Dollar jumps in early US session follow data that showed surprised re-acceleration in PCE inflation, and core. Stocks tumble at open while treasury yields rise. The situation for Fed interest to “stay longer and higher” continues to solidify. Selloff is more concentrated on Yen and commodity currencies while European majors are mixed.

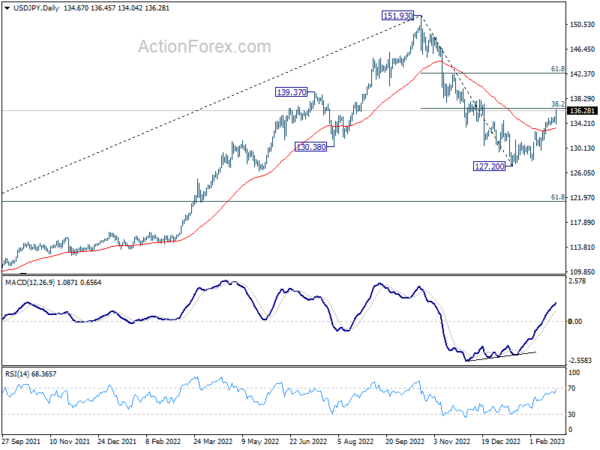

Technically, USD/JPY will be testing a major fibonacci resistance at 38.2% retracement of 151.93 to 127.20 at 136.64 soon. Strong break there will lower the chance of a long term bearish reversal. That will also bring further rally to 61.8% retracement at 142.48, even as just the second leg of the corrective pattern from 151.93.

In Europe, at the time of writing, FTSE is down -0.19%. DAX is down -1.21%. CAC is down -1.16%. Germany 10-year yield is up 0.075 at 2.556. Earlier in Asia, Nikkei rose 1.29%. Hong Kong HSI dropped -1.68%. China Shanghai SSE dropped -0.62%. Singapore Strait Times rose 0.53%. Japan 10-year JGB yield rose 0.0024 to 0.506.

US PCE inflation rose to 5.4% yoy, PCE core rose to 4.7% yoy

US personal income rose 0.6% mom or USD 131.1B in January, below expectation of 1.0% mom. But personal spending rose 1.8% mom or USD 312.5B, above expectation of 1.0% mom.

For the month, PCE price index rose 0.6% mom, above expectation of 0.5% mom. Core PCE (excluding food and energy) rose 0.6% mom, above expectation of 0.4% mom. Prices for goods and services rose 0.6% mom. Food prices rose 0.4% mom. Energy prices rose 2.0% mom.

For the year, PCE price index accelerated from 5.3% yoy to 5.4% yoy, above expectation of 4.9% yoy. Core PCE accelerated from 4.6% yoy to 4.7% yoy, above expectation of 4.1% yoy. Goods prices rose 4.7% yoy. Services rose 5.7% yoy. Food rose 11.1% yoy and energy rose 9.6% yoy.

Bundesbank Nagel: Stopping tightening too early is a cardinal error

Bundesbank President Joachim Nagel said, “What seems distinctive to me is that core inflation will remain at a very high level beyond March.”

“That’s why I don’t rule out that further significant interest rate hikes beyond March will be necessary,: he added.

Nagel also said ECB’s interest rate is not restrictive yet. He warned that stopping tightening too early would be a “cardinal error.”

Germany Gfk consumer confidence rose to -30.5, firmly on the path to recovery

Germany Gfk Consumer Confidence for March rose from -33.8 to -30.5, slightly below expectation of -30.0. In February, economic expectations rose from -0.6 to 6.0. Income expectations rose from -32.2 to -27.3. Propensity to buy rose from -18.7 to -17.3.

“Despite ongoing crises, such as the war in Ukraine, a weakening global economy, and high inflation rates, consumer sentiment has once again increased noticeably. It thus remains firmly on the path to recovery, even if the level remains low. Consumer pessimism, which peaked last fall, is fading”, explains Rolf Bürkl, GfK consumer expert.

“Recent drops in energy prices and reports that experts believe a recession in Germany this year can now be avoided mean that optimism is slowly returning.”

BoJ Ueda: Current policy a necessary, appropriate means to achieve 2% inflation

At a parliamentary confirmation hearing, incoming BoJ Governor Kazuo Ueda said, “current policy is a necessary, appropriate means to achieve 2% inflation,” despite various side effects emerging from the stimulus.

“Japan’s trend inflation is likely to rise gradually. But it will take some time for inflation to sustainably and stably achieve the BOJ’s 2% target,” he said.

“Consumer inflation is likely to fall below 2% in the latter half of the next fiscal year. It takes time for the effect of monetary policy to appear on the economy. ”

“It’s standard practice to act preemptively to demand-driven inflation, but not respond immediately to supply-driven inflation. Otherwise, the BOJ will be cooling demand, worsening economy and pushing down prices by tightening monetary policy.”

“If trend inflation heightens significantly and sustained achievement of the BOJ’s 2% target comes into sight, the central bank must consider normalizing policy. But if trend inflation lacks strength, the bank must continue how to maintain its ultra-easy policy, while paying attention to deterioration in market function.”

Japan CPI core hit 41-yr high at 4.2% in Jan

Japan all item CPI rose from 4.0% yoy to 4.3% yoy in January, below expectation of 4.5% yoy. CPI core (all-item ex-food) rose from 4.0% yoy to 4.2% yoy, matched expectations. CPI core-core (all-item ex-food and energy) rose from 3.0% yoy to 3.2% yoy, matched expectations.

Core CPI rate of 4.2% was the highest in 41-year since September 1981. The core inflation rate stayed above BoJ’s 2% target for nine consecutive months.

RBNZ Silk: A tightening pause is being contemplated now

RBNZ Assistant Governor Karen Silk said in a Bloomberg interview “there’s still more work to do here” on interest rate and fighting inflation. While “all levels are on the table” for April meeting, the central bank is not contemplating a pause.

“This is still an economy that has excess demand, a tight labor market, and as a consequence both headline inflation and core inflation at levels that are well outside the (target) band,” she said.

Regarding April meeting, “all levels are on the table for discussion at every meeting,” she said. “I’m not going to turn round and comment on whether we would be looking at 25, 50 or 75, they will all be on the table for discussion and they will depend on the information at hand.”

Nevertheless, a pause in tightening is “certainty not something that we’re contemplating at this point in time,” she said.

Silk also noted that some upside risk was built into the forecast interest peak of 5.5%. However, “without building that in, any variation to that peak would have been still at the margin,” she said. “There’s potentially still some upside risk on the fiscal side of it. Let’s just see how it plays out over the next six weeks.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0572; (P) 1.0600; (R1) 1.0623; More…

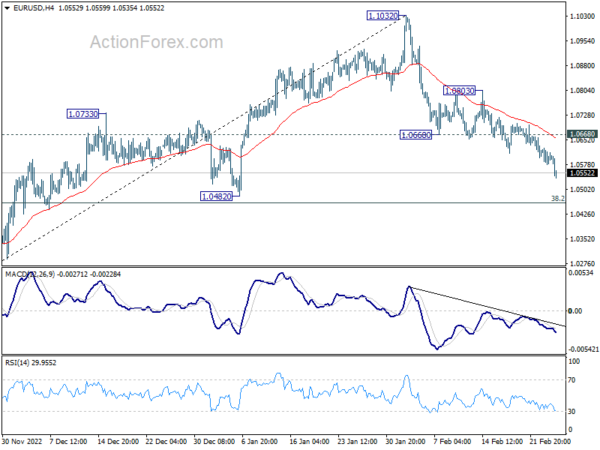

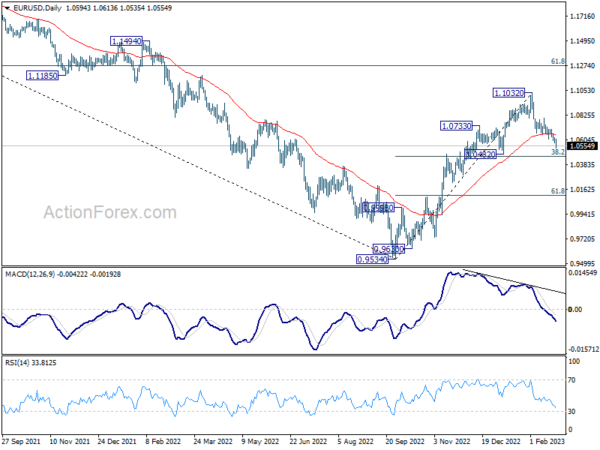

EUR/USD’s fall from 1.1032 continues today and intraday bias stays on the downside for 38.2% retracement of 0.9534 to 1.1032 at 1.0463. Strong support should be seen around there to bring rebound, at least on first attempt. On the upside, above 1.0668 support turned will turn bias back to the upside for 1.0803 resistance and above. However, sustained break of 1.0463 will carry larger bearish implications.

In the bigger picture, the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Jan | 4.20% | 4.20% | 4.00% | |

| 00:01 | GBP | GfK Consumer Confidence Feb | -38 | -40 | -45 | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Mar | -30.5 | -30 | -33.9 | -33.8 |

| 07:00 | EUR | Germany GDP Q/Q Q4 F | -0.40% | -0.20% | -0.20% | |

| 13:30 | USD | Personal Income M/M Jan | 0.60% | 1.00% | 0.20% | 0.30% |

| 13:30 | USD | Personal Spending Jan | 1.80% | 1.00% | -0.20% | -0.10% |

| 13:30 | USD | PCE Price Index M/M Jan | 0.60% | 0.50% | 0.10% | 0.20% |

| 13:30 | USD | PCE Price Index Y/Y Jan | 5.40% | 4.90% | 5.00% | 5.30% |

| 13:30 | USD | Core PCE Price Index M/M Jan | 0.60% | 0.40% | 0.30% | 0.40% |

| 13:30 | USD | Core PCE Price Index Y/Y Jan | 4.70% | 4.10% | 4.40% | 4.60% |

| 15:00 | USD | Michigan Consumer Sentiment Index Feb F | 66.4 | 66.4 | ||

| 15:00 | USD | New Home Sales Jan | 620K | 616K |