Sterling’s broad-based rally continues today and shows sign of upside acceleration. The Pound is additionally added by selloff in Swiss Franc, which is also seen against Euro. Dollar is currently the third strongest for the day as supported by resilience in benchmark treasury yields. Meanwhile, Yen and Swiss Franc are the worst performers, while commodity currencies are mixed.

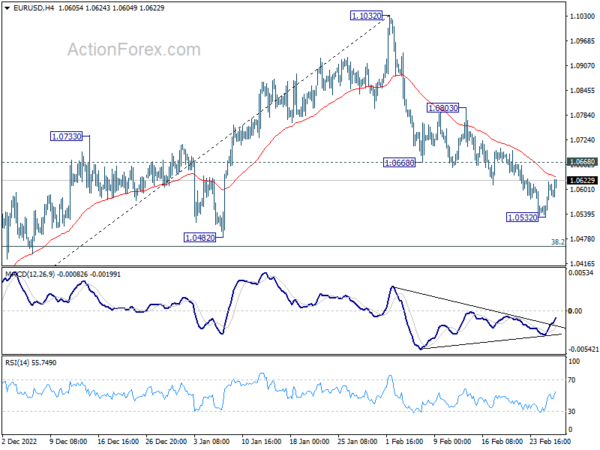

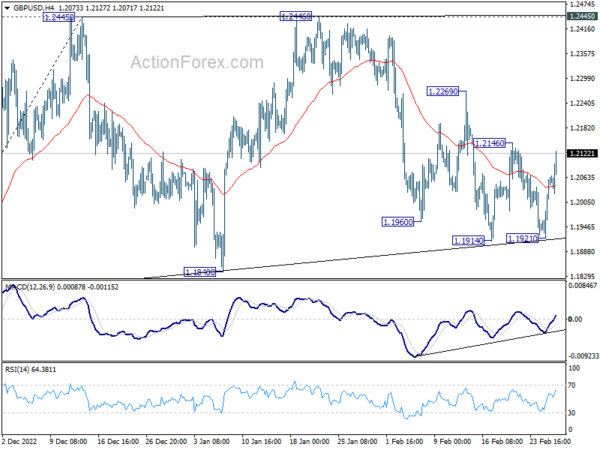

Technically, EUR/USD will be a focus in the next few sessions. Recovery from 1.0532 is picking up some momentum in 4 hour MACD. Firm break of 1.0668 support turned resistance will argue that whole corrective fall from 1.1032 has completed with three waves down to 1.0532, ahead of 1.0482 key structural support. In the case, stronger rise should be seen through 1.0803 towards 1.1032 high. If happens, that should be accompanied by GBP/USD’s rally through 1.2269 resistance towards 1.2446 high.

In Europe, at the time of writing, FTSE is down -0.52%. DAX is up 0.26%. CAC is up 0.20%. Germany 10-year yield is up 0.090 at 2.670. Earlier in Asia, Nikkei rose 0.08%. Hong Kong HSI dropped -0.79%. China Shanghai SSE rose 0.66%. Singapore Strait Times dropped -0.02%. Japan 10-year JGB yield dropped -0.0017 to 0.503.

Canada GDP down -0.1% mom in Dec, but expected to rebound in Jan

Canada GDP contracted -0.1% mom in December, worse than expectation of 0.2% mom expansion. Goods-producing industries declined -0.6% while service-producing industries were essentially unchanged.

For Q4, GDP grew 0.2% qoq, slowest pace since Q2, 2021. Services producing industries rose 0.5% qoq while goods-producing industries contracted -0.6% qoq.

Advance information indicates that real GDP grew 0.3% mom in January. Increases in the mining, quarrying, and oil and gas extraction, wholesale trade, professional, scientific and technical services, and transportation and warehousing sectors were slightly offset by decreases in construction and retail trade.

ECB Lane: We need another 50 basis points in March

ECB Chief Economist Philip Lane said in an interview, “our assessment of December remains solid, that we needed a sequence of 50 basis point hikes to bring us inside a zone where we would need to think harder about whether rates are sufficiently restrictive to deliver the return of inflation to 2%.

“The data flow since then suggests that the assessment is solid, that we need another 50 basis points in March,” he said.

Beyond March, “the overall philosophy is that we will bring rates to a level that is sufficiently restrictive, which depends on where the inflation forecast is, where we are with underlying inflation and where we are with the monetary transmission mechanism.”

“There is a zone of interest rate paths that the Governing Council will have to assess in March, in May and thereafter, and determine where in that zone we want to be,” he added.

Without commenting on whether rate will stay at a significantly long plateau, Lane said “I absolutely sign up to the monetary policy philosophy that wherever we get to, we should be slow to come down until we have very strong evidence – not just in the forecast but also in our ongoing assessment of underlying inflation – that we are returning inflation to target.”

Swiss KOF rose to 100, an encouraging upward trend

Swiss KOF Economic Barometer rose for the third month in a row, from 97.4 to 100 in February, hitting the long-term average. It’s also above expectation of 98.0.

KOF said, “Since the last low in November 2022 (89.3), we are now observing an encouraging upward trend lasting for already three months.”

“The indicators from the manufacturing sector are primarily responsible for the increase, but the indicators for the consumer-related sectors and the export economy as well as, albeit somewhat less clearly, the financial sector are also sending positive signals.

“The other indicators included in the barometer show hardly any change, with the exception of the hotel and restaurant industry, where sentiment has deteriorated slightly.”

Swiss GDP stagnated in Q4, challenging international environment curbed manufacturing and exports

Swiss GDP stagnated in Q4, worse than expectation of 0.3% qoq. Looking at some details by production approach, manufacturing contracted -0.3% qoq. Construction was down -0.2% qoq. Trade rose 0.4% qoq. By expenditure approach, private consumption rose 0.3% qoq, government consumption rose 0.3% qoq, construction investment dropped -0.5% qoq, exports of goods dropped -1.7% qoq.

SECO said, “The challenging international environment curbed manufacturing output and also exports. Domestic demand showed robust growth.”

BoJ Wakatabe: Dangers of secular stagnation and Japanification not yet passed

Deputy Governor Masazumi Wakatabe said, “the mild-inflation regime has not come to an end, and we should say that the potential dangers of secular stagnation and Japanification have not yet passed.”

“When an exogenous shock occurs, there is an adjustment from the old to a new price system. After adjustment, the rising inflation rate is likely to return to the steady-state inflation rate,” he said.

“So the important point is how this rate is affected. Of course, it is possible that cost-push factors will remain, but whether they will push up the steady-state inflation rate is uncertain,” Wakatabe said, adding that it was “well known that cost-push inflation does not last long.”.

BoJ Uchida: Shouldn’t modify easy policy just because there are side-effects

Incoming BoJ Deputy Governor Shinichi Uchida told an upper house confirmation hearing, “BOJ must maintain monetary easing. It shouldn’t modify easy policy just because there are side-effects. Rather, it must come up with ideas” to mitigate the costs and help sustain stimulus.

He also noted it’s premature to discuss an exit from the ultra-loose monetary policy. Any exit would involve adjustments in the interest targets and the balance sheet. “In what order and at what timing the BOJ will make these adjustments will depend on economic and financial developments at the time,” Uchida said.

Japan industrial production down -4.6% mom in Jan, expected to rebound in Feb

Japan industrial production declined -4.6% mom in January, much worse than expectation of -2.6% mom.

Upon the release of the data, the METI downgraded its assessment of industrial production, saying that it has weakened. Never the less, the ministry forecast industrial production to bounce back by 8.0% in February, and then a further 0.7% in March.

Retail sales rose 6.3% yoy, above expectation of 4.0% yoy.

Australia retail sales rose 1.9% mom in Jan, flat on average over the past few months

Australia retail sales turnover rose 1.9% mom to AUD 35.09B in January, above expectation of 1.6% mom. Compared with January 2022, sales turnover was up 7.5% yoy.

Ben Dorber, ABS head of retail statistics, said: “The rebound in retail turnover in January followed a substantial fall of 4.0 per cent in December and a large rise of 1.7 per cent in November.

“Looking through this volatility shows that turnover is at a similar level to September 2022, and on average, growth has been flat over the past few months.”

NZ ANZ business confidence rose to -43.3, firms wary but getting on with the job

New Zealand ANZ Business Confidence improved form -52.0 to -43.3 in February. Own Activity Outlook rose from -15.8 to -9.2.

Looking at some details, export intentions ticked up from -5.4 to -5.2. Investment intentions rose from -13.7 to -4.9. Employment intentions jumped from -11.1 to -3.4. Pricing intentions dropped from 62.4 to 58.8. Cost expectations dropped from 91.3 to 88.3. Inflation expectations ticked down from 5.99 to 5.94.

ANZ said: “The shock value of the November Monetary Policy Statement appears to have faded into the rear-vision mirror as firms focus on the risks and opportunities that are front and centre…. Opportunity is clearly still knocking. That said, the level of most indicators remain subdued – firms are still very wary, and understandably so. But they are getting on with the job.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1969; (P) 1.2017; (R1) 1.2112; More…

Focus in GBP/USD is now back on 1.2146 resistance as rebound form 1.1921 extends. Firm break there will turn bias back to the upside for 1.2269 resistance. In such case, whole corrective pattern from 1.2445 might have completed at 1.1914. Break of 1.2269 will bring retest of 1.2445/6 high.

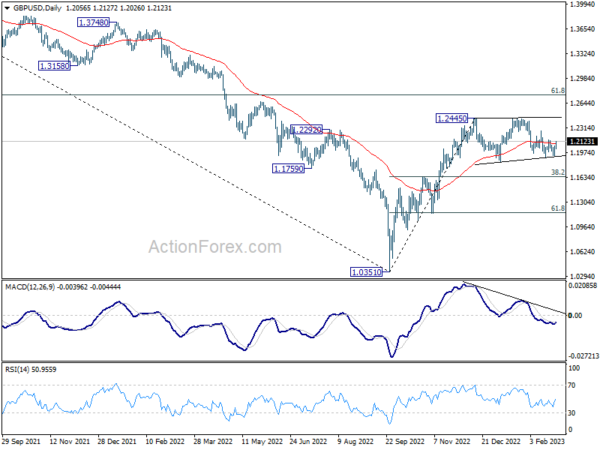

In the bigger picture,as long as 1.1840 support holds, rise from 1.0351 medium term bottom (2022 low) should still continue to 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. However, decisive break of 1.1840 will complete a double top pattern (1.2445, 1.2446) after rejection by 55 week EMA (now at 1.2251). Deeper decline should be seen back to 38.2% retracement of 1.0351 to 1.2445 at 1.1645.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Jan P | -4.60% | -2.60% | 0.30% | |

| 23:50 | JPY | Retail Trade Y/Y Jan | 6.30% | 4.00% | 3.80% | |

| 00:00 | NZD | ANZ Business Confidence Feb | -43.3 | -52 | ||

| 00:30 | AUD | Current Account Balance (AUD) Q4 | 14.1B | 6.8B | -2.3B | 0.8B |

| 00:30 | AUD | Private Sector Credit M/M Jan | 0.40% | 0.40% | 0.30% | |

| 00:30 | AUD | Retail Sales M/M Jan | 1.90% | 1.60% | -3.90% | -4.00% |

| 05:00 | JPY | Housing Starts Y/Y Jan | 6.60% | -1.20% | -1.70% | |

| 07:00 | EUR | Germany Import Price Index M/M Jan | -1.20% | 0.40% | -1.60% | |

| 07:45 | EUR | France GDP Q/Q Q4 F | 0.10% | 0.10% | 0.10% | |

| 08:00 | CHF | KOF Economic Barometer Feb | 100 | 98 | 97.2 | 97.4 |

| 08:00 | CHF | GDP Q/Q Q4 | 0.00% | 0.30% | 0.20% | |

| 13:30 | CAD | GDP M/M Dec | -0.10% | 0.20% | 0.10% | |

| 13:30 | USD | Goods Trade Balance (USD) Jan P | -91.5B | -91.0B | -90.3B | |

| 13:30 | USD | Wholesale Inventories Jan P | -0.40% | 0.10% | 0.10% | |

| 14:00 | USD | Housing Price Index M/M Dec | -0.20% | -0.10% | ||

| 14:00 | USD | S&P/CS Composite-20 HPI Y/Y Dec | 6.80% | 6.80% | ||

| 14:45 | USD | Chicago PMI Feb | 45 | 44.3 | ||

| 15:00 | USD | Consumer Confidence Feb | 108.5 | 107.1 |