As the United States widens its criticism of China beyond the trade spectrum, investors will be looking to Chinese trade figures due on Friday for possible signs that the Trump administration’s attacks on the country are starting to weigh on the economy. So far, Chinese export growth has held up well following the introduction of US tariffs and counter levies by China in July. However, fears that the US and China are headed for a prolonged stand-off triggered a sell-off in Chinese stocks and the yuan on Monday as concerns rise for a possible slowdown in the world’s second largest economy.

Exports from China rose by 9.8% year-on-year in August, slowing marginally from 11.2% in July when the first round of tariffs was enforced. The impressive figures were most likely down to front-loading of shipments by companies before the different tranches of tariffs came into force. As those effects subside, export growth is expected to slow in the coming months. For September, analysts are forecasting that exports grew by 8.9% y/y, a notable slowdown from the prior month but still a healthy figure. Investors will be paying specific attention to the size of the trade surplus with the US, which in August, had hit a record high.

Imports will also be watched, as the data is seen as a good indicator of the strength of domestic demand. Imports were up a revised 19.9% y/y in August and are expected to ease to 15.0% in September. The overall trade surplus during the month is forecast to narrow to $19.4 billion.

Chinese authorities have stepped up fiscal and monetary stimulus measures in recent weeks as they attempt to bolster the economy, which is facing downside pressure from the increased US trade barriers and investment restrictions. While initially, many market participants remained optimistic that the two sides would eventually find a way to work through their differences, the unexpectedly strong criticism of China on a range of policy issues in recent days by US officials, including President Trump himself, has taken traders, as well as Chinese politicians, by surprise. This led to steep losses in China’s main stock indices when markets re-opened on Monday from a week-long holiday, recording declines in the range of 4%. Those losses extended into the week with the Shanghai Composite index plunging to the lowest since late 2014.

The yuan also came under renewed selling pressure, slumping to a near 8-week low of 6.9331 yuan per dollar this week. Should Friday’s figures miss expectations, the yuan could weaken further, while its liquid proxy, the Australian dollar, would also likely come under pressure.

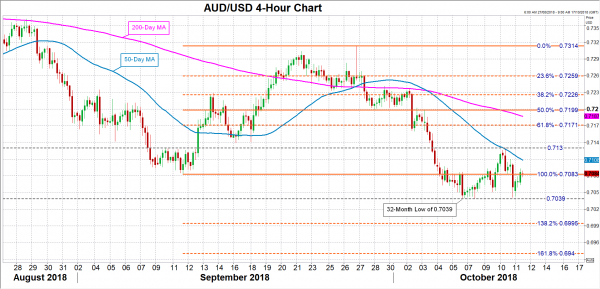

Having touched a 32-month low of $0.7039 during the past week, that level poses an immediate support point for the aussie. If breached, the aussie could next head towards the $0.70 handle, which is the 138.2% Fibonacci extension of the September upleg from 0.7083 to 0.7314. A drop below this key level would bring into range the 161.8% Fibonacci extension at $0.6940.

However, an upside surprise in the trade numbers would bring some relief to the markets and potentially trigger a rebound. The aussie could bounce back towards the $0.7130 level, which capped advances on Wednesday. However, it would first need to overcome immediate resistance in the $0.7085 region. Higher up, the 50% Fibonacci retracement at the $0.72 mark would be the next critical wall to break.

In the meantime, forex markets will be on edge for further headlines pertaining to US-China relations. President Trump and Vice President Pence recently accused Chinese authorities of meddling in the US mid-term elections, while a Bloomberg investigative report last week alleged that Chinese spies had placed tiny microchips in computer servers destined for US companies like Amazon and Apple (though this has not been substantiated by the US government). In a further blow for relations and for hopes of a quick end to the drawn-out trade dispute, there was a simmering in military tensions following a near collision between US and Chinese destroyers in the South China Sea.