Spending Aug | 0.70% | 0.30% | ||

| 12:30 | USD | PCE Price Index M/M Aug | 0.40% | |||

| 12:30 | USD | PCE Price Index Y/Y Aug | 4.20% | |||

| 12:30 | USD | Core PCE Price Index M/M Aug | 0.20% | 0.30% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Aug | 3.60% | |||

| 13:30 | CAD | Manufacturing PMI Sep | 57.2 | |||

| 13:45 | USD | Manufacturing PMI SepF | 60.2 | 60.5 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep | 71 | 71 | ||

| 14:00 | USD | ISM Manufacturing PMI Sep | 59.9 | 59.9 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Sep | 83.8 | 79.4 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Sep | 49 | |||

| 14:00 | USD | Construction Spending M/M Aug | 0.30% | 0.30% |