Risk sentiment is positive as another week starts, with major Asian indexes trading higher while Japan is on holiday. Dollar is extending its near term pull back while Yen and Swiss Franc are also soft. On the other hand, New Zealand Dollar is lifted slightly by stronger than expected consumer inflation data, while Aussie and Sterling are also firmer. Euro is mixed for now, and looks forward to ECB’s rate hike later in the week.

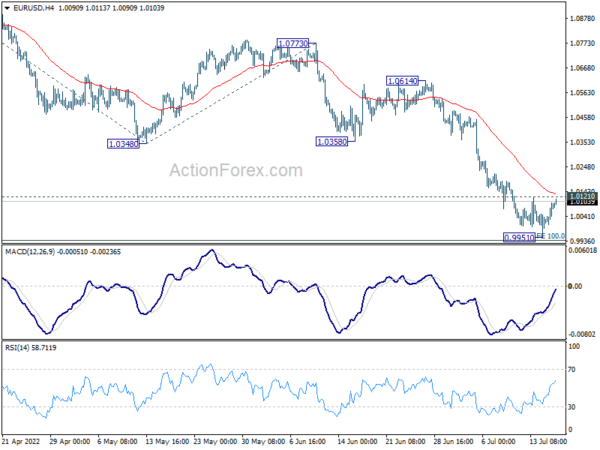

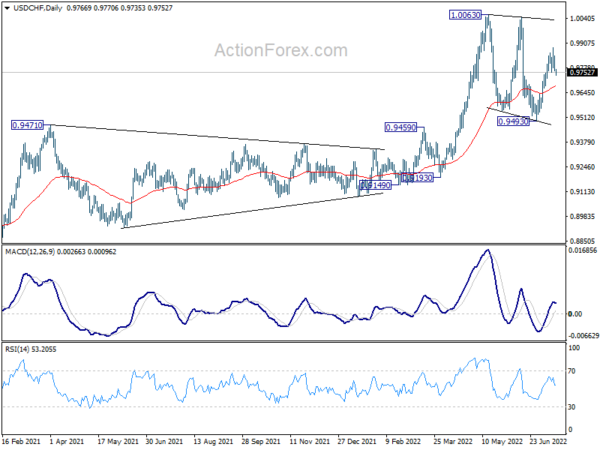

Technically, USD/CHF’s break of 0.9754 minor support is the first sign of a more sustainable pull back in Dollar. Attention will now be on 1.0121 minor resistance in EUR/USD. Firm break there will argue that parity is safe for EUR/USD for now, and stronger rebound would be seen back to 1.0348 support turned resistance. That would accompanied by more broad-based position squaring in the greenback.

In Asia, at the time of writing, Hong Kong HSI is up 2.57%. China Shanghai SSE is up 1.34%. Singapore Strait Times is up 0.62%. Japan is on holiday.

New Zealand BusinessNZ services rose slightly to 55.4, sustained improvement

New Zealand BusinessNZ Performance of Services Index ticked up from 55.3 to 55.4 in June, staying above long term average of 53.6 or the survey. Activity/sales dropped from 59.4 to 56.5. But employment improved notably from 49.0 to 53.1. New orders/business rose from 62.0 to 61.7. Stocks/inventories dropped from 54.7 to 54.1. Supplier deliveries rose from 45.6 to 47.8.

BNZ Senior Economist Craig Ebert said that “the move to traffic light Orange in mid-April, along with the expedited opening of the border, is clearly providing a basis for sustained improvement in New Zealand’s services sector”.

New Zealand CPI jumped to 32-yr high at 7.3% yoy in Q2

New Zealand CPI rose 1.7% qoq, 7.3% yoy in Q2, above expectation of 1.5% qoq, 7.1% yoy. The annual inflation accelerated from 6.9% yoy to 7.3%, a 32-year high, after 7.6% in Q2 1990.

StatsNZ said, “the main driver for the 7.3 percent annual inflation to the June 2022 quarter was the housing and household utilities group, due to rising prices for construction and rentals for housing… Transport was also a main driver of the quarterly rise, driven by petrol and diesel.”

ECB to finally start rate hikes, lots of data featured

ECB will finally start raising interest rate this week. As the central bank has pre-committed, there will be a 25bps rate hike, in all the three policy rates. The question is whether ECB will pre-commit the size of September’s hike, or keep it open. BoJ will also meet, but it’s very sure that the central bank will stand bank. Other central bank activity include RBA minutes.

On the data front, inflation will again come into spotlights will CPI from new Zealand, UK, Canada, and Japan featured. UK will also publish job data, retail sales, and consumer confidence. Meanwhile, PMI data from Australia, Japan, UK, and Eurozone will be the focus towards the end of the week. Some highlights for the week:

- Monday: New Zealand CPI; Italy trade balance; Canada housing starts, NAHB housing index.

- Tuesday: RBA minutes; Swiss trade balance; UK employment; Eurozone CPI final; US housing starts and building permits.

- Wednesday: Germany PPI; UK CPI, PPI; Eurozone current account; Canada CPI, IPPI and RMPI; US existing home sales.

- Thursday: New Zealand trade balance; Japan trade balance, BoJ rate decision; UK public sector net borrowing; ECB rate decision; Canada new housing price index; US Philly Fed survey, jobless claims, leading index.

- Friday: Australia PMIs; Japan CPI, PMI manufacturing; UK Gfk consumer confidence, retail sales, PMIs; Eurozone PMIs; Canada retail sales; US PMIs.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9731; (P) 0.9789; (R1) 0.9818; More…

USD/CHF’s break of 0.9754 minor support argues that rebound from 0.9493 is complete at 0.9884. Consolidation from 1.0063 is extending with another falling leg. Intraday bias is back on the downside for 55 day EMA (now at 0.9680). Firm break there will target 0.9493 support again. on the upside, above 0.9884 will resume the rebound to retest 1.0063 high.

In the bigger picture, medium term up trend from 0.8756 (2021 low) is still in progress. Next target is 1.0342 (2016 high). Sustained break there will resume long term up trend from 0.7065 (2011 low). This will remain the favored case as long as 0.9471 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Jun | 55.4 | 55.2 | 55.3 | |

| 22:45 | NZD | CPI Q/Q Q2 | 1.70% | 1.50% | 1.80% | |

| 22:45 | NZD | CPI Y/Y Q2 | 7.30% | 7.10% | 6.90% | |

| 08:00 | EUR | Italy Trade Balance (EUR) May | -2.32B | -3.67B | ||

| 12:15 | CAD | Housing Starts Y/Y Jun | 285K | 287K | ||

| 14:00 | USD | NAHB Housing Market Index Jul | 68 | 67 |