Live Comments

US PPI rises 0.5% mom in January as services drive monthly jump

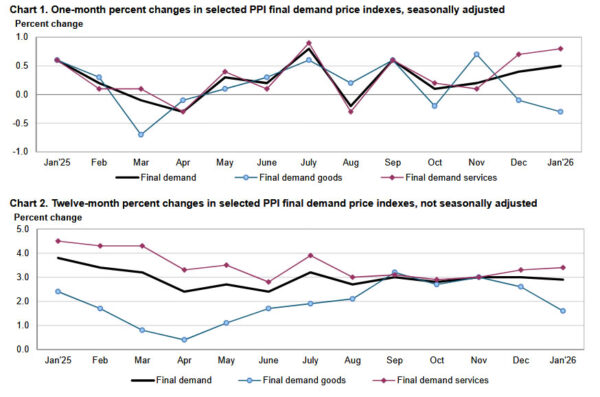

US producer prices rose more than expected in January, with headline PPI climbing 0.5% mom against forecasts of 0.3%. The increase was largely driven by a sharp 0.8% gain in final demand services, while prices for final demand goods declined -0.3%.

On an annual basis, PPI eased slightly from 3.0% yoy to 2.9% yoy, but above expectations of 2.6%. The moderation in the yearly rate does little to offset the firm monthly momentum, particularly as underlying measures continue to trend higher.

Core PPI excluding foods, energy, and trade services rose 0.3% mom, marking the ninth consecutive monthly increase. Over the past 12 months, this core gauge advanced 3.4%, suggesting persistent pipeline price pressures.

Canada GDP beats in December with 0.2% mom growth, but fragile start to 2026,

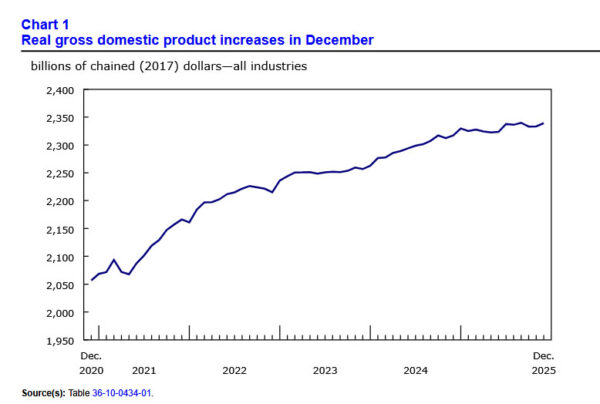

Canada’s economy closed 2025 on a slightly firmer note, with GDP rising 0.2% mom in December, above expectations of 0.1%. The expansion was driven by gains in both services-producing and goods-producing industries, suggesting a modest rebound in activity toward year-end.

Services industries led the monthly increase, rising 0.2%, supported by wholesale trade, the public sector, and transportation and warehousing. Meanwhile, goods-producing sectors also expanded 0.2%, partially reversing back-to-back declines in October and November, with manufacturing and utilities contributing to the recovery. In total, 11 of 20 industrial sectors recorded growth in December.

Advance estimates suggest real GDP was essentially unchanged in January, pointing to a fragile start to 2026.

The quarterly picture was less encouraging. GDP by industry edged down -0.1% in Q4 following a solid 0.6% expansion in Q3. Manufacturing was the main drag, contracting -1.5% in the quarter—its third decline of 2025 and fourth in the past five quarters—highlighting persistent weakness in the sector.

Swiss KOF barometer strengthens to 104.2, demand outlook improves

Switzerland’s economic outlook brightened in February as the KOF Economic Barometer rose from 103.3 to 104.2, beating expectations of 103.1. The increase resumes the upward trend seen in recent months after a brief dip in January and leaves the gauge comfortably above its medium-term average of 100.

According to KOF, the improvement reinforces a positive outlook for the Swiss economy, with strength concentrated on the demand side. Indicator bundles linked to consumption and foreign demand both point to favorable momentum.

However, the production side presents a more "mixed" picture. While some sectors remain stable, manufacturing is experiencing a setback, signaling that industrial momentum has yet to fully align with the broader demand recovery.