World markets rose yesterday after Donald Trump said that he had a phone call with China’s Xi Jinping. In the tweet, he said that they will discuss trade in the G20 meeting in Argentina later this month. This brought relief among market participants regarding trade. They believe that the two leaders will reach an agreement about how to end the ongoing trade conflict. Previously, the US had said the discussion will only take place if China had a list of the concessions it is willing to make about trade.

The Australian dollar halted its gains against the USD in the Asian market. This happened after Australia released the retail sales and PPI data. The retail sales for September rose by 0.2%, which was lower than the expected gain of 0.4%. It was also lower than the previously-released data of 1.0%. Retail sales data is closely watched because it is an important measure of consumer spending. The PPI data for the second quarter rose by 2.1%, which was higher than the 2.0% that traders had expected. On a QoQ basis, they rose by 0.8%, which was higher than the consensus forecast of 0.2%. Today, the AUD/USD pair’s movement will depend mostly on the US dollar. This is because traders will receive the official jobs numbers from the Labor Department.

The price of crude oil fell sharply yesterday as the US and OPEC flooded the oil market ahead of the US mid-terms. Yesterday, data from OPEC showed that its members had increased production to the highest level since 2016. The biggest gainers in production were Saudi Arabia, UAE, and Libya. Recent data from the US also show that the country is increasing its production sharply. All this has happened ahead of the Iranian sanctions that will begin on Sunday night. A new report showed that the US will use satellite data to track the Iranian sanctions. Before, the country was able to avoid the sanctions by using unmarked ships to transport the oil.

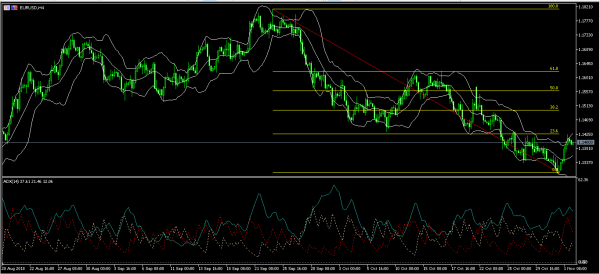

EUR/USD

The EUR/USD pair halted gains yesterday as traders wait for the official US jobs numbers and German manufacturing PMI. In the Asian session today, the pair remained around the 23.6% Fibonacci Retracement level of 1.14100. This level is along the upper band of the Bollinger Bands while the ADX is at 37 and moving higher. There is a likelihood that the pair will continue the upward movements today and test the 38.2% Fibonacci Retracement level of 1.1500. If it moves lower, it will likely move to below 1.1300.

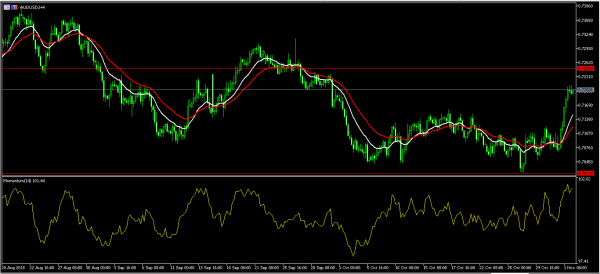

AUD/USD

The AUD/USD pair halted the sharp upward movements started yesterday. It is now trading at the 0.7200 level, which is slightly lower than yesterday’s high of 0.7215. With no data expected again from Australia, the US jobs numbers will be the main movers today. The momentum indicator shows that the upward trend could continue. This is also shown by the double Exponential Moving Average indicators. If it continues the upward trend, the pair will likely test the 0.7250 level.

XBR/USD

The price of crude oil declined sharply in the Asian session. It reached a low of 72.60, which was the lowest level since August 20. This was a continuation of the downward trend that started in October 10. The pair will likely continue the downward momentum as evidenced by the Ichimoku Kinko Hyo and the momentum indicators shown below. The RSI is at the oversold territory, which is an indicator that the XBR/USD pair will drop further before it recovers. It will likely do this when it reaches the important support level of 70.