The dollar is higher against major pairs on Friday after the release of the October U.S. non farm payrolls (NFP) report showed a massive 250,000 jobs gain and the fastest wage growth pace since 2009. US fundamentals have been solid and boosted the US dollar higher despite rising political risk ahead of the US mid-terms next week. The President used the employment data point as political leverage with Democrats leading the polls on retaking the House of representatives, and Republicans maintaining the Senate.

Central banks have kept monetary policy on hold for the most part after evaluating external risks versus economic performance. Next up is the Reserve Bank of New Zealand (RBNZ) due to publish its cash rate and monetary policy statement on Wednesday, November 7 at 4:00 pm EST. RBNZ Governor Orr will host a press conference at 5:00 pm EST. The U.S. Federal Reserve will kick off its two day Federal Open Market Committee (FOMC) at the end of with it will publish its statement and Fed Funds rate. No major changes expected in the language of the statement with a highly anticipated interest rate lift happening in the December meeting.

- RBNZ expected to hold rates at 1.75%

- UK services PMI index to decrease slightly to 53.4

- Fed to hold rates awaiting December hike

Dollar Higher on Data, softer on Trade Tensions Easing

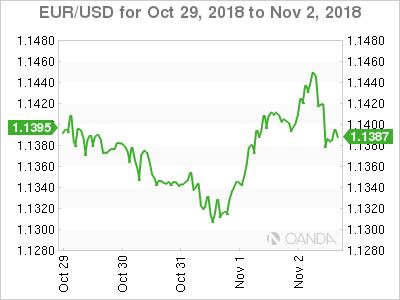

The EUR/USD fell 0.22 percent on Friday after the US posted solid job growth. The single pair is trading at 1.1383 despite the easing of trade war concerns removing support for the US dollar. Fundamentals came in at the right time for the greenback as a solid jobs report gave plenty of evidence of the strength of the US economy.

European fundamentals disappointed with quarterly growth at 0.4 percent showing a lack of momentum ahead of stronger headwinds. Italian growth was stagnant which will be a talking point between Brussels and Rome as they discuss the Italian budget that was sent back for breaking fiscal limits. The Italian government is arguing that higher spending is needed for that reason alone, to boost growth, while the EU is worried of rising debt levels without a positive growth signal.

New Zealand Dollar Rises on Lower Trade Tensions

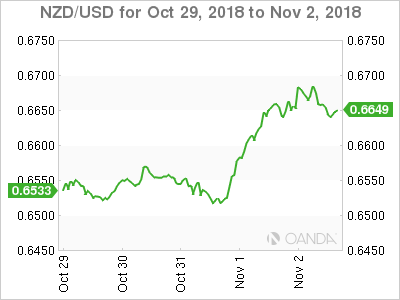

The NZD/USD lost 0.16 percent on Friday. The currency pair is trading at 0.6642 and was one of the biggest movers against the dollar during the week. The kiwi appreciated 1.85 percent after reports of a possible intervention by the central bank of China at the beginning of the week. The NZD maintained the upward momentum as trade tensions eased with comments from President Donald Trump about Chinese President Xi Jinping ahead of a meeting between the two leaders in Argentina.

Oil Falls after Iran Sanction Waivers

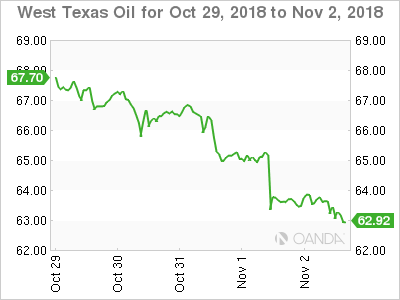

Oil prices continued to fall with WTI losing 0.89 percent on Friday and 6.6 percent on a weekly basis. The US issued waivers to a list of Iran oil buyers stoking anxiety about oversupply of the energy market. The Trump administration had put the Organization of the Petroleum Exporting Countries (OPEC) on the spot during its memorable UN address and kept putting pressure on Saudi Arabia to fill the gap that would be left in the aftermath of the US sanctions against Iran.

Gold prices fell after the massive jobs gains in the October non farm payrolls (NFP) report. The yellow metal fell 0.36 percent on Friday but its save haven asset minimized losses coming in at –0.14 in the last five trading days. The strong October NFP lent support to the US dollar and put downward pressure on the metal.

Market events to watch this week:

Monday, November 5

- 5:30am GBP Services PMI

- 9:10am CAD BOC Gov Poloz Speaks

- 11:00am USD ISM Non-Manufacturing PMI

- 11:30pm AUD RBA Rate Statement

Tuesday, November 6

- All Day USD US Midterm Elections

- 5:45pm NZD Employment Change q/q

- 10:00pm NZD Inflation Expectations q/q

Wednesday, November 7

- 4:00pm NZD RBNZ Monetary Policy Statement

- 5:00pm NZD RBNZ Press Conference

Thursday, November 8

- 3:00pm USD FOMC Statement

- 8:30pm AUD RBA Monetary Policy Statement

Friday, November 9

- 5:30am GBP GDP m/m

- GBP Manufacturing Production m/m

- GBP Prelim GDP q/q

- 9:30am USD PPI m/m

*All times EDT