Dollar recovers mildly in quiet trading in Asia, digesting some of last week’s losses. Yen and Canadian Dollar are following the greenback, while Swiss Franc leads Europeans lower. But overall, major pairs and crosses are bounded inside Friday’s range, suggesting lack of activity. The economic calendar is light today and trading could remain subdued. But lots of important economic data are scheduled for the week, including inflation, retail sales and employment, which are worth attention.

EUR/GBP is a pair to watch this week, considering the the UK government will finally announce a new budget plan on Thursday. Additionally, UK will release a batch of economic data. Technically, the correction form 0.9267 could be considered finalized with three waves down to 0.8570. Break of 0.8827 resistance will affirm this case. Further break of 0.8869 will open up stronger rally back towards 0.9267 high. Yet, break of 0.8689 support will probably extend the correction through 0.8570 instead.

In Asia, at the time of writing, Nikkei is down -0.78%. Hong Kong HSI is up 2.63%. China Shanghai SSE is up 0.47%. Singapore Strait Times is up 1.51%. Japan 10-year JGB yield is up 0.146 at 0.246.

BoJ Kuroda: Should continue with monetary easing

BoJ Governor Haruhiko Kuroda said in a speech that Japan’s situation “differs” from both the US and the Eurozone. The country is still “on its way to recovery”. Output gap has “remained in negative territory”, but projected to “turn positive” as some point in H2 of this fiscal year. Inflation rate “has not risen from the demand side”. Current rise in inflation was “led by rise in import prices”, and the rate is projected to decline back to below 2% from fiscal 2023.

He reiterated that BoJ “deems that it should continue with monetary easing and thereby firmly support economic activity”. By doing so, “it aims to provide a favorable environment for firms to raise wages and to achieve the price stability target in a sustainable and stable manner, accompanied by wage increases.”

Regarding exchange rates, Kuroda said the “abnormally one-sided, sharp yen weakening appears to have paused, thanks partly to government’s FX intervention.” He emphasized it is “important for forex rates to move stably reflecting economic fundamentals”.

Fed Waller: Start paying attention to the endpoint, not the pace

Fed Governor Christopher Waller said over the weekend, “we’re at a point we can start thinking maybe of going to a slower pace,” but “we’re not softening”.

“Quit paying attention to the pace and start paying attention to where the endpoint is going to be,” he urged. “Until we get inflation down, that endpoint is still a ways out there.”

Last week’s CPI report was “good, finally, that we saw some evidence of inflation starting to come down, but I just cannot stress [enough] this is one data point. We’re going to need to see a continued run of this kind of behavior and inflation slowly starting to come down, before we really start thinking about taking our foot off the brakes here,” he said.

Inflation, retail sales and job data to watch

More inflation data will be featured this week, including CPI from UK, Canada and Japan, as well ass PPI from US, UK and New Zealand. Additionally, retail sales data from China, US, and UK will be featured. Job data will be released from UK, and Australia. Additionally, RBA will release meeting minutes.

Here are some highlights for the week:

- Monday: Swiss PPI; Eurozone industrial production.

- Tuesday: Japan GDP; RBA minutes; China industrial production, retail sales, fixed asset investment; UK job data; Germany ZEW economic sentiment; Eurozone GDP, employment, trade balance; Canada manufacturing sales, wholesales; US PPI, Empire State manufacturing.

- Wednesday: Japan machine orders, tertiary industry index; Australia wage price index; UK CPI, PPI; Canada housing starts, CPI; US retail sales, industrial production, business inventories, NAHB housing index.

- Thursday: New Zealand PPI; Japan trade balance; Australia employment; Swiss Trade balance; Eurozone CPI final; US jobless claims, Philly Fed survey, building permits and housing starts.

- Friday: Japan CPI; UK Gfk consumer confidence, retail sales; Canada IPPI and RMPI; US existing home sales.

AUD/USD Daily Report

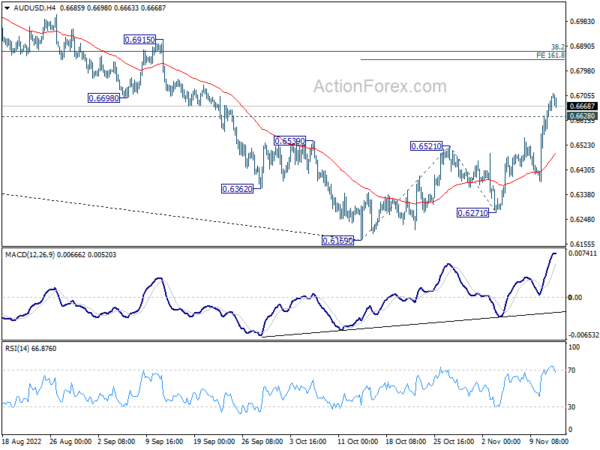

Daily Pivots: (S1) 0.6618; (P) 0.6667; (R1) 0.6757; More…

AUD/USD retreats mildly today, but intraday bias stays on the upside. Current rise from 0.6169 would target 161.8% projection of 0.6169 to 0.6521 from 0.6271 at 0.6841. On the downside, below 0.6628 minor support will turn intraday bias neutral and bring consolidations, before staging another rally.

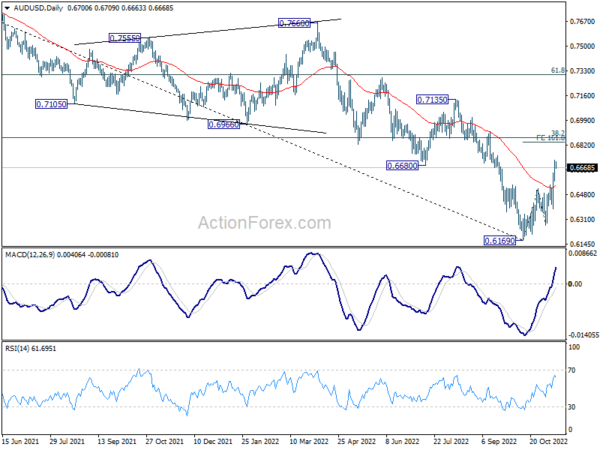

In the bigger picture, the break of 0.6680 support turned resistance confirms medium term bottoming at 0.6169. It’s too early to call for trend reversal. But even as a corrective move, rise from 0.6169 should target 38.2% retracement of 0.8006 to 0.6169 at 0.6871. Sustained trading above 55 week EMA (now at 0.6934) will raise the chance of the start of a bullish up trend. This week now remain the favored case as long as 0.6521 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:30 | CHF | Producer and Import Prices M/M Oct | 0.20% | 0.20% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Sep | 0.10% | 1.50% |