Global financial markets are trading in general risk seeking mode today. At the time of writing, European indices are trading in black with FTSE up 0.4%, DAX up 1.7% and CAC up 1.1%. US futures also point to higher open as S&P 500 and NASDAQ could extend their record runs. Meanwhile, DJIA is head for a take on 20000 handle again. In the currency markets, while the greenback remains generally weak, Aussie is even weaker after disappointing consumer inflation data. On the other hand, recent news regarding Brexit seems to be welcomed by the markets as Sterling surges broadly.

In UK, prime minister Theresa May said she will publish the Brexit plan in a formal "white paper" for the parliament. She said today that "I set out that bold plan for a global Britain last week and I recognize there is an appetite in this house to see that plan set out in a white paper." And, "I can confirm to the house that our plan will be set out in a white paper." The decision came after Supreme court ruled that the Brexit plan must be approved by the Parliament. And opposition Labour Party has expressed they will try to shape to deal with EU even though they will not reject it. May is still set to triggered the so-called Article 50 for Brexit by end of March. Also from UK, UK CBI trends total orders rose to 5 in January.

German Ifo business climate dropped to 109.8 in January,d own from 111.0 and below expectation of 111.3. Expectations gauge dropped notably to 103.2, down from 105.6, below consensus of 105.8. Current assessment gauge, however, rose to 116.9, up from 116.6, met expectations. Ifo chief Clemens Fuest noted that "the German economy made a less confident start to the year." However, Ifo economist Klaus Wohlrabe noted "there is no Trump effect seen in this numbers as export expectations have risen, even in the car industry." Also from Europe, Swiss ZEW expectations rose sharply to 18.5 in January, UBS consumption indicator rose to 1.5 in December.

Released in Australia, CPI rose 0.5% qoq and 1.5% yoy in Q4, below expectation of 0.7% qoq and 1.6% qoq. Down from prior month’s 0.7% qoq and 1.3% yoy. RBA trimmed mean CPI rose 0.4% qoq, 1.6% yoy, compares to expectation of 0.5% qoq, 1.6% yoy. RBA weighted mean CPI rose 0.4% qoq, 1.5% yoy, compares to expectation of 0.5% qoq, 1.4% yoy. AUD/USD bottomed at 0.6826 in Feb 2016 and engaged in range trading for nearly a year. While US Dollar was strong, Aussie stayed relatively resilient on fading expectation of more RBA rate cut. But some economists pointed out that today’s data are highlighting the downside risks to the country and could prompt RBA to rethink the need to more policy accommodation later in the year. Also from Australia, Westpac leading index rose 0.4% mom in December. In Japan, trade surplus narrowed to JPY 0.36T in December, above expectation of JPY 0.22T.

GBP/USD Mid-Day Outlook

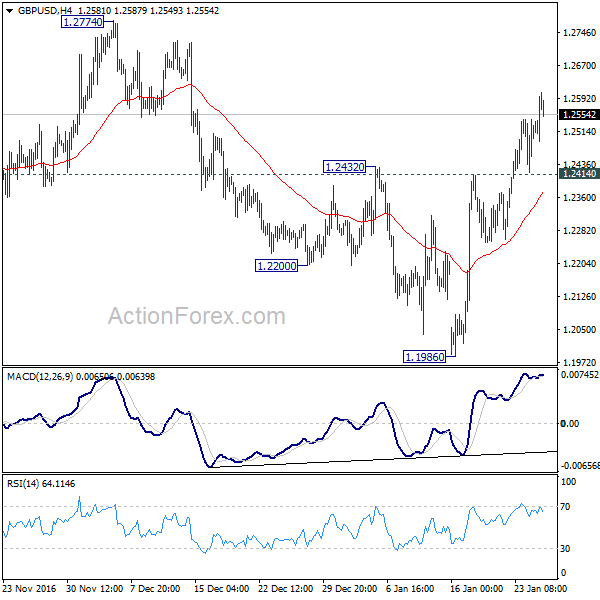

Daily Pivots: (S1) 1.2422; (P) 1.2480; (R1) 1.2591; More…

GBP/USD’s rebound from 1.1986 resumed and reaches as high as 1.2605 so far. Intraday bias is back on the upside for 1.2774 resistance next. Again, rise from 1.1986 is seen as the third leg of the consolidation pattern from 1.1946. We’d expect strong resistance at 1.2774 to limit upside and bring down trend resumption eventually. On the downside, below 1.2414 minor support will turn bias to the downside for retesting 1.1946 low.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Dec | 0.40% | 0.02% | 0.30% | |

| 23:50 | JPY | Trade Balance (JPY) Dec | 0.36T | 0.22T | 0.54T | 0.47T |

| 0:30 | AUD | CPI Q/Q Q4 | 0.50% | 0.70% | 0.70% | |

| 0:30 | AUD | CPI Y/Y Q4 | 1.50% | 1.60% | 1.30% | |

| 0:30 | AUD | CPI RBA Trimmed Mean Q/Q Q4 | 0.40% | 0.50% | 0.40% | |

| 0:30 | AUD | CPI RBA Trimmed Mean Y/Y Q4 | 1.60% | 1.60% | 1.70% | |

| 0:30 | AUD | CPI RBA Weighted Median Q/Q Q4 | 0.40% | 0.50% | 0.30% | 0.40% |

| 0:30 | AUD | CPI RBA Weighted Median Y/Y Q4 | 1.50% | 1.40% | 1.30% | |

| 7:00 | CHF | UBS Consumption Indicator Dec | 1.5 | 1.43 | 1.45 | |

| 9:00 | EUR | German IFO – Business Climate Jan | 109.8 | 111.3 | 111 | |

| 9:00 | EUR | German IFO – Expectations Jan | 103.2 | 105.8 | 105.6 | |

| 9:00 | EUR | German IFO – Current Assessment Jan | 116.9 | 116.9 | 116.6 | |

| 9:00 | CHF | ZEW Survey (Expectations) Jan | 18.5 | 12.9 | ||

| 11:00 | GBP | CBI Trends Total Orders Jan | 5 | 2 | 0 | |

| 14:00 | USD | House Price Index M/M Nov | 0.30% | 0.40% | ||

| 15:30 | USD | Crude Oil Inventories | 2.3M |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box