The pattern continues today with Dollar trying to recovery but fails. Economic data from US are solid but that gives little support to the greenback. Instead, Euro shines today as PMI data confirmed a "stellar" end to 2017, as the best year for over a decade. Released from US, ADP report showed 250k growth in private sector jobs in December, above expectation of 190k. Initial claims rose 5k to 250k in the week ended December. Challenger report showed -3.6% yoy fall in planned layoffs in December. From Canada, IPPI rose 1.4% mom in November. RMPI rose 5.5% mom.

Eurozone economy had best year for a decade in 2017

Eurozone PMI services was revised up by 0.1 to 56.6 in December. Germany PMI services was unrevised at 55.8. France PMI services was revised lower by 0.3 to 59.1. Italy PMI services dropped 0.1 to 54.6 in December. Markit noted that "a stellar end to 2017 for the euro zone rounded off the best year for over a decade, continuing to confound widely held fears that rising political uncertainty would curb economic growth." Also, "based on past experience, the extent to which demand appears to be outstripping supply for many goods and services suggests that inflationary pressures could continue to build in the coming months."

UK services PMI beat expectation

UK PMI services rose to 54.2 in December, up from 53.8 and beat expectation of 54.0. After disappointment from manufacturing and construction PMIs, there’s finally a better than consensus piece of data. Markit noted that the set of PMI data suggests 0.4-0.5% growth in UK GDP in Q4. But Markit chief economist Chris Williamson also cautioned that "as has been increasingly the case in recent months, the good news comes with a health warning about the sustainability of the upturn." He added "digging into the details behind the resilient strength signaled by the headline numbers, the survey data reveal an economy that is beset with uncertainty about the outlook, which is in turn dampening business spending and investment."

Also from UK, Nationwide house price rose 0.6% mom in December. Mortgage approvals rose to 65.1k in November, M4 rose 0.1% mom.

Released earlier today, Japan PMI manufacturing was revised down to 54 in December. China Caixin PMI services rose to 53.9 in December, up from 51.9, above expectation of 51.8.

EUR/USD Mid-Day Outlook

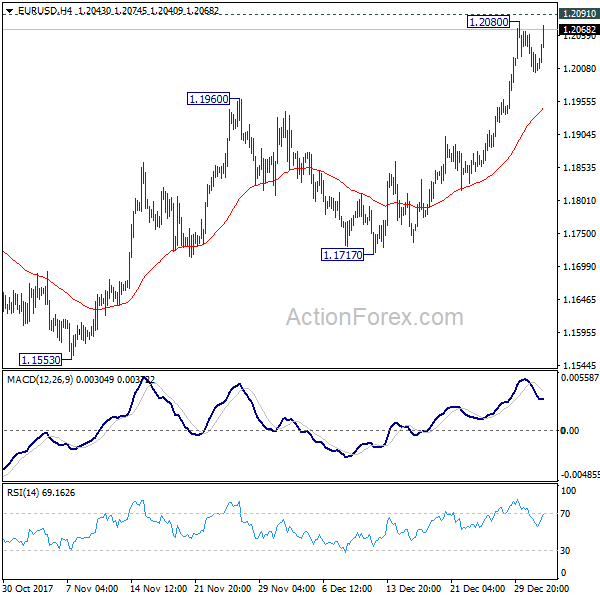

Daily Pivots: (S1) 1.1987; (P) 1.2026 (R1) 1.2052; More….

EUR/USD rebounds strongly today but stays below 1.2091 resistance. Intraday bias remains neutral first. Further rise is expected as long as 4 hour 55 EMA (now at 1.1946) holds. Firm break of 1.2091 will confirm medium term rally resumption and target next key fibonacci level at 1.2494/2516. However, sustained break of 4 hour 55 EMA will extend the consolidation pattern from 1.2091 with with another decline through 1.1717 support.

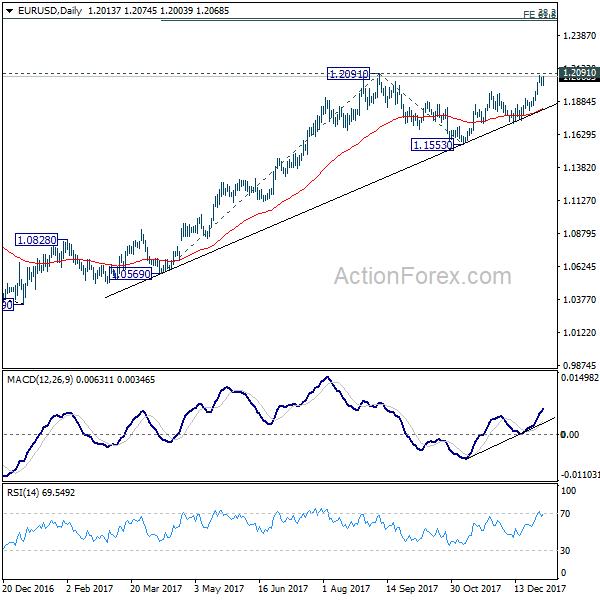

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | PMI Manufacturing Dec F | 54 | 54.2 | 54.2 | |

| 01:45 | CNY | Caixin PMI Services Dec | 53.9 | 51.8 | 51.9 | |

| 07:00 | GBP | Nationwide House Price M/M Dec | 0.60% | 0.10% | 0.10% | |

| 08:45 | EUR | Italy Services PMI Dec | 54.6 | 54.7 | 54.7 | |

| 08:50 | EUR | France Services PMI Dec F | 59.1 | 59.4 | 59.4 | |

| 08:55 | EUR | Germany Services PMI Dec F | 55.8 | 55.8 | 55.8 | |

| 09:00 | EUR | Eurozone Services PMI Dec F | 56.6 | 56.5 | 56.5 | |

| 09:30 | GBP | Mortgage Approvals Nov | 65.1k | 64.1k | 64.6k | 64.9k |

| 09:30 | GBP | Money Supply M4 M/M Nov | 0.10% | 0.40% | 0.60% | |

| 09:30 | GBP | Services PMI Dec | 54.2 | 54 | 53.8 | |

| 12:30 | USD | Challenger Job Cuts Y/Y Dec | -3.60% | 30.10% | ||

| 13:15 | USD | ADP Employment Change Dec | 250K | 190k | 190k | 185K |

| 13:30 | CAD | Industrial Product Price M/M Nov | 1.40% | 0.80% | 1.00% | 1.10% |

| 13:30 | CAD | Raw Materials Price Index M/M Nov | 5.50% | 4.00% | 3.80% | |

| 13:30 | USD | Initial Jobless Claims (DEC 30) | 250K | 244K | 245K | |

| 14:45 | USD | US Services PMI Dec F | 52.4 | 52.4 | ||

| 15:30 | USD | Natural Gas Storage | -221B | -112B | ||

| 16:00 | USD | Crude Oil Inventories | -5.2M | -4.6M |