Sterling remains the weakest major currency today as traders are awaiting progress in Brexit negotiation. It probably takes a few more days for UK Prime Minister Theresa May to sort things out before she goes back to Brussels. Dollar regains some ground against Europeans and Yen. But commodity currencies are the ones who’re shining today. In particular USD/CAD drops through 1.2665 support and is heading to 1.2598 key near term support level.

Released in US session, US trade deficit widened to USD -48.7b in October. Canada trade deficit narrowed to CAD -1.5b in October. The Senate Banking Committee will vote today on nomination of Jerome Powell as the next Fed chair. The confirmation should be smooth and it’s generally expected that full Senate approval will be completed by early February.

UK PMI services disappointed in November

UK PMI services dropped to 53.8 in November, down from 55.6 and below expectation of 55.0. Markit chief business economist Chris Williamson pointed to the surge in prices in November that hurt services industry. He noted that "rising oil prices were again to blame in November, with firms also reporting the need to pass higher costs of a wide variety of other inputs on to customers as a result of the weak pound having driven up import prices." Also, "as such, the survey data suggest that inflationary pressures have yet to peak."

Nonetheless, "slower service sector growth comes as a disappointment after the improved performances of both manufacturing and construction in November. However, despite the weaker service sector expansion, the latest survey data indicate that the economy is on course to enjoy robust growth in the fourth quarter. The survey data are so far consistent with the economy growing at a quarterly rate of 0.45 per cent in the closing months of 2017."

UK PM Theresa May to brief Cabinet on Brexit

UK Prime Minister Theresa May will meet with her cabinet to brief the situation regarding Brexit negotiation with EU. Then May will try to persuade DUP leader Arlene Foster on the issue of Irish border, before going back to Brussels by the end of the week. Foster intervened the meeting between May and European Commission President Jean Claude Juncker, expressing her objection to the Irish border arrangement, which then caused the collapse of the talk. The pro-Brexit DUP was deeply concerned that the deal would make Northern Ireland leaving EU on different terms then other part of the UK.

European Commission chief spokesperson Margaritis Schinas said today that "there are some topics still open, which will need further consultation and negotiation, notably in London. The show is now in London. We stand ready here in the Commission to resume talks with the United Kingdom at any moment in time when we get the sign that London is ready."

ECB to pause asset purchase during Christmas holidays

ECB will pause bond buying from December 21 to December 29 as market liquidity will drop sharply during Christmas holidays. And, ECB also said that purchases in December will be somewhat frontloaded to take advantage of the relatively better market conditions expected during the earlier part of the month. Purchases will resume on January 2 2018. From Eurozone, retail sales dropped -1.1% mom in October, worse than expectation of -0.7% mom. Eurozone services PMI was finalized at 56.2 in November, unchanged. German services PMI was revised down by 0.6 to 54.3. France services PMI was revised up by 0.2 to 60.4. Italy services PMI rose to 54.7 in November, above expectation of 53.2.

RBA stands pate, weary of soft inflation and wage growth

RBA left the cash rate unchanged at 1.5% today, following the last reduction in August 2016. The accompanying statement contained little surprise. While staying confident over the employment situation, policymakers remained weary of the persistently soft inflation and wage growth. The RBA stance is largely unchanged from the previous meeting. We retain the view that the policy rate would stay unchanged for the entire 2018. More in RBA Remains Cautious As Wage Growth Subdued.

Australia dollar was lifted earlier today by stronger than expected retail sales, which grew 0.5% mom, versus consensus of 0.3% mom. Also from Australia, current account deficit narrowed slightly to AUD -9.1b in Q3. Elsewhere, China Caixin PMI services rose to 51.9 in November, up from 51.2, above expectation of 51.5.

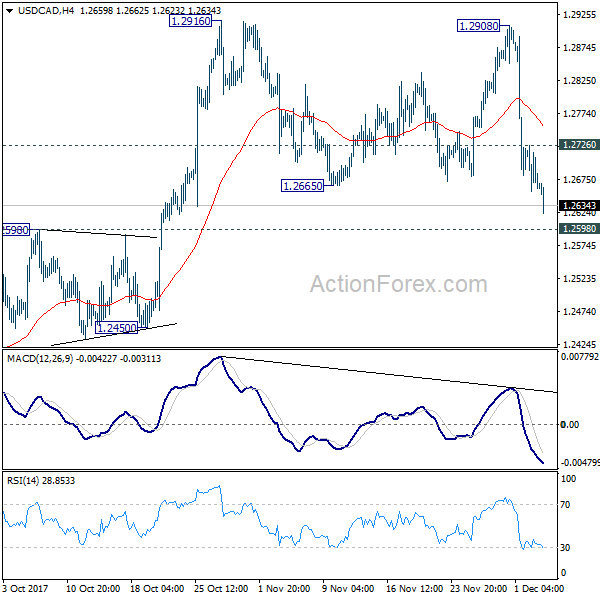

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2643; (P) 1.2685; (R1) 1.2714; More….

USD/CAD drops further to as low as 1.2623 so far as consolidation from 1.2916 continues. At this point, we’d still expect downside to be supported by 1.2598 resistance turned support to bring rise resumption. Above 1.2726 minor resistance will turn intraday bias back to the upside for 1.2916. Break of 1.2916 will resume the rally from 1.2061 and target 1.3065 medium term fibonacci level next. However, sustained break of 1.2598 will argue that rebound from 1.2061 has completed after hitting 55 week EMA (now at 1.2880). Near term outlook will be turned bearish in this case.

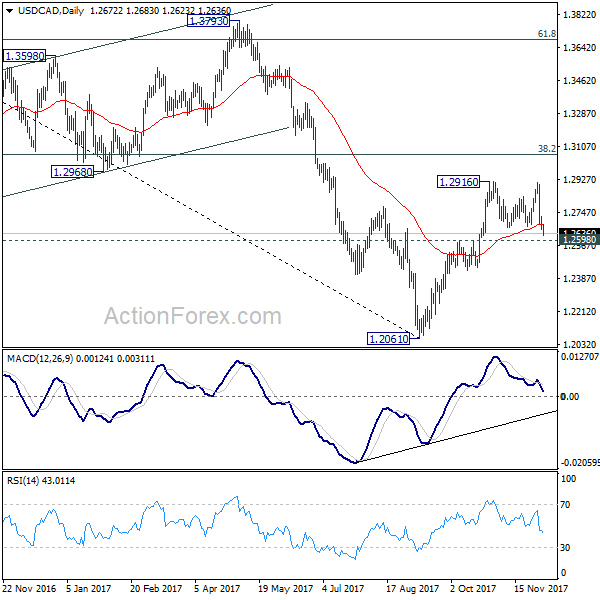

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Rise from 1.2061 medium term bottom should now target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Firm break there will target 1.3793 key resistance next (61.8% retracement at 1.3685). We’ll now hold on to this bullish view as long as 1.2450 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Retail Sales Monitor Y/Y Nov | 0.60% | -1.00% | ||

| 00:30 | AUD | Current Account Balance (AUD) Q3 | -9.1B | -8.8B | -9.6B | -9.7B |

| 00:30 | AUD | Retail Sales M/M Oct | 0.50% | 0.30% | 0.00% | 0.10% |

| 01:45 | CNY | Caixin PMI Services Nov | 51.9 | 51.5 | 51.2 | |

| 03:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 08:45 | EUR | Italy Services PMI Nov | 54.7 | 53.2 | 52.1 | |

| 08:50 | EUR | France Services PMI Nov F | 60.4 | 60.2 | 60.2 | |

| 08:55 | EUR | Germany Services PMI Nov F | 54.3 | 54.9 | 54.9 | |

| 09:00 | EUR | Eurozone Services PMI Nov F | 56.2 | 56.2 | 56.2 | |

| 09:30 | GBP | Services PMI Nov | 53.8 | 55 | 55.6 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Oct | -1.10% | -0.70% | 0.70% | |

| 13:30 | CAD | International Merchandise Trade (CAD) Oct | -1.5B | -2.3B | -3.2B | -3.7B |

| 13:30 | USD | Trade Balance Oct | -48.7B | -46.2B | -43.5B | -44.9B |

| 14:45 | USD | Services PMI Nov F | 55.3 | 54.7 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Nov | 59 | 60.1 |