Euro is trading as the strongest one today so far, followed by Sterling, Swiss Franc and Dollar. All four currencies are going to have respective central bank meetings this week, and all are expected to hike by 50bps. Australian Dollar is leading commodity currencies and Yen lower. News flow is slow while the economic calendar is very light today. UK GDP report was largely ignored by investors. So, today’s moves are probably due to traders preparing ahead of the main events.

Technically, EUR/JPY’s break of near term channel resistance suggests that corrective fall from 148.48 has completed at 140.75 already. Further rise is in favor to 146.12 resistance first. Break there will bring retest of 148.38 high. The question now is on whether EUR/JPY’s rally would be accompanied by break of 137.84 minor resistance in USD/JPY, or 1.0594 high in EUR/USD.

In Europe, at the time of writing, FTSE is down -0.25%. DAX is down -0.29%. CAC is down -0.28%. Germany 10-year yield is down -0.025 at 1.907. Earlier in Asia, Nikkei dropped -0.21%. Hong Kong HSI dropped -2.20%. China Shanghai SSE dropped -0.87%. Singapore Strait Times dropped -0.19%. Japan 10-year JGB yield rose 0.0007 to 0.257.

NIESR: UK GDP to remain flat in Q4

NIESR said the 0.5% mom growth in UK GDP in October “largely reflects the weakness in September” resulting from additional Bank Holiday for the State Funeral of HM Queen Elizabeth II. The risks of GDP contraction in Q4 “remains elevated”. It expects GDP to remain flat in Q4.

Paula Bejarano Carbo Associate Economist, NIESR said:

“Monthly GDP grew by 0.5 per cent in October, in line with our forecast last month, driven by a strong pick-up in wholesale and retail trade, and repair of motor vehicles and motorcycles, which seem to have been strongly affected by the additional September bank holiday.

“Despite this positive outlook from the monthly growth figure, there are still strong downside risks to GDP in the fourth quarter of this year due to high inflation and interest rates –which continue to suppress demand –and supply chain disruptions, as well as work backlogs due to industrial action and a tight labour market –which continue to weigh on business growth. We still expect GDP to remain flat in the fourth quarter of this year.”

UK GDP grew 0.5% mom in Oct, driven by services

UK GDP grew 0.5% mom in October, better than expectation of 0.4% mom. Services grew 0.6% mom and was the main driver of growth in GDP. Production was broadly flat for the month. Construction grew 0.8% mom. GDP is estimated to be 0.4% above is pre-coronavirus levels in February 2020.

In the three months to October, compared with the three months to July, GDP contracted -0.3%. Services was down -0.1%. Production dropped -1.7%. Construction rose 1.1%.

Also released, industrial production came in at 0.0% mom, -2.4% yoy, versus expectation of -0.3% mom, -4.2% yoy. Manufacturing was at 0.7% mom, -4.6% yoy, versus expectation of -0.1% mom, -6.3% yoy. Goods trade deficit narrowed to GBP -14.5B, versus expectation of GBP -15.0B.

Japan PPI slowed to 9.3% yoy in Nov, global commodity prices easing

Japan corporate goods price index slowed from 9.4% yoy to 9.3% yoy in November, above expectation of 8.9% yoy. The index, at 118.5, was a record high. Yen-based import price index slowed notably from 42.3% yoy to 28.2% yoy.

“Companies were passing on rising raw material costs for a broad range of goods. But some goods saw the impact of recent easing of global commodity prices,” a BOJ official told a briefing.

Also from Japan, MoF’s Business Survey Index for all large industries rose from 0.4 to 0.7 in Q4. BSI large manufacturing, however, dropped from 1.7 to -3.6. BSI large non-manufacturing improved form -0.2 to 2.7. BSI medium all industries rose from -2.2 to 4.7. BSI small all industries rose from -15.9 to -6.0.

EUR/USD Mid-Day Outlook

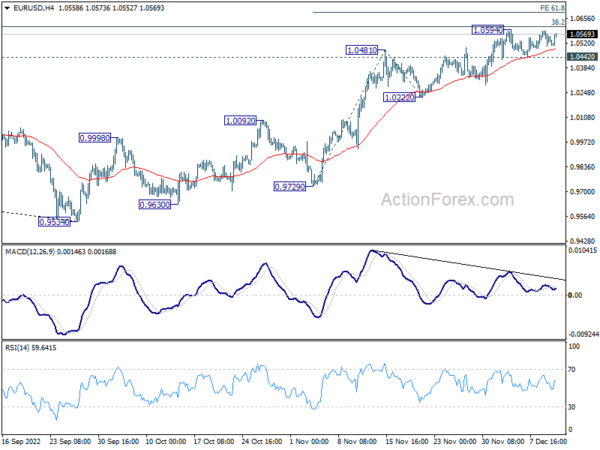

Daily Pivots: (S1) 1.0497; (P) 1.0543; (R1) 1.0579; More…

Intraday bias in EUR/USD stays neutral for the moment as range trading continues. On the downside, break of 1.0442 support will indicate rejection by 1.0609 fibonacci level. Bias will be back on the downside for 1.0222 support and below. However, firm break of 1.0594/0609 resistance zone will carry larger bullish implication. Next near term target is 61.8% projection of 0.9729 to 1.0481 from 1.0222 at 1.0687, and then 100% projection at 1.0974.

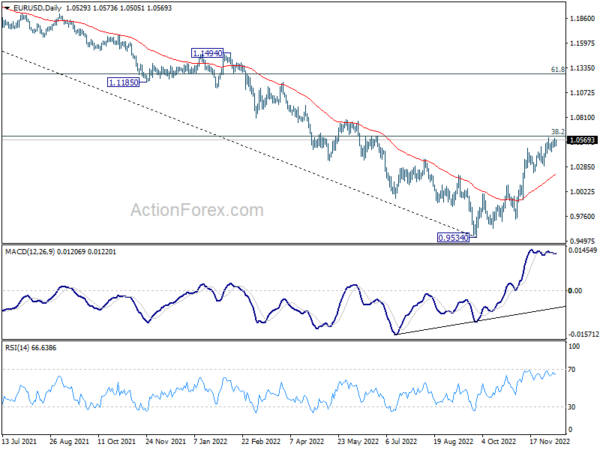

In the bigger picture, focus is now on 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Rejection by 1.0609 will suggest that price actions from 0.9534 medium term bottom are developing into a corrective pattern. Thus, medium bearishness is retained for another fall through 0.9534 at a later stage. However, sustained break of 1.0609 will raise the chance of trend reversal and target 61.8% retracement at 1.1273.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Nov | 9.30% | 8.90% | 9.10% | 9.40% |

| 23:50 | JPY | BSI Manufacturing Index Q4 | -3.6 | 2.3 | 1.7 | |

| 06:00 | JPY | Machine Tool Orders Y/Y Nov P | -7.80% | -5.40% | -5.50% | |

| 07:00 | GBP | GDP M/M Oct | 0.50% | 0.40% | -0.60% | |

| 07:00 | GBP | Index of Services 3M/3M Oct | -0.10% | -0.10% | 0.00% | |

| 07:00 | GBP | Industrial Production M/M Oct | 0.00% | -0.30% | 0.20% | |

| 07:00 | GBP | Industrial Production Y/Y Oct | -2.40% | -4.20% | -3.10% | |

| 07:00 | GBP | Manufacturing Production M/M Oct | 0.70% | -0.10% | 0.00% | |

| 07:00 | GBP | Manufacturing Production Y/Y Oct | -4.60% | -6.30% | -5.80% | |

| 07:00 | GBP | Goods Trade Balance (GBP) Oct | -14.5B | -15.0B | -15.7B | |

| 12:13 | GBP | NIESR GDP Estimate (3M) Nov | -0.30% | -0.30% |