Dollar is apparently trying for a breakout in early US session after strong PPI inflation data. US futures also tumble while 10-year yield jumps. Still, The greenback is staying in range so far except versus Yen. As for the week, Yen is still the worst performer followed by Kiwi and then Canadian Euro is the best followed by Swiss Franc and Dollar.

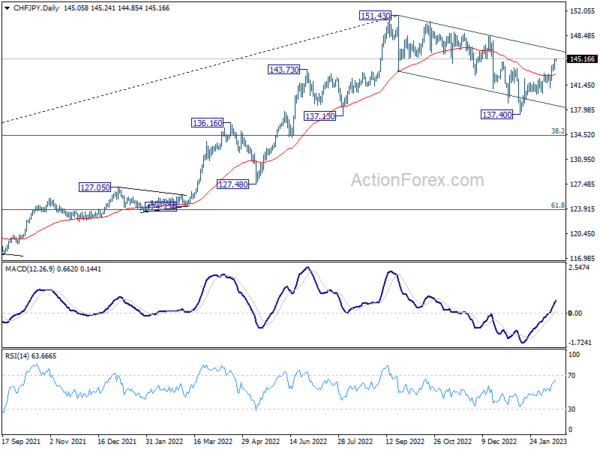

Technically, CHF/JPY’s rally from 137.40 extended higher this week. The strong break of 55 day EMA (now at 143.06) raising the chance that corrective pattern from 151.43 has completed at 137.40. Near term focus is now on channel resistance at 146.35. Sustained break there will argue that larger up trend is ready to resume through 151.43 high. Let’s see if that would happen, and be accompanied by rises in Yen crosses elsewhere.

In Europe, at the time of writing, FTSE is up 0.05%. DAX is up 0.01%. CAC is up 0.77%. Germany 10-year yield is up 0.0241 at 2.499. Earlier in Asia, Nikkei rose 0.71%. Hong Kong HSI rose 0.84%. China Shanghai SSE dropped -0.96%. Singapore Strait Times rose 0.93%. Japan 10-year JGB yield rose 0.0005 to 0.507.

Fed Mester: Need to bring rate above 5% and hold it there for some time

Cleveland Federal President Loretta Mester said, “at this juncture, the incoming data have not changed my view that we will need to bring the fed funds rate above 5% and hold it there for some time to be sufficiently restrictive to ensure that inflation is on a sustainable path back to 2%.”

“Setting aside what financial market participants expected us to do, I saw a compelling economic case for a 50-basis-point increase, which would have brought the top of the target range to 5%,” she said.

“It is welcome news to see some moderation in inflation readings since last summer, but the level of inflation matters and it is still too high,” She said. Adding that the January CPI data “showed a jump in the monthly rate of overall inflation and no improvement in underlying inflation”

Mester said “I continue to see the risks to the inflation forecast as tilted to the upside for a number of reasons.” She also said “the transition back to price stability will take some time and will not be without some pain.”

The impact of Fed policy actions “will result in growth well below trend this year and some cooling off in labor markets, with slower employment growth and an increase in the unemployment rate from its very low level.”

US PPI up 0.7% mom, 6.0% yoy in Jan

US PPI for final demand rose 0.7% mom in January, above expectation of 0.4% mom. PPI goods led the advance and rose 1.2% mom while services rose 0.4% mom. PPI less foods, energy, and trade services rose 0.6% mom, largest advance since March 2022.

For the 12 months period, PPI rose 6.0% yoy, above expectation of 5.1% yoy. PPI less foods, energy and trade services rose 4.5% yoy.

US initial claims ticked down to 194k

US initial jobless claims dropped -1k to 194k in the week ending February 11, below expectation of 200k. Four-week moving average of initial claims rose 500 to 189.5k.

Continuing claims rose 16k to 1696k in the week ending February 4. Four-week moving average of continuing claims rose 10k to 1673k.

ECB Panetta: Resolute in the right direction, but not drive like crazy at night

ECB Executive Board member Fabio Panetta said in a speech “as policy rates move more firmly into restrictive territory and the energy shock abates, the risks to the inflation outlook have become more balanced.”

“The outlook for the economy and inflation has become increasingly uncertain, both globally and in the euro area.”

In this environment, we no longer need to overweight upside risks to avoid worst-case scenarios. We now need to take into account the risk of overtightening alongside the risk of doing too little.” he said.

A “data-dependent calibration of monetary policy” offers the best way forward while “smoothing our policy moves we ensure that their cost to the economy is minimal.”

“This doesn’t mean we will not be resolute in the fight against inflation. It means being resolute in the right direction. What we do not want is “to drive like crazy at night with our headlights turned off” – as Italian singer Lucio Battisti once put it.”

Japan posts record monthly trade deficit as exports to China tumbled

Japan goods exports rose 3.5% yoy to JPY 6551B in January, better than expectation of 0.8% yoy, but much worse than prior month’s 11.5% yoy. Exports to China fell -17.1% yoy on cars, car parts and chip-making equipment. Exports to the US were up 10.2% yoy. Exports to Europe ere up 9.5% yoy.

Imports rose 17.8% yoy to JPY 10048B, below expectation of 18.4% yoy and prior month’s 20.7% yoy. Import growth was boosted by coal, liquefied natural gas and crude oil,

Trade deficit came in at JPY -3497B.The monthly deficit was the largest on record going back to 1979.

In seasonally adjusted term, exports dropped -6.3% mom to JPY 7788B. Imports dropped -5.1% mom to JPY 9609B. Trade deficit was largely unchanged at JPY -1821B.

Australian employment down -11.5k in Jan, unemployment rate rose to 3.7%

Australia employment contracted -11.5k or -0.1% mom in January, worse than expectation of 20k growth. Unemployment rate rose from 3.5% to 3.7%, above expectation of 3.5%. Participation rate dropped from 66.6% to 66.5%. Monthly hours worked dropped -2.1% mom.

ABS noted: Along with a larger-than-usual increase in unemployed people in January, there was also a similarly larger-than-usual rise in the number of unemployed people who had a job to go to in the future.

Bjorn Jarvis, ABS head of labour statistics said: “January is the most seasonal time of the year in the Australian labour market, with people leaving jobs but also getting ready to start new jobs or return from leave. This January, we saw more people than usual with a job indicating they were starting or returning to work later in the month.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0650; (P) 1.0698; (R1) 1.0734; More…

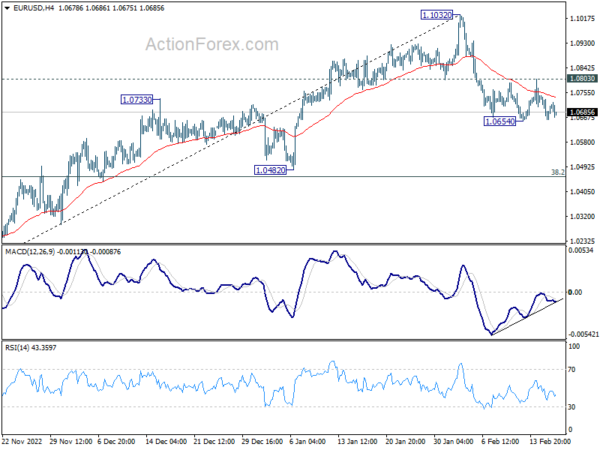

Intraday bias in EUR/USD remains neutral and outlook is unchanged. On the downside, break of 1.0654 will resume the corrective fall from 1.1032 to 38.2% retracement of 0.9534 to 1.1032 at 1.0463. Strong support should be seen around there to bring rebound, at least on first attempt. On the upside, firm break of 1.0803 minor resistance will turn bias back to the upside for retesting 1.1032 high instead.

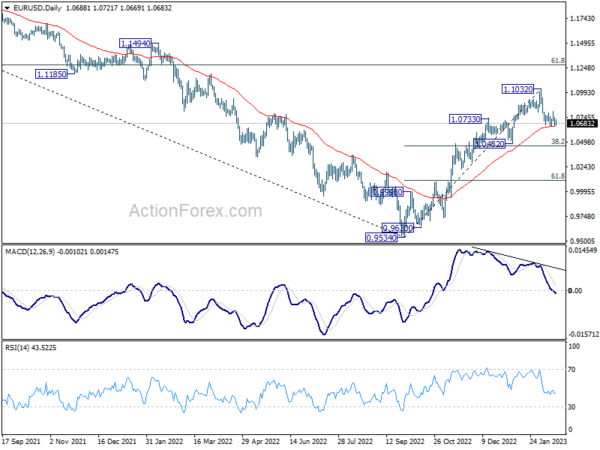

In the bigger picture, the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jan | -1.82T | -2.47T | -1.72T | -1.82T |

| 23:50 | JPY | Machinery Orders M/M Dec | 1.60% | 2.70% | -8.30% | |

| 00:00 | AUD | Consumer Inflation Expectations Feb | 5.10% | 5.60% | ||

| 00:30 | AUD | Employment Change Jan | -11.5K | 20.0K | -14.6K | -20.0K |

| 00:30 | AUD | Unemployment Rate Jan | 3.70% | 3.50% | 3.50% | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Housing Starts Jan | 1.31M | 1.36M | 1.38M | |

| 13:30 | USD | Building Permits Jan | 1.34M | 1.35M | 1.34M | |

| 13:30 | USD | PPI M/M Jan | 0.70% | 0.40% | -0.50% | -0.20% |

| 13:30 | USD | PPI Y/Y Jan | 6.00% | 5.10% | 6.20% | 6.50% |

| 13:30 | USD | PPI Core M/M Jan | 0.50% | 0.30% | 0.10% | 0.30% |

| 13:30 | USD | PPI Core Y/Y Jan | 5.40% | 4.90% | 5.50% | |

| 13:30 | USD | Initial Jobless Claims (Feb 10) | 194K | 200K | 196K | 195K |

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Feb | -24.3 | -7.7 | -8.9 | |

| 15:30 | USD | Natural Gas Storage | -97B | -217B |