Yen, Swiss Franc, and Dollar are trading higher today on overall risk off sentiment. Selloff was particularly steep in Chinese stock markets on risks of more lockdowns in major cities, in particular Beijing. While European markets and US futures are in red, downside is relatively limited for now. Australian Dollar is still the worst performing one. But it’s hard to pick whether Euro, Sterling or Kiwi is the second weakest.

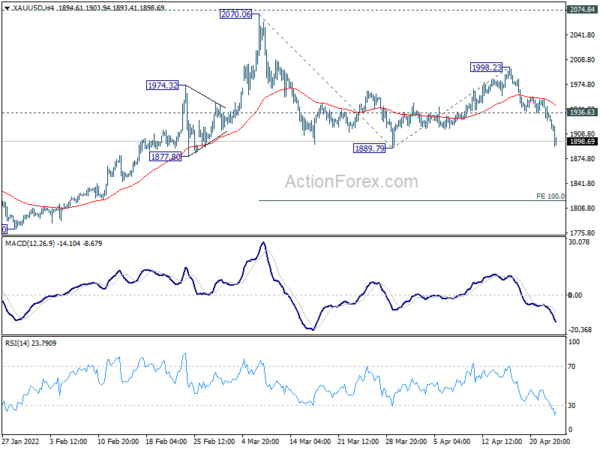

Technically, Gold also falls sharply today on Dollar strength and it’s now eyeing 1889.79 support. Firm break there will resume whole decline form 2070.06 and target 100% projection of 2070.06 to 1889.79 from 1998.23 at 1817.96. In any case, risk will stay on the downside as long as 1936.63 minor resistance holds. Overall development is favoring more upside in the greenback in general.

In Europe, at the time of writing, FTSE is down -1.47%. DAX is down -0.91%. CAC is down -1.35%. Germany 10-year yield is down -0.099 at 0.873. Earlier in Asia, Nikkei dropped -1.90%. Hong Kong HSI dropped -3.73%. China Shanghai SSE dropped 5.13%. Singapore Strait Times dropped -0.64%. Japan 10-year JGB yield rose 0.0008 to 0.251.

Germany Ifo business climate rose to 91.8, shows resilience after initial shock of Russian attack

Germany Ifo business climate rose from 90.8 to 91.8 in April, above expectation of 88.1. Current assessment index rose from 97.0 to 97.2, above expectation of 95.0. Expectations index rose from 85.1 to 86.7, above expectation of 82.3.

By sector, manufacturing rose from -3.6 to -1.0. Services rose from 0.8 to 5.4. Trade dropped from -12.0 to -13.3. Construction dropped sharply from -12.3 to -20.0.

Ifo said, the improvement was “due primarily to less pessimism in companies’ expectations. Their assessments of the current situation are minimally better. After the initial shock of the Russian attack, the German economy has shown its resilience.”

Chinese stocks and Yuan on fear of lockdown spread

The markets in China were in free fall today on fears on the impact of the spread of coronavirus, and more importantly, imposition of strict covid zero policy and lockdowns. Beijing is the believed to be evolving into the next Shanghai, after the government ordered residents not to leave the Chaoyang district.

The Shanghai SSE dropped -5.13% to 2928.51, the first close below 3000 handle since 2020. In any case, near term outlook will remain bearish as long as 3140.89 resistance holds. Deeper decline lies ahead.

More importantly, based on current momentum, long term fibonacci support at 61.8% retracement of 2440.90 to 3731.68 at 2933.97 is unlikely to be defended. That is, the whole down trend from 3731.68 could extend in to 2440.90/2646.80 support zone before bottoming

The decline in Chinese Yuan also looks unstoppable, even after the worst week since 2015 last week. PBOC announced to cut foreign exchange deposit ratio of financial institutions by 100 basis point, from 9.00% to 8.00%. The move is to improve the ability of financial institutions to use foreign exchange funds, and thus help stabilize Yuan from recent free fall. But the impact is so far limited.

USD/CNH (offshore Yuan) surged through 6.6 handle today, breaking through another important medium term resistance at 6.5872 (2021 high). The next hurdle is long term fibonacci resistance at 38.2% retracement of 7.1961 (2020 high) to 6.3057 (2022 low) at 6.6458. Strong resistance is expected there to cap upside on first attempt. But overall, break of 6.5214 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat. That is, there would be more downside in Yuan then not.

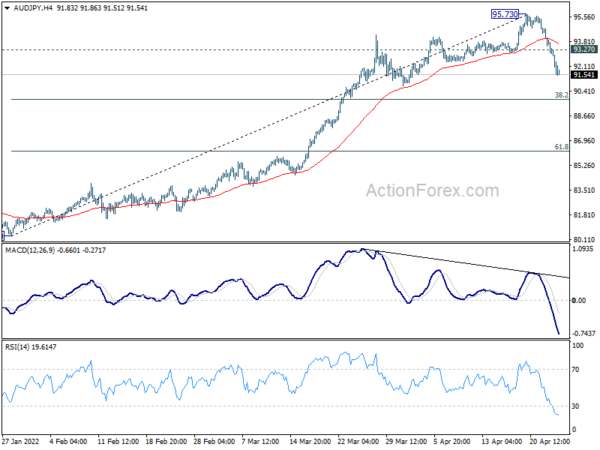

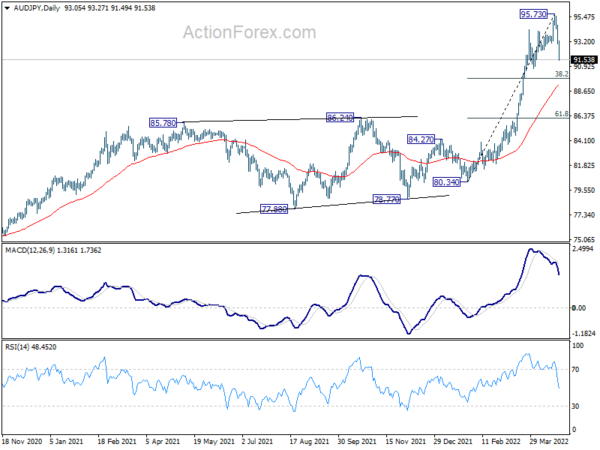

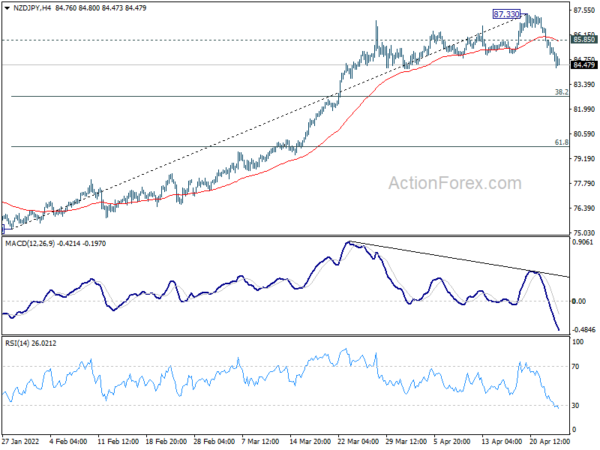

AUD/JPY and NZD/JPY in deep correction to recent up trend

AUD/JPY is under some heavy selling today. The development should confirm that a short term top was formed at 95.73, on bearish divergence condition in 4 hour MACD. It’s now correcting the whole rally from 80.34. Deeper fall should be seen to 38.2% retracement of 80.34 to 95.73 at 89.85. Break of 93.27 minor resistance is needed to indicate completion of the pull back, or risk will stay on the downside.

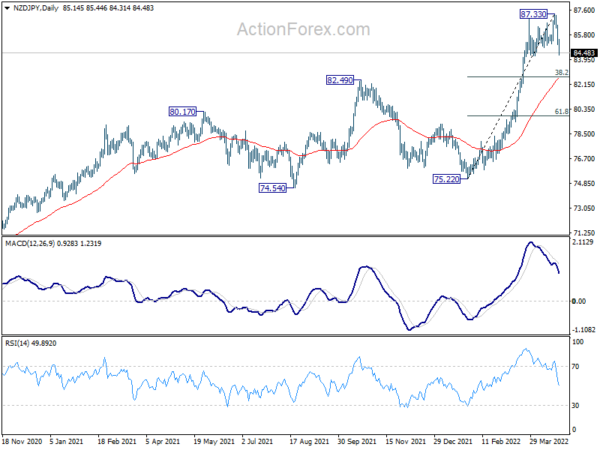

Similarly, NZD/JPY is also in correction to rise from 75.22 to 87.33. Deeper decline could be seen to 38.2% retracement of 75.22 to 87.33 at 82.70. Break of 85.85 minor resistance is needed to indicate completion of the pull back, or risk will stay on the downside too.

GBP/USD Mid-Day Outlook

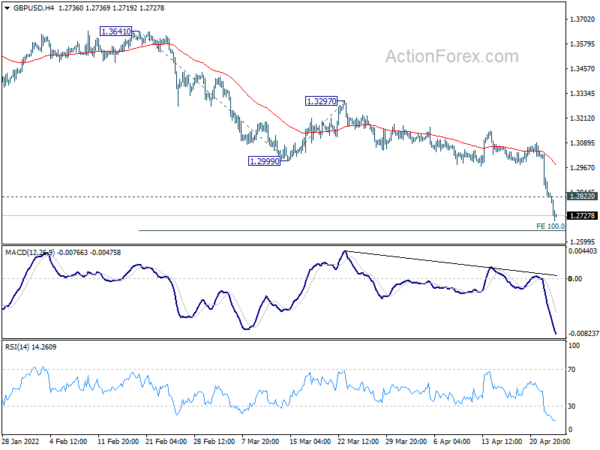

Daily Pivots: (S1) 1.2763; (P) 1.2899; (R1) 1.2976; More…

Intraday bias in GBP/USD remains on the downside as down trend continues. Next target is 100% projection of 1.3641 to 1.2999 from 1.3297 at 1.2655. Sustained break there will target 161.8% projection at 1.2258. On the upside, above 1.2822 minor resistance will turn intraday bias neutral and bring consolidation first, before staging another decline.

In the bigger picture, rise from 1.1409 (2020 low) has completed at 1.4248, ahead 1.4376 long term resistance (2018 high). Decline from 1.4248 could still be a corrective move, or it could be the start of a long term down trend. In either case, deeper decline would be seen back to 61.8% retracement of 2.1161 to 1.1409 at 1.2493. In any case, break of 1.3158 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Mar | 1.30% | 1.20% | 1.10% | |

| 08:00 | EUR | Germany IFO Business Climate Apr | 91.8 | 88.1 | 90.8 | |

| 08:00 | EUR | Germany IFO Current Assessment Apr | 97.2 | 95.0 | 97.0 | |

| 08:00 | EUR | Germany IFO Expectations Apr | 86.7 | 82.3 | 85.1 |