New Zealand will be on the receiving end of employment and wage growth data for Q2 during the Asian trading session on Wednesday (Tuesday 2245 GMT). Economists’ forecasts suggest the nation’s labor market remained strong, and wage pressures picked up some steam. That said, survey-based gauges of employment were less optimistic during the quarter, which likely renders the kiwi vulnerable to a negative surprise.

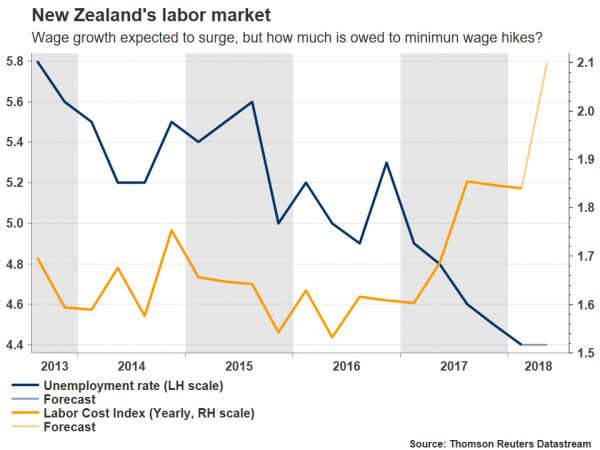

Following the recent expansion of the Reserve Bank of New Zealand’s (RBNZ) mandate to include full employment in addition to price stability, labor market data will likely begin to attract even greater attention than previously. In the second quarter, the nation’s unemployment rate is projected to have held steady at the 9-year low of 4.4%, stabilizing after five consecutive quarters of declines. Meanwhile, the labor cost index is anticipated to show that wage pressures picked up some steam. In quarterly terms, wages are expected to have accelerated by 0.6% from 0.3% previously, which would bring the yearly rate up to 2.1%, from 1.9% in Q1.

Although these appear like rather strong prints at first glance, particularly on the wages front, a second look might reveal otherwise. In particular, most of the acceleration expected in wages is likely to be a by-product of large hikes in the minimum wage that took effect in April, and hence may carry little importance in guiding RBNZ policy decisions. For the Bank, what is most vital is seeing broad and sustained gains in wages, not improvements owed to one-off effects like minimum wage hikes, which are likely to only provide a temporary lift.

With regards to employment, it’s useful to note that survey-based measures have softened somewhat in recent months. The ANZ job ads survey, for instance, showed that advertisements slowed markedly during the quarter, rising by a mere 0.1% from Q1. Job advertisements are typically considered to have a good correlation with employment growth. Moreover, another survey from the ANZ – the business outlook one – revealed a notable deterioration in firms’ employment intentions. Meanwhile, the employment sub-index of the Business NZ manufacturing PMI alarmingly recorded notable declines, staying below 50 in both May and June, signaling contracting jobs growth in the sector.

While employment data can be notoriously volatile, these suggest the risks surrounding the kiwi from this data release may be somewhat tilted to the downside. Markets seem to be expecting a “steady as she goes” employment report, while surveys tracking the labor market imply that some weakness could well emerge. Even in case of a positive surprise in these figures, it’s doubtful whether markets would move to price in any probability of an RBNZ rate increase in the coming quarters, amid weakening business confidence, signs of a slowdown in the broader economy, and the ongoing risk of trade tensions escalating.

Taking a technical look at kiwi/dollar, in case of declines initial support could come around 0.6760, this being the 27 July low. A downside break could open the way for the July 19 trough of 0.6710, before the two-year low of 0.6686 comes into view.

On the flipside, and in case of stronger-than-expected figures, preliminary resistance to advances may be found near 0.6850, the July 26 high. Even higher, the 0.6920 territory – defined by the peaks of June 25 – would attract attention, with even steeper advances opening the way for the 0.6955 zone, marked by the June 18 highs.