The Japanese yen declined slightly against the USD after the Japan’s manufacturing PMI numbers rose to 53.1. This was higher than the consensus estimate of 52.6. It was also the highest level in six months and came amidst a challenging business environment. At the same time, the country’s stocks declined to the lowest level in 13 months. This was mostly because of the problems in Italy and concerns about the Chinese economy.

The euro was little moved even after yesterday’s decision by Brussels to reject Italy’s budget plan for 2019. In recent weeks, the new Italian government has been in talks with the EU regarding the proposal, but the country has now been told they need to redraft the budget which proposed a controversial deficit equal to 2.4 percent of the country’s annual output – a figure much higher than the deficit goal promised by the previous Italian administration. Today, traders will continue to focus on the budget issue. They will also receive important PMI numbers from Germany and the EU.

The Canadian dollar strengthened slightly as traders waited for the interest rates decision from the Bank of Canada. Today, the BOC is expected to raise interest rates to 1.75%, the first hike since Canada made a deal with the US on the new NAFTA. This will be the second and possibly the final rate hike this year. Two more hikes are expected in 2019. This will be an important rates decision because of the disappointing inflation data released on Friday. Market participants will listen to the BOC to learn more about its impact on future hikes.

USD/CAD

This month, the USD/CAD pair has risen from a low of 1.2780 and reached a high of 1.3133. Today, it has fallen slightly ahead of the important decision by the BOC. The current price is along an important support level as shown in the four-hour chart below. It is also at an important point where a crossover between the 28-day EMA and 14-day EMA is starting. This means it’s likely that the pair will continue moving lower, potentially to the 1.3000 level.

EUR/USD

Yesterday, the EUR/USD pair had a false upward breakout. This ended when the pair reached a high of 1.1492. Today, it was little moved in the Asian session as traders waited for the important manufacturing data from the EU. The pair will likely test the important support of 1.1430 and attempt a downward breakout. If it does, and based on the double EMA, the pair will likely continue the downward momentum to the 1.1350 in the next few days.

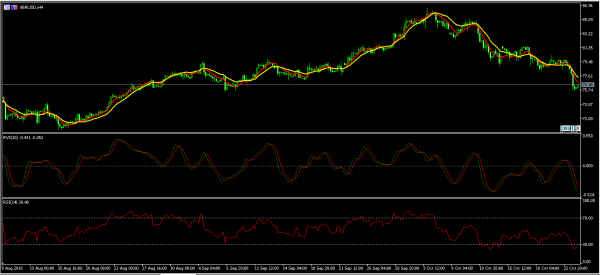

XBR/USD

The price of crude declined sharply yesterday after data from the American Petroleum Institute (API) showed an increase buildup in inventories. The inventories rose to 9.88 million barrels, which was higher than last week’s drawdown. In the Asian session, the price of Brent declined to a low of $75.65. This was a continuation of the falling prices that started on October 8. The moving average indicators point to a more sustained decline. This is confirmed by the RSI and Relative Vigor Index indicators as shown below. Today’s movement will be mostly influenced by the EIA data.