Dollar’s rally presses on today and extends into early US session, reflecting continued strength even after a period of brief consolidation. Swiss Franc and Japanese Yen are also rebounding notably, indicating a broader trend of currency strength in traditionally safe-haven assets. This pattern is further underscored by the ongoing record rally in Gold, pointing to an underlying risk-off sentiment among global investors.

Despite these movements in the currency markets and previous metals, major European stock indexes are trading positively, while US futures show only a slight downturn. This divergence presents a contrasting picture, leaving the question on the dominant driving force unanswered for now.

As the trading week nears its close, Dollar stands out as the clear frontrunner, significantly outpacing other major currencies. New Zealand Dollar holds the second strongest position, although it appears vulnerable to being overtaken by the surging Japanese Yen, currently in third place. At the other end of the spectrum, Euro is the week’s weakest performer, with British Pound and Australian Dollar following. Swiss Franc and Canadian Dollar are positioning in the middle of the pack.

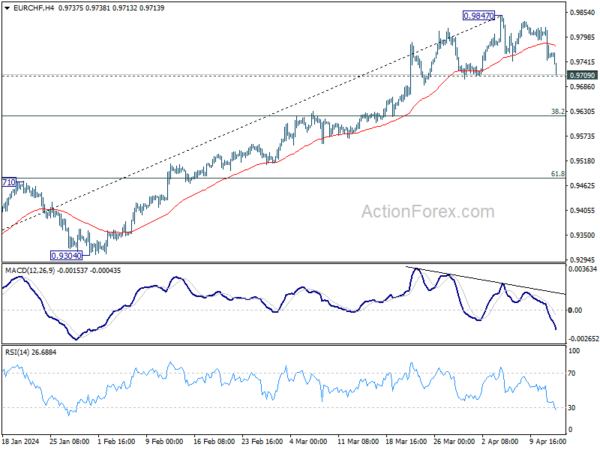

Technically, immediate focus is now on 0.9709 in EUR/CHF with current deep decline. Firm break there will at least bring deeper correction to 38.2% retracement of 0.9252 to 0.9847 at 0.9620. If realized, that would probably trigger downside acceleration in EUR/USD too.

In Europe, at the time of writing, FTSE is up 1.43%. DAX is up 0.85%. CAC is up 0.76%. UK 10-year yield is down -0.0612 at 4.142. Germany 10-year yield is down -0.105 at 2.362. Earlier in Asia, Nikkei rose 0.21%. Hong Kong HSI fell -2.18%. China Shanghai SSE fell -0.49%. Singapore Strait Times fell -0.33%. Japan 10-year JGB yield rose 0.0094 to 0.867.

Fed’s Collins in the range of two rate cuts this year

In a Reuters interview, Boston Fed President Susan Collins revealed that she “in the range of two” rate cuts for this year, as per the quarterly forecast she submitted during the Fed’s March meeting.

Collins was clear that an increase in interest rates is “not part of my baseline”. However, she remained open to adjustments based on upcoming economic data, emphasizing, “I don’t think you can take possibilities as not being on the table, it really depends on where the data take us.”

Looking ahead, Collins anticipates slowdown in demand which she expects to continue into 2024. She believes this deceleration will be crucial in reducing inflationary pressures later in the year.

ECB’s Stournaras advocates for insurance rate cut to nurture Eurozone recovery

ECB Governing Council member Yannis Stournaras expressed the need for an “insurance rate cut” to bolster the nascent recovery within Eurozone. Speaking to Bloomberg, Stournaras highlighted the critical balance the ECB aims to maintain in fostering economic growth without stifling it with persistently high interest rates.

Stournaras detailed the emerging signs of economic recovery across the Eurozone, particularly noting positive developments in Germany. “We see the first seeds of a recovery in Europe — also in Germany,” he remarked, emphasizing “We don’t want to kill these first seeds of recovery.”

The concept of an insurance rate cut, as described by Stournaras, is intended to preemptively address potential downturns, mirroring the approach taken last September when rates were increased to guard against surging inflation.

Reflecting on the past year’s policy decisions, Stournaras acknowledged that the situation has reversed, with new risks that “fall too far below the 2% target”. Hence, “We now need an insurance in order not to get behind the curve,” he added.

Moreover, Stournaras argued for a divergence from Fed’s current monetary policy approach, citing fundamental differences between the economic environments in Eurozone and the US. He pointed out that unlike the US, where demand is buoyed by significant governmental budgetary measures, the Eurozone’s inflation dynamics have been primarily driven by supply-side factors, not by demand or wage increases.

UK GDP rises 0.1% mom in Feb, led by production

UK GDP grew 0.1% mom in February, matched expectations. Services grew by 0.1% mom. Production output grew 1.1% mom, and was the largest contributor to growth in the month. Construction output fell -1.9% mom.

For the three months to February, compared with the three months to November 2023, GDP has grown 0.2%. Services rose 0.2%. Production grew 0.7%. Construction fell -1.0%.

NZ BNZ manufacturing falls to 47.1, 13th month of contraction

New Zealand BusinessNZ Performance of Manufacturing Index PMI fell from 49.1 to 47.1 from 49.1 in February, marking the lowest level since last December and indicating that the sector has been in contraction for 13 consecutive months.

Key components painted a concerning picture. Production experienced a notable decline from 49.1 to 45.7. Employment also fell from 49.2 to 46.8, suggesting that businesses are reducing their workforce in response to reduced demand. New orders, a critical indicator of future activity, decreased from 47.5 to 44.7.

Finished stocks were the only component of the index to show an increase, from 48.8 to 49.2. This could indicate that products are remaining in inventory longer due to lower sales volumes. Delivery times also worsened from 51.1 to 47.8, which could reflect logistical issues or supply chain disruptions.

The proportion of negative comments from survey respondents increased to 65% in March, up from 62% in February and 63.2% in January. Many cited a lack of orders and the general economic slowdown as major concerns.

Looking ahead

UK GDP is the main focus in European session, and trade balance will also be released. Germany will publish CPI final. Later in the day, US will release import price index and U of Michigan consumer sentiment.

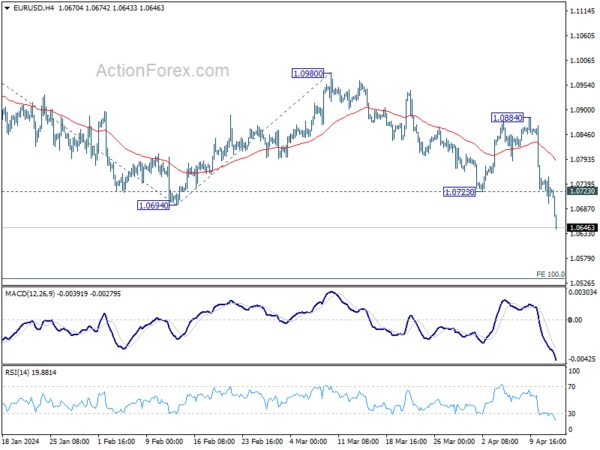

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0697; (P) 1.0727; (R1) 1.0755; More…

EUR/USD’s decline extends through 1.0694 support today. The development confirms resumption of whole fall from 1.1138. Intraday bias stays on the downside for 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536 next. On the upside, above 1.0723 support turned resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Current fall from 1.1138 is seen as the third leg. While deeper decline is would be seen to 1.0447 and possibly below. Strong support should emerge from 61.8% retracement of 0.9534 to 1.1274 at 1.0199 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Mar | 47.1 | 49.3 | 49.1 | |

| 04:30 | JPY | Industrial Production M/M Feb F | -0.60% | -0.10% | -0.10% | |

| 06:00 | EUR | Germany CPI M/M Mar F | 0.40% | 0.40% | 0.40% | |

| 06:00 | EUR | Germany CPI Y/Y Mar F | 2.20% | 2.20% | 2.20% | |

| 06:00 | GBP | GDP M/M Feb | 0.10% | 0.10% | 0.20% | 0.30% |

| 06:00 | GBP | Manufacturing Production M/M Feb | 1.20% | 0.20% | 0.00% | -0.20% |

| 06:00 | GBP | Manufacturing Production Y/Y Feb | 2.70% | 2.10% | 2% | 1.50% |

| 06:00 | GBP | Industrial Production M/M Feb | 1.10% | 0.00% | -0.20% | -0.30% |

| 06:00 | GBP | Industrial Production Y/Y Feb | 1.40% | 0.60% | 0.50% | 0.30% |

| 06:00 | GBP | Goods Trade Balance (GBP) Feb | -14.2B | -14.5B | -14.5B | |

| 11:00 | GBP | NIESR GDP Estimate Mar | 0.40% | 0.00% | 0.20% | |

| 12:30 | USD | Import Price Index M/M Mar | 0.40% | 0.30% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Apr P | 79 | 79.4 |