Was recent data enough to ease concerns about first quarter downturn?

The Bank of England meeting on Thursday should be another interesting affair following a week in which two other major central banks – the Federal Reserve and ECB – have announced new tightening measures.

- No rate hike expected this month

- Markets still not convinced about August

- Sterling could respond positively to hike clues

The BoE was close to doing the same in May and had it not been for a slowdown in the first quarter, it may well have raised interest rates by 25 basis points, taking them above 0.5% for the first time since March 2009.

Instead, the Monetary Policy Committee opted to wait for evidence that the downturn in the first quarter was in fact temporary and not the start of a more worrying trend. The fact that inflation has fallen back to more palatable levels also gave them the freedom to do so.

Will we see a rate hike on Thursday?

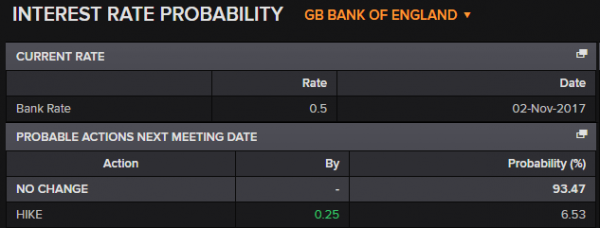

While we shouldn’t write off the possibility of a rate hike this month, it looks extremely unlikely and with markets only pricing in a 6% probability of an increase, investors would appear to agree.

There hasn’t been sufficient evidence yet that the downturn in the first quarter was a blip. The recent retail sales data was encouraging and there has been some improvement in the PMI surveys which provides hope but I’m not convinced that will be enough.

There’s also no press conference or new economic projections accompanying this decision which at this stage of the tightening cycle I think policy makers would prefer.

The central bank has also been heavily criticized for misleading investors, so to raise interest rates without warning would just invite more criticism and raise questions over the banks forward guidance, or lack of.

Finally, with Brexit negotiations at such a critical stage, it would seem an odd time to be hiking interest rates. Later in the year when we have more clarity would surely be more suitable.

What does all of this mean for sterling?

With a rate hike almost entirely priced out, it would come as a major shock if the central bank decided to pull the trigger, something I expect would send the pound sharply higher.

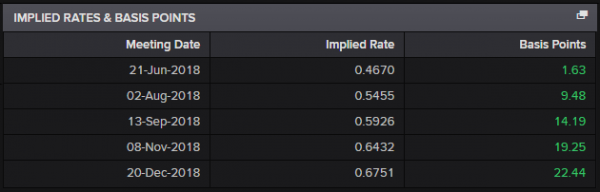

Assuming this doesn’t happen, traders will be looking for more subtle clues about when we can expect the next rate hike with the next meeting in August being one of those that does include new economic projections and a press conference, otherwise known as Super Thursday.

With the markets currently pricing in only a small chance – roughly 40% – of a hike in August, this may be where the potential for surprise lies. A strong signal that the central bank is going to push ahead with a hike at the next meeting – either in an accompanying statement or with more policy makers voting for a hike – could also be bullish for the pound.