The market witnessed some ups and downs today with BoE and SNB rate decisions stirring the waters. However, these movements failed to usher in a sustainable trend, as both currencies remain shackled within yesterday’s range against most major counterparts. BoE’s larger than expected rate hike sparked initial momentum but the impact quickly faded quickly. The impact of offset by repeated emphasis that inflation is going to fall significantly in the coming months. On the other hand, SNB’s new economic projection has left market players scratching their heads. The projection sees CPI dipping below target this year before a bounce-back, adding to the uncertainty.

Taking a broader view of the week, Euro emerges as the star performer, the Canadian Dollar and Swiss Franc following behind. Australian Dollar, on the other hand, finds itself at the tail end of the performance spectrum, with New Zealand Dollar and Sterling keeping it company. Dollar and Japanese Yen are holding their ground for now, standing on the sidelines waiting for clearer signals from the risk markets. Hopefully, tomorrow’s release of PMI data from various countries and regions might just be the catalyst needed to trigger decisive market movements.

Technically, EUR/CHF’s rally from 0.9670 continues today. With SNB risk now cleared, the rise remains on track to 0.9878 resistance. Decisive break there will add to the case that whole correction form 1.0095 has completed, and target a test on this resistance. Strength in EUR/CHF should help cushion any pull back attempts in Euro.

In Europe, at the time of writing, FTSE is down -0.96%. DAX is down -0.45%. CAC is down -0.88%. Germany 10-year yield is up 0.0461 at 2.486. Earlier in Asia, Nikkei dropped -0.92%. Japan 10-year JGB yield rose 0.0051 to 0.379. Singapore Strait Times dropped -0.04%.

US initial jobless claims unchanged at 264k

US initial jobless claims was unchanged at 264k in the week ending June 17, above expectation of 256k. Four-week moving average of initial claims rose 8.5k to 256k highest since November 13, 2021.

Continuing claims dropped -13k to 1759k in the week ending June 10. Four-week moving average of continuing claims dropped -7.5k to 1770.

BoE hikes 50bps by 7-2 vote, further tightening could be required

BoE raises Bank Rate by 50bps to 5.00%, larger than consensus of 25bps. The decision was made by 7-2 vote, with only known dove Swati Dhingra and Silvana Tenreyro voted for no change again.

Tightening bias is maintained as the central bank noted, “if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”

BoE continues to expect CPI to “fall significantly further during the course of the year”. Services CPI is projected to “remain broadly unchanged in the near term”. Meanwhile, core goods CPI is expected to “decline later this year”.

Second-round effects in domestic price and wage developments are “likely to take longer to unwind than they did to emerge”. There has been “significant upside news in recent data that indicates more persistence in the inflation process.”

SNB hikes 25bps, inflation to fall to 1.7% in Q3 then bounce

SNB raises policy rate by 25bps to 1.75%, for “countering inflationary pressure, which has increased again over the medium term”. The central bank also leaves the door open for more tightening, as “it cannot be ruled out that additional rises in the SNB policy rate will be necessary”. SNB also maintains the willingness to intervene in the currency markets, with focus on “selling foreign currency”.

In the new conditional forecast, 2023 inflation projection is lowered from 2.6% to 2.2%, down in from Q2 through Q4, with trough at 1.7% in Q3. However, 2024 and 2025 inflation projections are raised from 2.0% (both) to 2.2% and 2.1% respectively. Inflation is estimated to stay above 2% target from the tart of 2024 through Q1 2026, with a peak at 2.3% in Q3 2023.

Regarding the economy, SNB expects “modest growth” for the rest of the year. Overall GDP is to growth by 1.0% in 2023 and unemployment rise will “probably rise slightly”. “Subdued demand from abroad, the loss of purchasing power due to inflation, and more restrictive financial conditions are having a dampening effect.”

SNB Jordan: We cannot rule out further tightening

In the post-meeting press conference, SNB Chair Thomas Jordan affirmed that “We cannot rule out further monetary policy tightening”.

“Without a more restrictive monetary policy, there would be a danger of inflation becoming entrenched and much stronger rate increases would be needed in the future,” Jordan warned.

Jordan acknowledged the recent marked decline in inflation as a welcome result of SNB’s more restrictive monetary policy in place for the past year. However, he cautioned that underlying inflationary pressure continued to intensify. “We are therefore observing persistent second-round effects in many domestic goods and services,” Jordan said.

Despite today’s rate increase, SNB’s new forecasts for inflation from 2024 onwards are higher than their March predictions. Jordan attributed this upward revision to ongoing second-round effects, increased electricity prices and rents, and sustained inflationary pressure from overseas.

BoJ Noguchi: Important to maintain monetary easing

BoJ board member Asahi Noguchi underlined the necessity of maintaining monetary easing as Japan navigates signs of wage growth.

“What’s most important now is for the BOJ to maintain monetary easing and ensure budding signs of wage growth become a sustained, strong trend,” he said.

Noguchi predicts that core consumer inflation, which has been running above the bank’s 2% target, will likely drop below this level around September or October. He attributed this anticipated decrease to the fading effects of past increases in raw material costs.

However, he noted that the possibility of inflation bouncing back above 2% later on and maintaining that level hinges largely on future wage trends and service prices.

New Zealand goods exports up 2.8% yoy in may, imports rose 4.4% yoy

New Zealand’s monthly trade balance in May registered smaller surplus than anticipated, clocking in at NZD 46m against expected NZD 350m. This outcome followed rise in goods exports by NZD 189m (2.8% yoy) to NZD 7.0B, while goods imports saw an increase of NZD 292m (4.4% yoy), totalling NZD 6.9B.

China led the growth in monthly exports, with total exports increasing by NZD 308m (18% yoy). USA also reported a significant rise in exports, up by NZD 68m (9.7% yoy), while Japan experienced a modest increment of NZD 18m (4.2% yoy). On the other hand, total exports to Australia and the European Union fell by NZD -122m (-14% yoy) and NZD -60m (-11% yoy) respectively.

When it comes to imports, USA claimed the top spot with a massive jump of NZD 435m (87% yoy). South Korea followed with an increase of NZD 152m (41% yoy), while Australia and the European Union saw increases of NZD 81m (11% yoy) and NZD 31m (3.2% yoy) respectively. However, China’s imports into New Zealand declined by NZD 52m (-3.6% yoy).

GBP/USD Mid-Day Outlook

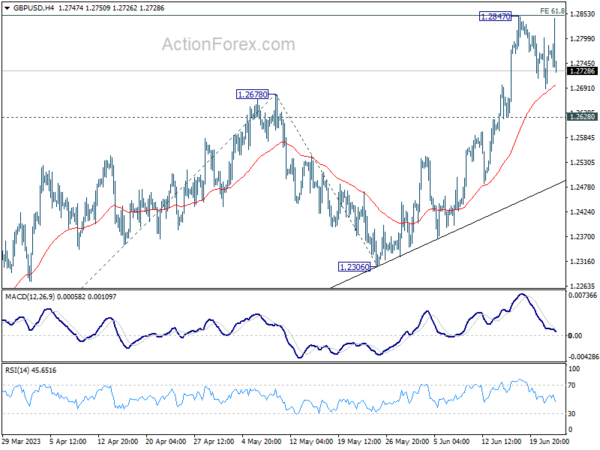

Daily Pivots: (S1) 1.2705; (P) 1.2754; (R1) 1.2815; More…

GBP/USD failed to break through 1.2847 resistance today, and stays in consolidations. Intraday bias remains neutral for the moment. On the upside, firm break of 1.2847 will resume larger up trend and target 100% projection of 1.1801 to 1.2678 from 1.2306 at 1.3183 next. However, firm break of 1.2628 will turn bias to the downside, for deeper fall to 1.2306 support instead.

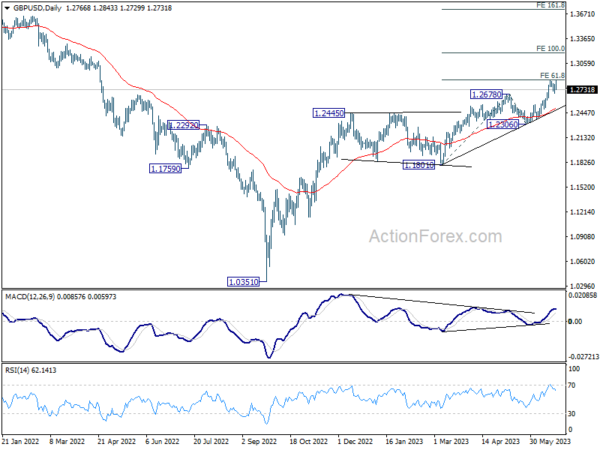

In the bigger picture, the strong support from 55 W EMA (now at 1.2345) is a medium term bullish sign. Outlook will stay bullish as long as 1.2306 support holds. Rise from 1.0351 medium term bottom (2022 low) is expected to extend further to retest 1.4248 key resistance (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) May | 46M | 350M | 427M | 236M |

| 07:30 | CHF | SNB Rate Decision | 1.75% | 1.75% | 1.50% | |

| 08:00 | CHF | SNB Press Conference | ||||

| 11:00 | GBP | BoE Rate Decision | 5.00% | 4.75% | 4.50% | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 7–0–2 | 7–0–2 | 7–0–2 | |

| 12:30 | USD | Initial Jobless Claims (Jun 16) | 264K | 256K | 262K | 264K |

| 12:30 | USD | Current Account (USD) Q1 | -219B | -217B | -207B | -216B |

| 14:00 | USD | Existing Home Sales May | 4.25M | 4.28M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jun P | -17 | -17.4 | ||

| 14:30 | USD | Natural Gas Storage | 89B | 84B | ||

| 15:00 | USD | Crude Oil Inventories | 0.3M | 7.9M |