China’s manufacturing industry suffered another month of decline in September. Figures from the Chinese National Bureau of Statistics showed that the manufacturing PMI declined to 50.2, which was lower than August’s 50.8. The 50.2 figure was an indication that the industry was nearing contraction. A figure below 50 in PMI is an indication that the industry is contracting. The services PMI was at 53.9, which was lower than the 54.9 from the previous month. These numbers raised concerns about the slowing global economy because China is the world’s biggest manufacturer. They also raised the issue of the ongoing trade war with the USA. On Monday, it was revealed that the Trump administration was prepared to impose tariffs on all Chinese goods if his meeting with Xi does not yield results.

The Japanese yen continued weakening against the USD after the Bank of Japan made its monetary policy decision. As expected, the bank left rates unchanged at minus 0.10% and indicated that it will tweak the bond buying process but it won’t rush changes. The new decision was made to ensure that the government debt market reflected the fundamentals. The reason for the yen weakness was that the bank did not give any forward guidance on the future of interest rates. In addition, the bank trimmed the inflation target for 2019 to 0.9% from the July forecast of 1.1%.

Yesterday, Wall Street had a mixed day as October comes to an end. Wall Street opened higher after the previous day’s losses. Intraday, the stocks declined sharply with the S&P moving to the bear territory. The market then recovered and the Dow ended the day up by 431 points. After hours, the focus turned to Facebook, which missed analysts’ forecasts on revenues which was a sign of the challenges it is facing.

The Australian dollar declined against the USD after the country’s statistics office released the CPI data for the third quarter. The CPI remained unchanged at 0.4%, which was lower than the consensus estimates of 0.5%. On a YoY basis, the CPI declined from 2.1% to 1.9% in the quarter. However, the YoY numbers remain close to the RBA’s target of 2.0%.

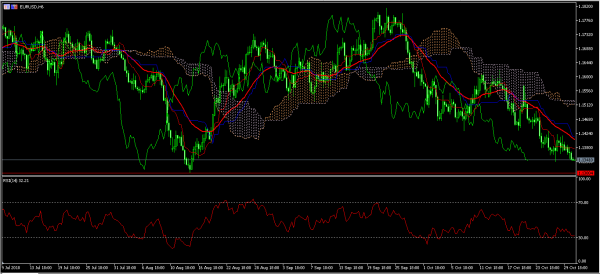

EUR/USD

The EUR/USD pair declined to an intraday low of 1.1340. This was as the previous gains looked like a failed reversal. Today’s low in the Asian session is the lowest it has been since Monday this week. The trend indicators like the moving averages, Ichimoku Kinko Hyo show that the pair could continue moving lower. This is confirmed by the oscillators like the RSI and the volumes indicators like the MFI as shown below. While this is the path of the least resistance, traders should be cautious about opening bearish trades past the 1.1300 level.

GBP/USD

The GBP/USD pair moved lower in the Asian session and reached an intraday low of 1.2700. This was the lowest it has been since August 23. The double EMA indicator show that the pair’s path of least resistance is downwards. This is confirmed by the MACD, which is at a multi-monthly low. However, as the new month starts, and as the pair edges closer to the important support of 1.2665, traders should be cautious about further bearish bets.

USD/JPY

The USD/JPY pair moved higher, continuing a strong trend started on Wednesday last week. The pair reached an intraday high of 113.32. This was the highest it has been since October 11. The upward trend is gaining momentum as shown by the momentum indicator below. The Average Directional Index (ADX) which measures the strength of the trend is currently at 61 while the price is along the upper band of the Bollinger Bands. This is an indication that the pair could continue moving up in the new month.