In a move that left many market observers bemused, Yen declined in Asian trading session after BoJ opted for continuity, leaving its monetary policy untouched. Notably, the bank refrained from dropping any hints about potential alterations in its policy stance in the foreseeable future. With US 10-year yield surging to a remarkable 16-year high, Yen may face further selling pressure in the coming sessions. Meanwhile, attention is shifting to forthcoming PMI releases from major economies, including Eurozone, UK, and US, as the week approaches its end.

Reflecting on the week’s performance, both Sterling and Swiss Franc have been the laggards, affected by decisions of BoE and SNB to maintain their policies unchanged. The anticipation is growing that these central banks might have reached the apex of their tightening cycles already. Trailing closely behind in terms of weakness is Yen. New Zealand Dollar has emerged as the top performer, followed by Canadian Dollar and US Dollar. Euro and Australian Dollar are exhibiting a mixed performance.

Technically, in light of Fed’s hawkish stance this week, market players are keenly watching for signs of escalating risk aversion. If DOW plunges below 34092.22 support level and wraps up the week beneath it, it would not only signify a renewed decline from 15679.13 but also set a bearish tone that extends into Q4, potentially aiming for 31429.82 support.

In Asia, at the time of writing, Nikkei is down -0.43%. Hong Kong HSI is up 0.86%. China Shanghai SSE is up 0.67%. Singapore Strait Times is up 0.05%. Japan 10-year JGB yield is down -0.0037 at 0.750. Overnight, DOW dropped -1.08%. S&P 500 dropped -1.64%. NASDAQ dropped -1.82%. 10-year yield surged 0.131 to 4.480.

BoJ stands pat, drops no hint on future adjustment

BoJ maintains a steady course today and keeps monetary policy unchanged. It also chooses choosing not to make any adjustments in the statement that would suggest a departure from its existing negative interest rate stance or the yield curve control measures. The central bank even retains the pledge that it “will not hesitate to take additional easing measures if necessary.”

In unanimous decisions, short-term policy interest rate is held at -0.10%. 10-year JGB yield target is held at 0%, with a band of plus and minus 0.5%. Moreover, the bank’s offer to purchase 10-year JGBs at a rate of 1.0% daily through fixed-rate market operations remains unchanged.

BoJ anticipates the Japanese economy to maintain a moderate recovery in the near term. However, it has also flagged concerns, noting that the economy is “under downward pressure stemming from a slowdown in the pace of recovery in overseas economies.” Beyond this phase, the central bank is optimistic that the economy will exhibit growth “at a pace above its potential growth rate” due to the strengthening of a “virtuous cycle from income to spending.”

Regarding inflation, BoJ foresees the year-on-year core CPI to “decelerate” owing to diminishing import price effects. Nevertheless, in the subsequent period, the CPI is projected to “accelerate again moderately”, spurred by an improving output gap, along with rising medium-to-long-term inflation expectations and wage growth.

Released earlier, Japan headline CPI slowed slightly from 3.3% yoy to 3.2% yoy in August. CPI core (ex-food) was unchanged at 3.1% yoy. CPI core-core (ex food and energy) was unchanged at 4.3% yoy.

Japan’s PMI manufacturing fell to 48.6, slackening demand and lower employment

Japan’s Manufacturing PMI further declined from 49.6 to 48.6 in September, falling short of the anticipated 49.9, marking the most pronounced contraction since February. PMI Services also receded from 54.3 to 53.3. PMI Composite, which gives a holistic view of the broader economy, tapered off from 52.6 to 51.8.

Usamah Bhatti, an Economist at S&P Global Market Intelligence, noted that the future doesn’t seem particularly rosy, with forward-looking indicators hinting at a possible slackening of demand and activity. While service firms did experience a rise, manufacturing segment reported a sharp decline in new orders, the most pronounced in seven months.

Another worrisome development is the reduced employment levels in the private sector. Bhatti stated, “As pressure on capacity eased, there was a renewed reduction in employment levels.” This trend was “the first since the start of the year and the quickest since August 2020.” He attributed this to companies not replacing those who voluntarily exited, often as a strategy “amid elevated cost burdens.”

Australia PMI composite back to expansion, risk of “no land” for the economy

In September, Australia’s Manufacturing PMI slipped to a 3-month low, declining from 49.6 to 48.2. In contrast, PMI Services showcased resilience, rising from 47.8 to a 4-month high of 50.5. PMI Composite also surged from 48.0 to 50.2, a 4-month peak, signaling a return to expansion in the broader economy.

Warren Hogan, Chief Economic Advisor at Judo Bank,said that “demand in the economy is holding up, and business activity remains on a sound footing.” He further remarked that, contrary to some expectations, the present economic scenario isn’t about choosing between a “hard or soft landing.” Instead, he proposed that the real risk is of “no landing” for the economy.

Hogan further touched upon the inflation concerns that have been a pivotal discussion in financial circles. “The inflation indicators remain elevated at levels pointing to above-target CPI over the next 6-9 months,” he stated. He pointed out that input prices remained unchanged in September, hinting at continued cost pressures. However, the final prices index experienced a slight dip in the September flash report. Despite this marginal decline, Hogan suggested that “inflation over the second half of 2023 could be higher than desired.”

This latest PMI data follows a trend of stronger-than-predicted figures emerging from Australia in recent weeks. While this demonstrates economic stamina and persisting inflation, all eyes are on RBA’s next steps. Hogan postulates that the RBA Board, under leadership of the new Governor Michele Bullock, will likely adopt a patient stance. However, he doesn’t rule out further monetary tightening, possibly “in early November on Melbourne Cup day,” should the economic indicators not align with RBA’s projections of a slowdown.

New Zealand’s trade data sees China dominates decline in exports and imports

In August, New Zealand observed a dip in both its goods exports and imports compared to the previous year, leading to a monthly trade deficit of NZD -2.3B.

Compared to figures from August 2022, goods exports saw a reduction of NZD -296m, marking a -5.6% yoy drop, settling at NZD 5.0B. On the other hand, goods imports displayed an even steeper decline, shrinking by NZD -639m or -8.1% yoy, amounting to NZD 7.3B.

A deeper dive into the export figures revealed China as the major contributor to the monthly dip. Exports to China fell sharply by NZD -262m, representing an -18% yoy decline. Other notable declines were witnessed in exports to Australia, which dipped by NZD -71m (-9.0% yoy), and Japan, with a decrease of NZD -34m (-11% yoy). However, there was some silver lining with US and EU. Exports to the USA grew by NZD 62m, marking a 9.6% yoy increase, and those to the EU surged by NZD 28m, a 7.7% yoy rise.

China also took the lead in the contraction in imports. Imports from China plummeted by NZD -363m, a stark -19% yoy decline. Other significant reductions in imports were observed from Australia, down by NZD -92m (-9.7% yoy), South Korea with a drop of NZD -74m (-13% yoy), and US decreasing by NZD -36m (-5.4% yoy). In contrast, imports from EU displayed a robust growth, climbing by NZD 120m or 12% yoy.

ECB’s Lane: 4% deposit rate can bring inflation back to target within projection horizon

ECB’s Chief Economist, Philip Lane, offered insights into last week’s rate hike during a speech overnight. He noted that “the choice between holding at 375 and moving to 400 was finely balanced,” referring to the deposit rate. Lane went on to express that opting for an additional hike was a safer decision “at a margin”.

He believed that 4% deposit rate should be “consistent with a return of inflation to target within the projection horizon.” The condition is that it’s to be ” maintained for a sufficiently long duration”.

Looking to the future, Lane cautioned about the extended phase of uncertainty that looms regarding the disinflation process. Highlighting the intricacies of the present economic climate, Lane pointed to the “initial inflation shock, the lagged nature of wage adjustment in the euro area, [and] the considerable sectoral rebalancing” as contributors to the prolonged period of inflation uncertainty.

Looking ahead

UK retail sales and PMIs will be featured in European session together with Eurozone PMIs. Later in the day, Canada will release retail sales while US will publish PMIs too.

USD/JPY Daily Outlook

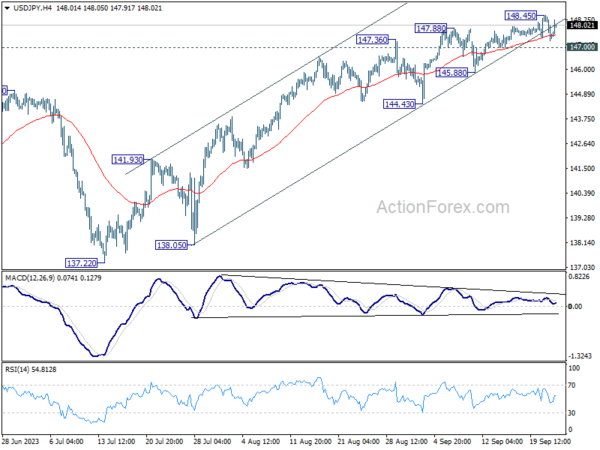

Daily Pivots: (S1) 147.10; (P) 147.78; (R1) 148.24; More…

USD/JPY dipped to 147.31 but quickly recovered. Intraday bias is turned neutral first. For now, further rally is in favor as long as 147.00 support holds. Above 148.45 will resume larger rally from 127.20. Next target is 151.93 high. However, firm break of 147.00 will should confirm short term topping, and turn bias to the downside for 145.88 support and below.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by break of 137.22 support will indicate that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Aug | -2291M | -1107M | -1177M | |

| 23:00 | AUD | Manufacturing PMI Sep P | 48.2 | 49.6 | ||

| 23:00 | AUD | Services PMI Sep P | 50.5 | 47.8 | ||

| 23:01 | GBP | GfK Consumer Confidence Sep | -21 | -27 | -25 | |

| 23:30 | JPY | National CPI Y/Y Aug | 3.20% | 3.30% | ||

| 23:30 | JPY | National CPI ex-Fresh Food Y/Y Aug | 3.10% | 3.00% | 3.10% | |

| 23:30 | JPY | National CPI ex Food Energy Y/Y Aug | 4.30% | 4.30% | ||

| 00:30 | JPY | Manufacturing PMI Sep P | 48.6 | 49.9 | 49.6 | |

| 02:52 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 06:00 | GBP | Retail Sales M/M Aug | 0.50% | -1.20% | ||

| 07:15 | EUR | France Manufacturing PMI Sep P | 46 | 46 | ||

| 07:15 | EUR | France Services PMI Sep P | 46 | 46 | ||

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 39.5 | 39.1 | ||

| 07:30 | EUR | Germany Services PMI Sep P | 47.1 | 47.3 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 44 | 43.5 | ||

| 08:00 | EUR | Eurozone Services PMI Sep P | 47.5 | 47.9 | ||

| 08:30 | GBP | Manufacturing PMI Sep P | 43 | 43 | ||

| 08:30 | GBP | Services PMI Sep P | 49 | 49.5 | ||

| 12:30 | CAD | Retail Sales M/M Jul | 0.40% | 0.10% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Jul | 0.50% | -0.80% | ||

| 13:45 | USD | Manufacturing PMI Sep P | 47.8 | 47.9 | ||

| 13:45 | USD | Services PMI Sep P | 50.3 | 50.5 |