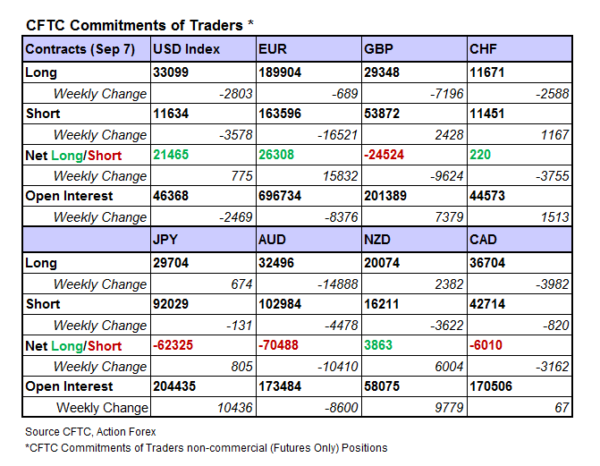

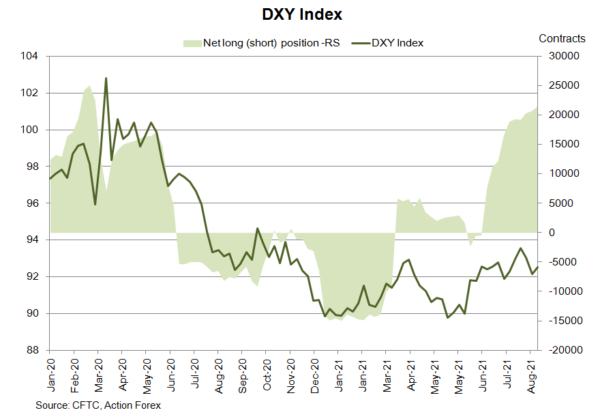

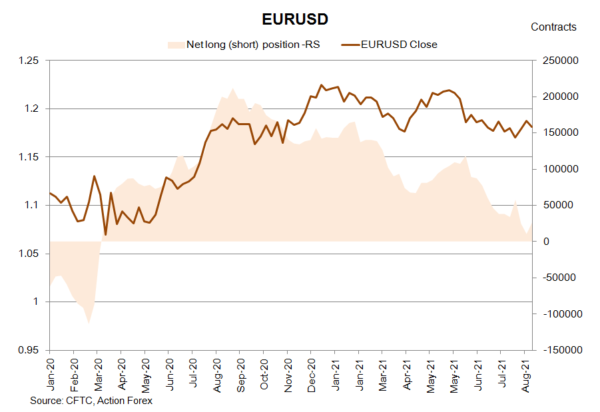

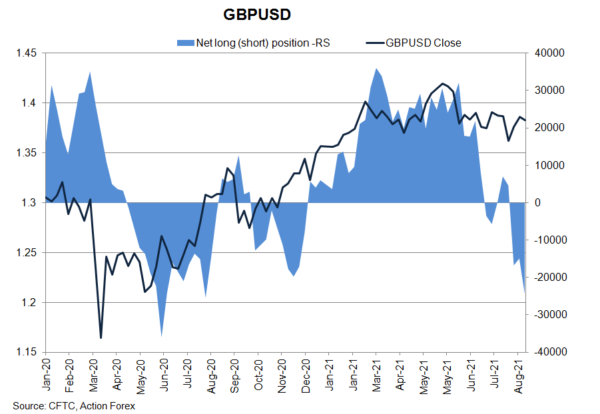

As suggested in the CFTC Commitments of Traders report in the week ended September 7, NET SHORT of USD index futures added +775 contracts to 21 465. Trades continued to drop on both sides with speculative long positions down -2 803 contracts while speculative shorts down -3 578. Concerning European currencies, NET LENGTH in EUR futures jumped +15 832 contracts to 26 308. GBP futures’ NET SHORT rose +9 624 contracts to 24 524.

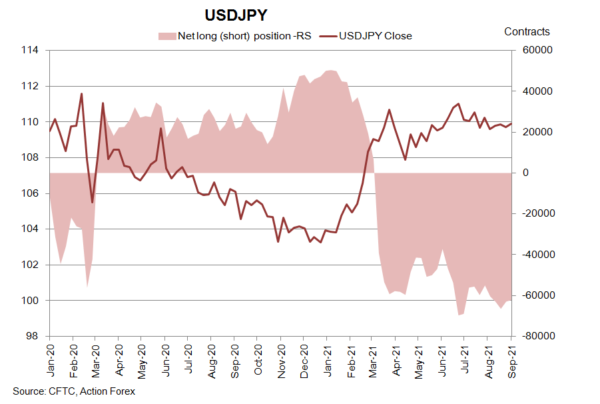

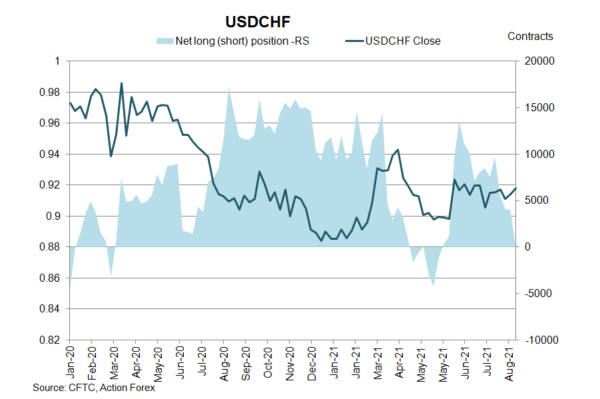

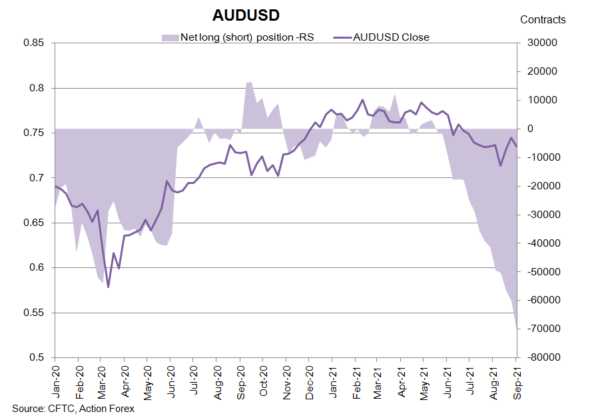

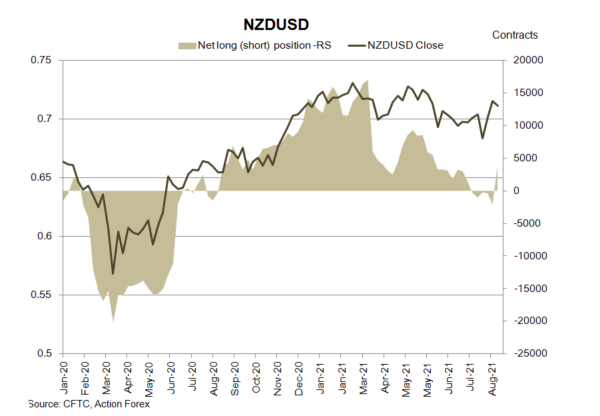

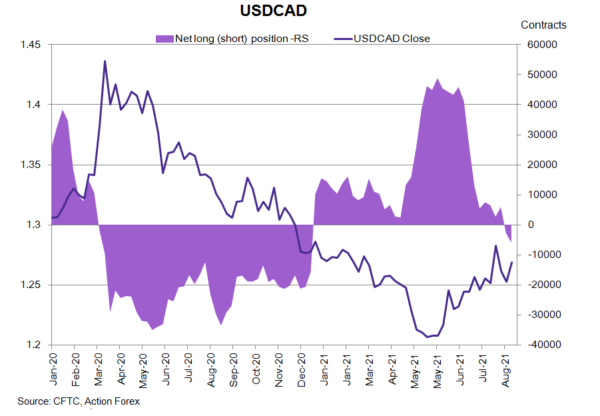

On safe-haven currencies, NET LENGTH of CHF future fell -3 755 contracts to 220 while NET SHORT of JPY futures slipped -805 contracts to 62 325. Concerning commodity currencies, NET SHORT of AUD futures soared +10 410 contracts to 70 488. NET LENGTH for NZD futures jumped +6 004 contracts to 3 863 during the week. CAD futures’ NET SHORT rose +3 162 contracts to 6 010.

On safe-haven currencies, NET LENGTH of CHF future fell -3 755 contracts to 220 while NET SHORT of JPY futures slipped -805 contracts to 62 325. Concerning commodity currencies, NET SHORT of AUD futures soared +10 410 contracts to 70 488. NET LENGTH for NZD futures jumped +6 004 contracts to 3 863 during the week. CAD futures’ NET SHORT rose +3 162 contracts to 6 010.