Dollar’s post-CPI rally faltered quickly, as risk sentiment staged a historic U-turn. For now, Sterling is the strongest one for the week on rumors that UK Prime Minister Liz Truss is going to reverse the mini-budget. New Zealand Dollar is the second strongest, followed by Euro. Yen remains the worst performer despite sign of intervention. Australian Dollar is the next worst, followed by Swiss Franc. The greenback is mixed for now, awaiting retail sales data from the US.

Technically, both EUR/JPY and GBP/JPY has resumed their near term rebounds from 137.32 and 148.93 respectively. Further rally would be seen towards 145.62 and 169.10 highs. But the question remains on what Japan would do with USD/JPY close to 1998 high, and the impact on other pairs. That is, if USD/JPY is knocked down again, would other Yen crosses follow, or Dollar is sold off instead?

In Asia, Nikkei closed up 3.25%. Hong Kong HSI is up 2.59%. China Shanghai SSE is up 1.93%. Singapore Strait Times is up 0.68%. Japan 10-year JGB yield is down -0.0018 at 0.249. Overnight, DOW rose 2.83%. S&P 500 rose 2.60%. NASDAQ rose 2.23%. 10-year yield rose 0.0050 to 3.952, after hitting as high as 4.080.

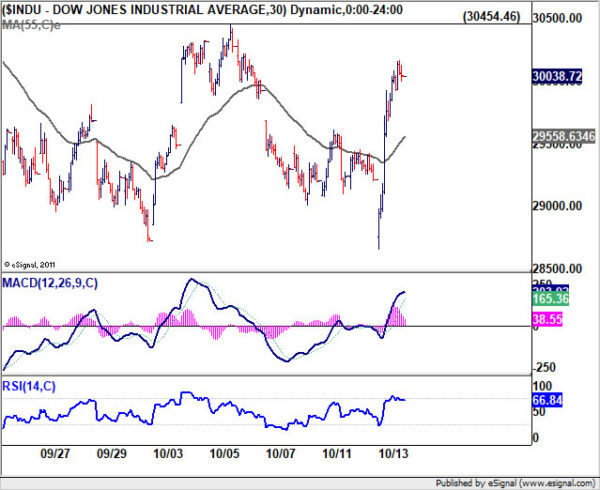

No reversal yet after DOW’s 1500 historic U-turn

US stock staged a historic U-turn overnight, after initial post-CPI selloff. DOW had a jaw-dropping swing of more than 1500 pts, falling to as low as 28660.94, then rebounded to close at 30038.72, after hitting intraday high at 30168.54. There is no convincing explanation to the reversal. Some said investors saw the set of data as a “last gasp” for rising inflation. But after all, Fed is set to continue with aggressive tightening and there is no clear sign on where interest rate would really peak.

Anyways, immediate focus is now on 30454.46 resistance in DOW. Firm break there will complete a double bottom pattern, and bring stronger rebound through 55 day EMA (now at 30914.85) in the near term. Rejection by 30454.46 should set the stage for resuming the down trend through 28660.94 later in the month.

In either case, there is no clear sign of trend reversal for now, and the whole pattern from 36965.83 should still extend to 100% projection of 36965.83 to 29653.29 from 34281.36 at 26982.00 before completion.

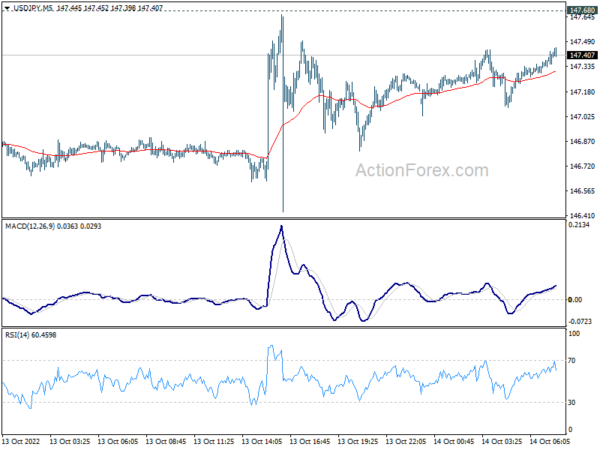

Japan didn’t confirm intervention after unusually USD/JPY volatility

There was some unusual volatility in USD/JPY overnight at it approached 1998 high at 147.68. The pair was knocked down but there was no sustained selling. Japan Ministry of Finance declined to confirm whether that was caused by intervention.

Meanwhile, Finance Minister Shunichi Suzuki just reiterated that government’s readiness to take “appropriate action” against “excessive volatility” in the markets. He said, “we cannot tolerate excessive volatility driven by speculative moves. We’re watching market developments with a strong sense of urgency.”

Separately, BoJ Governor Haruhiko Kuroda maintained that “raising rates now is inappropriate in light of Japan’s economic, price conditions.” He added that “pace of Japan’s economic recovery still slow so BoJ must continue supporting economy.”

NZ BNZ manufacturing dropped to 52.0, positive trend with ongoing volatility

New Zealand BusinessNZ Performance of Manufacturing Index dropped back from 54.8 to 52.0 in September, comparing to July’s 53.5 and June’s 50.2. Looking at some details, production dropped from 54.5 to 52.0. Employment dropped from 53.6 to 51.9. New orders tumbled sharply from 59.7 to 48.4. Finished stocks rose from 52.0 to 55.0. Deliveries edged down from 55.0 to 54.5.

BNZ Senior Economist, Doug Steel stated “the overall trend remains positive, but with ongoing volatility around it. On the positive side, the PMI’s 3-month moving average has continued to edge higher this month but, not so good, the 52.0 monthly reading is now back below the PMI’s longer-term norm”.

Looking ahead

Eurozone will release trade balance today. But focus will be on US retail sales, while import price, U of Michigan consumer sentiment and business inventories will be featured. Canada will publish manufacturing sales and wholesale sales.

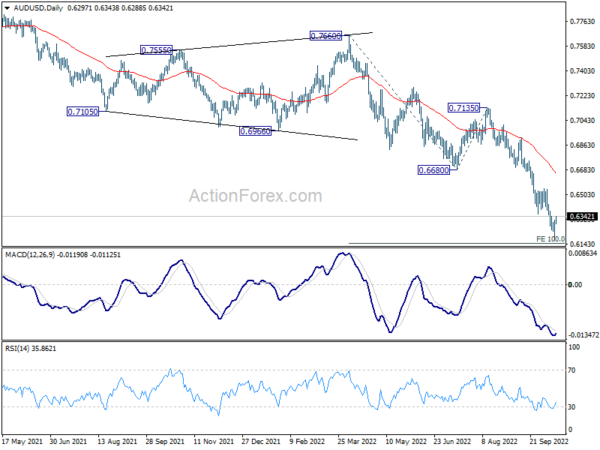

AUD/USD Daily Report

Daily Pivots: (S1) 0.6206; (P) 0.6261; (R1) 0.6352; More…

In temporary low is formed at 0.6169 in AUD/USD, just ahead of 100% projection of 0.7660 to 0.6680 from 0.7135 at 0.6155. Intraday bias is turned neutral first but outlook will stay bearish as long as 0.6539 resistance holds. Firm break of 0.6155 will target 138.2% projection at 0.5781. Nevertheless, firm break of 0.6539 will confirm short term bottoming and bring stronger rebound.

In the bigger picture, down trend form 0.8006 (2021 high) is expected to continue as long as 0.6680 support turned resistance holds. Next target is 0.5506 low. Medium term momentum will now be closely monitored to gauge the chance of break of 0.5506.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Sep | 52 | 54.9 | 54.8 | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Sep | 3.30% | 3.40% | 3.40% | |

| 01:30 | CNY | CPI Y/Y Sep | 2.80% | 2.80% | 2.50% | |

| 01:30 | CNY | PPI Y/Y Sep | 0.90% | 1.10% | 2.30% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Aug | -40.0B | -40.3B | ||

| 12:30 | CAD | Manufacturing Sales M/M Aug | -1.10% | -0.90% | ||

| 12:30 | CAD | Wholesale Sales M/M Aug | 0.10% | -0.60% | ||

| 12:30 | USD | Retail Sales M/M Sep | 0.20% | 0.30% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Sep | -0.10% | -0.30% | ||

| 12:30 | USD | Import Price Index M/M Sep | -1.10% | -1.00% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Oct P | 58.8 | 58.6 | ||

| 14:00 | USD | Business Inventories Aug | 0.90% | 0.60% |