Tuesday August 14: Five things the markets are talking about

Tuesday sees a tentative reprieve for global equities in the wake of Turkey’s induced turmoil and the forex market has managed to stabilize a tad, aided by reports this morning that the Turkish Finance Ministry has scheduled an investor call for Thursday, Aug 16.

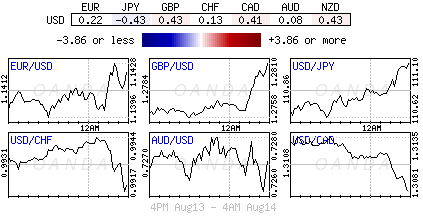

The ‘big’ dollar has managed to slip from its 15-month highs against G10 currency pairs as U.S Treasury prices ease as a degree of calm returns to Turkish markets – USD/TRY is down -4.75% at $6.5622.

Nevertheless, a sizable rate increase by the Central Bank of the Republic of Turkey (CBRT) followed by drastic measures to reduce the fiscal deficit still appears to be the most viable option to re-anchor the lira and pull the country’s economy from the brink. Currently, fixed income dealers are pricing in a +10% rate hike by the CBRT to stem the lira’s depreciation.

Is it economic suicide or attack? President Erdogan knows what needs to be done, but will he allow it? The U.S. has nothing further to negotiate until the detained American pastor is freed.

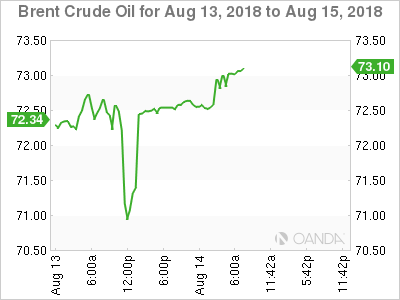

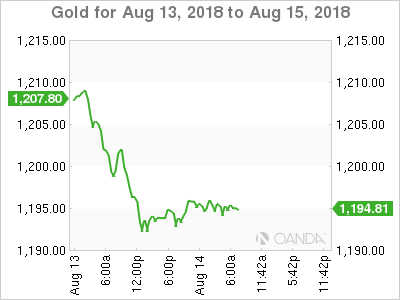

Elsewhere, crude oil has pared some of its recent losses, while gold finds a bid on a weaker dollar and BTC is again under pressure dropping below $6,000.

On tap: U.S retail sales data appears stateside tomorrow, followed by housing data on Thursday. In Brussels Thursday, Brexit talks between the E.U and the U.K resume.

1. Stocks mixed results on bargain hunting

In Japan, the Nikkei posted its biggest gain in five month after the Turkish lira pared some of yesterday’s losses. Export-driven firms benefited from a pause in the safe-haven yen’s (¥111.01) strengthening. The Nikkei share average surged +2.3%, while the broader Topix rallied +1.6%.

Note: Japanese trading volumes remain thin as many domestic investors are on holiday.

Down-under, Aussie shares closed firmer, supported by the financial and material sectors. The S&P/ASX 200 index rose +0.8% at the close of trade. The benchmark slipped -0.4% on Monday. In S. Korea, both the Kospi stock index and the won gained overnight, supported by recovering confidence after the Turkish turmoil. The Kospi closed up +0.47%.

In Hong Kong and China, stocks fell for a third consecutive session overnight, after data showed further signs of cooling in China’s economy and as trade war worries lingered. In Hong Kong, the Hang Seng index fell -0.7%, while the China Enterprises Index lost -0.2%. In China, the blue-chip CSI300 index fell -0.5%, while the Shanghai Composite Index closed down -0.2%.

Note: Overnight, China July data missed market expectations amid trade frictions – industrial production y/y, +6.0% vs. +6.3%e and retail sales y/y, +8.8% vs. +9.1%e.

In Europe, regional bourses have opened higher across the board as concerns over geopolitical issues, as well as improved outlook over Turkey is helping to support risk sentiment.

U.S stocks are set to open in the ‘black’ (+0.3%).

Indices: Stoxx50 +0.4% at 3,246, FTSE +0.1% at 7,655, DAX +0.5% at 12,415, CAC-40 +0.4% at 5,432; IBEX-35 +0.2% at 9,550, FTSE MIB +0.4% at 21,047, SMI +0.4% at 9,0.42, S&P 500 Futures +0.3%

2. Oil edges up on Saudi output cut and Iran sanctions, gold higher

Crude oil prices are better bid this morning after Saudi Arabia said it had cut production in July. However, market concerns over a slowdown in global economic growth is capping prices for now.

Brent crude oil is up +50c at +$73.11 a barrel, while U.S light crude has gained +55c to +$67.75.

Saudi Arabia has told OPEC that it had reduced crude output by -200Kbpd to +10.29M bpd in July.

Note: Saudi Arabia is OPEC’s biggest producer and the only major exporter that can easily adjust output to balance global supply. A self-imposed cut in product would suggest that Saudi’s are keen to avoid a repeat of a global glut that has depressed prices over the past few years.

Ahead of the U.S open, gold prices are better bid, edging away from yesterday’s 18-month low print (+$1,191.25). Support is coming from a weaker U.S dollar and a break below some key psychological levels has triggered some technical buying interest. Spot gold is up +0.2% at +$1,195.51 an ounce. U.S gold futures are up +0.3% at +$1,202.50 per ounce.

3. Italian bond yields fall from two-month highs

Italian bond yields have pared some of yesterday’s sharp rise on reassuring comments from the government and as fears about contagion from Turkey has eased for now.

PM Conte and his top ministers discussed the 2019 budget yesterday – investors have been concerned that the government’s high-spending plans would lead to a further deterioration in Italy’s finances. However, the Italian government have agreed to preserve the “stability of state finances and lower public debt.”

Italy’s 10-year BTP yield has fallen – 7 bps to +3.03%, off two-month highs of +3.109% set yesterday, with its 5-year note yield down -6 bps at +2.32%.

Elsewhere, the yield on U.S 10-year Treasuries have backed up +2 bps to +2.89%, the largest gain in a week. In Germany, the 10-year Bund yield has gained +2 bps to +0.33%, the first advance in a week, while in the U.K, 10-year Gilt yield has also climbed +2 bps to +1.277%, the largest surge in almost a fortnight.

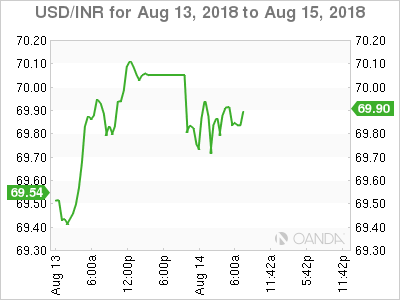

4. Indian rupee hits new all time low

Emerging-market currencies remain under pressure despite today’s TRY reprieve that Turkey’s Finance Ministry has scheduled an investor call for Thursday, Aug 16. Overnight, INR fell to new record low of $70.08 outright, retaining its position as one of Asia’s worst performing currencies this year. It’s believed that the Reserve Bank of India (RBI) has been trying to defend the $70 level by selling USD.

Note: The rupee has fallen -9.5% in 2018. Among other major emerging markets, only BRL, RUB and ZAR currencies have weakened more.

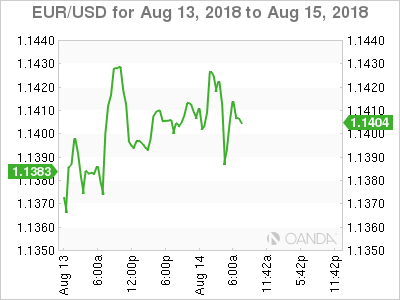

EUR (€1.1401) is trading above yesterday’s intraday low (€1.1367) after German Q2 GDP data suggested that the slowdown in Q1 was temporary. The single unit still faces resistance from Italian discussions on their 2019 budget. Italy Deputy PM Di Maio believes that Italy is not at risk of financial market attack.

GBP (£1.2783) saw its best levels of the session erode (£1.2809) despite its ILO Unemployment falling to its lowest level since 1975.

And cryptocurrencies are stung by ETF Delay – Bitcoin and ethereum continue to fall as reports from earlier this month that the application of a Bitcoin exchange traded fund has been postponed is keeping global institutional money on the sidelines. Bitcoin is down-3.6% to around +$6,035.

5. Eurozone avoids Q2 Slowdown, supported by German growth

Data this morning shows that Germany’s economic growth accelerated in Q2, guaranteeing the eurozone as a whole avoided a slowdown. Nevertheless, expect global trade tensions to cloud the outlook for businesses.

The Federal statistics office reported Germany’s GDP grew at a quarterly rate of +0.5%, or +1.8% in annualized terms. It also raised its Q1 growth estimate to an annualized +1.5% from +1.2% growth reported in May.

And because of Germany’s expansion, the agency has also raised its growth estimate for the eurozone as a whole to +1.5% in annualized terms from +1.4% reported in late July.