Dollar was in a pole position to end as the strongest major currency. But disappointing non-farm payroll report gave dollar bulls a reality check as the greenback ended mixed, after late selloff. Australian and New Zealand Dollar have indeed closed as the best performers, followed by Sterling. Euro, Swiss Franc and Yen were the weakest.

Could the resumed up trend in US stocks and treasury yield bring Dollar index higher? That’s a major question to answer in the coming weeks. Gold’s weakness might help the greenback. But Dollar index has to take out a key near term resistance level by itself first, before having some more sustainable rally. We’d argue that, in the risk-on environment, Sterling and Aussie are better bets.

S&P 500 resumed record run after brief pull back

Despite the slightly deeper than expected pull back, S&P 500 draw strong support from 55 day EMA and rebounded. Near term bullishness was retained and it has indeed surged to close at new record high at 3719.81. Current medium term up trend should now continue to 61.8% projection of 2191.86 to 3588.11 form 3233.94 at 4096.82. The question is whether there would be upside acceleration through near term channel resistance. But in any case, outlook will now remain bullish as long as 3694.12 support holds.

10-year yield on track to 1.266 key resistance

10-year yield also rebounded strongly after drawing some strong support around both near term rising channel and 55 day EMA. The development keeps up trend from 0.504 intact for 1.266 key resistance. This level was last seen at the start of the pandemic in March 2020. Solid break of this level would be a vote of confidence on “back to normal”. We’ll see how it goes from there. But for now, TNX would maintain the up trend as long as 1.001 support holds.

Dollar index struggled to catch up, capped by 91.74 resistance

Dollar index followed stocks and yield higher last week but clearly lagged behind in terms of momentum. Rejection by 91.74 could drag DXY down towards 89.20 support. But, with resilience in US yields, we’re not expecting a break of this low. Thus, Dollar could turn mixed against other major currencies. On the other hand, firm break of 91.74 will argue that DXY is at least correcting the down trend form 102.99 to 89.20. Stronger rise should then be seen back to 38.2% retracement at 94.46. That would mark and more sustainable rally in Dollar, in broad-based way.

GBP/CHF and AUD/JPY to gain further from risk-on sentiments

It’s now unsure if Dollar could ride on surging US stocks and yields. But general risk-on sentiment should continue to support Sterling and Aussie. In particular, buying could intensify if GBP/USD breaks 1.3758 high while AUD/USD breaks 0.7819 (which is relatively farther away for now).

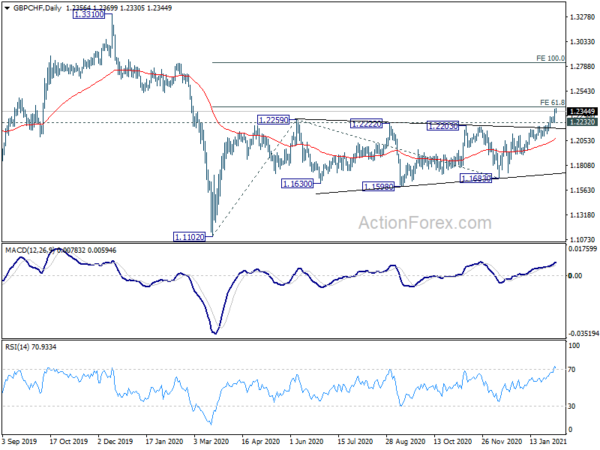

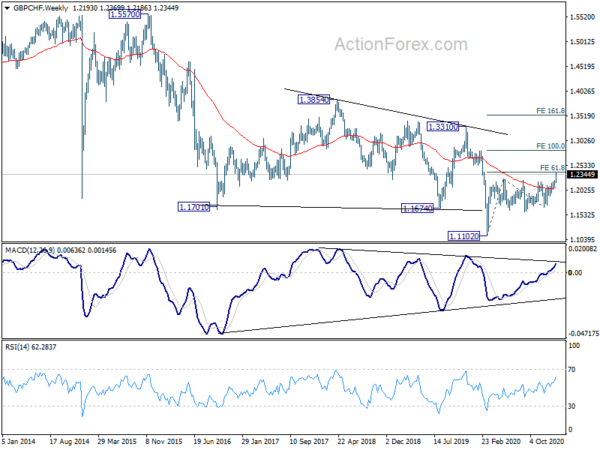

GBP/CHF’s medium term rise from 1.1102 resumed by breaking through 1.2259 resistance decisively. Outlook will remain bullish as long as 1.2232 support holds. Next target is 61.8% projection of 1.1102 to 1.2259 from 1.1683 at 1.2398. Firm break there would likely bring upside acceleration to 100% projection at 1.2840.

It’s still a bit early to say, but the strong break of 55 week EMA is an early sign of long term trend reversal. Let’s not forget the bullish convergence condition in weekly MACD. Sustained break of 1.2840 could add to the case of the start of a new long term up trend and turn focus to 1.3310 resistance for confirmation.

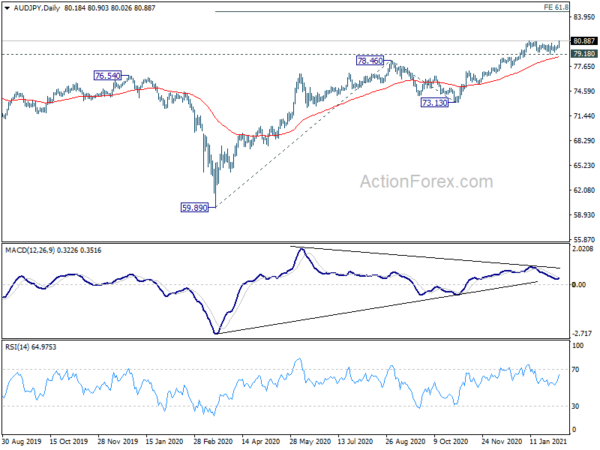

AUD/JPY should also be resuming the up trend from 59.89 with Friday’s rally. Outlook will stay bullish as long a s79.18 support holds. Next target is 61.8% projection of 59.89 to 78.46 from 73.13 at 84.60.

Current development also argues that long term channel resistance from 105.42 (2013 high) is being decisively taken out. Break of 84.60 would pave the way to 90.29 structural resistance.

EUR/USD Weekly Outlook

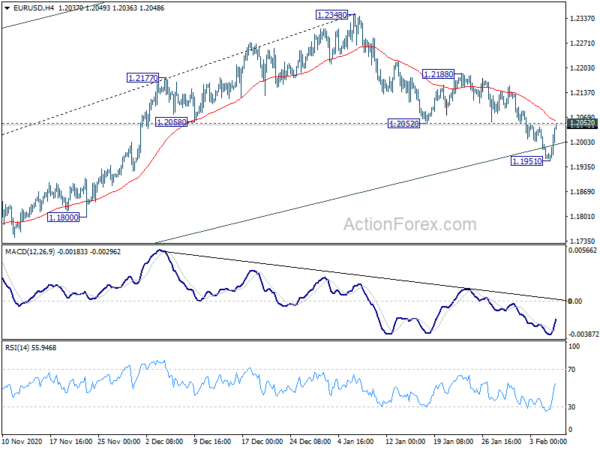

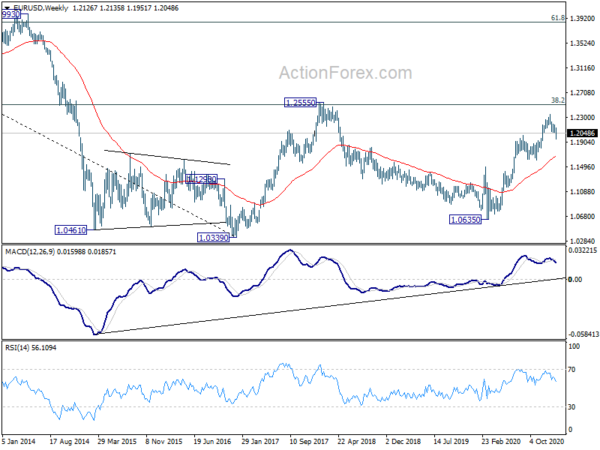

EUR/USD dropped to as low as 1.1951 last week and breached medium term channel. However, as it quickly formed a temporary low there and recovered, initial bias remains neutral this week first. On the upside, firm break of 1.2052 support turned resistance will suggest that the correction from 1.2348 has completed, and larger up trend isn’t finished. Intraday bias will be turned back to the upside for 1.2188 resistance and then 1.2348 high. However, break of 1.1951 will bring deeper correction to 38.2% retracement of 1.0635 to 1.2348 at 1.1694.

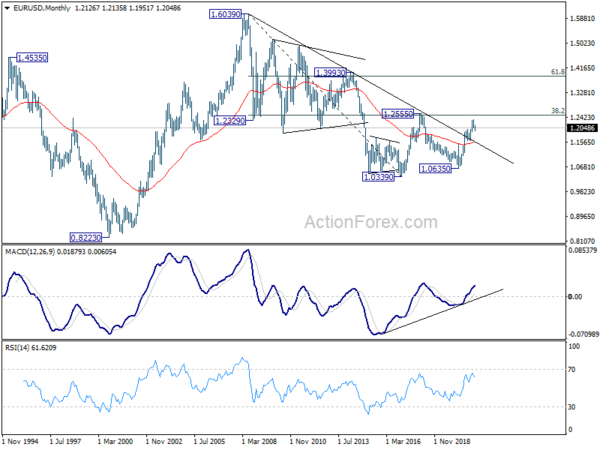

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

In the long term picture, the case of long term bullish reversal continues to build up, with bullish convergence condition in monthly MACD, sustained trading above 55 month EMA and long trend falling trend line. Focus is now on 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). Decisive break there will confirm and target 61.8% retracement at 1.3862 and above.