Risk-on sentiment is somewhat taking a breather as S&P closed slightly lower after making new high. But Yen remains overwhelmingly the worst performing one for the week, followed by Kiwi and then Euro. On the other hand, Sterling is currently the strongest one together with Swiss Franc, thanks additional to Euro’s weakness. Aussie is firm too while Dollar is mixed.

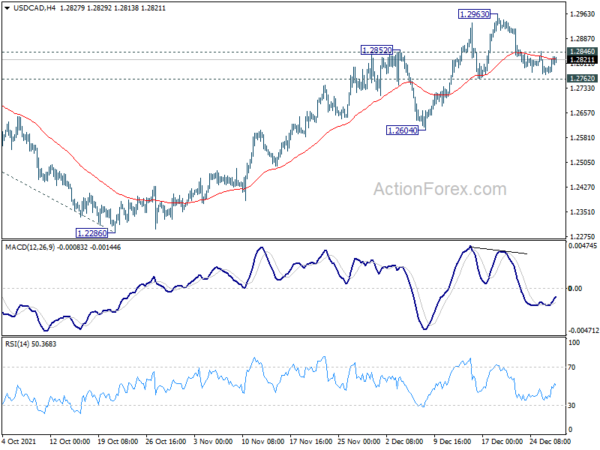

Technically, both Aussie and Canadian appear to be losing momentum against Dollar. Break of 0.7205 minor support in AUD/USD and 1.2846 minor resistance in USD/CAD would signal that Dollar is coming back against commodity currencies, probably as risk-on sentiment recedes further ahead of new year holiday.

In Asia, at the time of writing, Nikkei is down -0.76%. Hong Kong HSI is down -0.88%. China Shanghai SSE is down -0.79%. Japan 10-year JGB yield is down -0.0036 at 0.061. Overnight, DOW rose 0.26%. S&P 500 dropped -0.10%. NASDAQ dropped -0.56%. 10-year yield closed flat at 1.481.

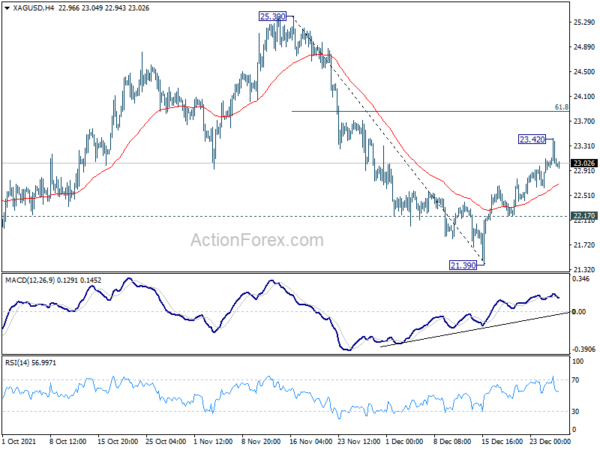

Gold and Silver edged higher in weak momentum

Both Gold and Silver edged higher yesterday but quickly lost momentum and retreated. At this point, Gold’s rebound from 1752.32 should still extend higher as long as 1784.78 support holds. We’re seeing fall form 1877.05 as complete in 1752.43. Above 1820.02 will target 61.8% retracement of 1877.05 to 1752.32 at 1829.40 first. Sustained break there will pave the way back to retest 1877.05 resistance.

Silver’s picture is similar. Fall from 25.39 should have completed at 21.39 already. Rise from 21.39 is in favor to extend higher as long as 22.17 support holds. Break of 23.42 will target 61.8% retracement of 25.39 to 21.39 at 23.86 first. Sustained break there will pave the way to retest 25.39 resistance.

CHF/JPY to break through 125.48 to resume up trend

Selloff in Yen gathers momentum this week on the back of risk-on sentiment. Even CHF/JPY manages to accelerate to as high as 125.37. We’re seeing the correction from 125.48 has completed at 122.10 after drawing support from 55 day EMA. Immediate focus is now on this 125.48 resistance. Firm break there will resume larger up trend to 61.8% projection of 117.51 to 125.48 from 122.10 at 127.02.

The bigger question is whether there would be more upside acceleration after breaking through 125.48. The key channel is the long term channel resistance. Sustained break there could easily send CHF/JPY to 100% projection at 130.07. And that would be a strong signal of Yen weakness elsewhere. Nevertheless, rejection by the channel resistance will just keep the selling in Yen steady.

Looking ahead

Swiss Credit Suisse economic expectations and Eurozone M3 money supply will be released in European session. US will release goods trade balance, wholesale inventories and pending home sales later in the day.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 153.97; (P) 154.27; (R1) 154.54; More…

GBP/JPY is losing some upside momentum as seen in 4 hour MACD. But further rise is expected with 153.02 minor support intact. Firm break of 154.70 should confirm the bullish case that correction from 158.19 has completed at 148.94, after defending 148.93 key support. Further rally should then be seen to retest 158.19 next. On the downside, however, break of 153.02 minor support will mix up the near term outlook and turn intraday bias neutral again first.

In the bigger picture, strong rebound from 148.93 key structural support will retain medium term bullishness. Firm break of 158.19 high will resume whole up trend from 123.94 (2020 low), to 61.8% retracement of 195.86 to 122.75 at 167.93. Nevertheless, firm break of 148.93 will bring deeper correction to 38.2% retracement of 123.94 to 158.19 at 145.10, and possibly further lower, as a correction to up trend from 123.94 at least

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | CHF | Credit Suisse Economic Expectations Dec | -10.8 | |||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Nov | 7.60% | 7.70% | ||

| 13:30 | USD | Goods Trade Balance(USD) Nov P | -89.0B | -82.9B | ||

| 13:30 | USD | Wholesale Inventories Nov P | 1.80% | 2.30% | ||

| 15:00 | USD | Pending Home Sales M/M Nov | 0.60% | 7.50% | ||

| 15:30 | USD | Crude Oil Inventories | -4.7M |