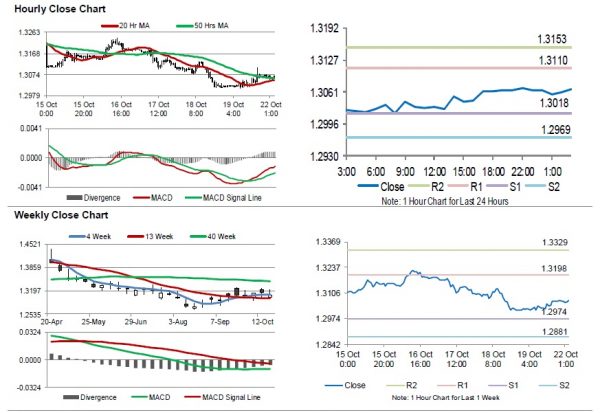

For the 24 hours to 23:00 GMT, the GBP rose 0.35% against the USD and closed at 1.3066 on Friday.

In economic news, UK’s public sector net borrowing posted a deficit of £4.1 billion in September, notching its lowest level since 2007. In the preceding month, the nation registered a revised deficit of £5.6 billion. Market had expected for public sector net borrowing to record a deficit of £4.5 billion.

The Bank of England Governor, Mark Carney, indicated that the UK’s financial system is making provisions to tackle the consequence of the “disorderly, cliff-edge” Brexit, however unlikely that may be. The Governor stated that the central bank is not hoping for the best but preparing to face the worst situation in the process.

In the Asian session, at GMT0300, the pair is trading at 1.3067, with the GBP trading a tad higher against the USD from friday’s close.

The pair is expected to find support at 1.3018, and a fall through could take it to the next support level of 1.2969. The pair is expected to find its first resistance at 1.3110, and a rise through could take it to the next resistance level of 1.3153.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages