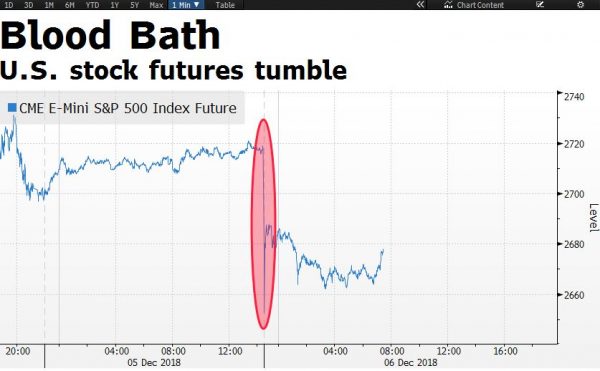

It is a bloodbath today, the sell-off is that intense that the CME had to pause the trading for the S&P500 futures when they opened. Anyone who is long in the market is feeling the pain and the violence which comes with it. We have a market which has more buyers than sellers.

The risk aversion trade has returned with vengeance as the MSCI Asia Pacific index is on track for its worst three-day plunge since October. The entire trade truce element between the US and China which promoted some optimism in the market is under a huge threat after the arrest of the CFO of the Chinese telecom company Huawei. The arrest was made by the Canadian authorities on the extradition request by the US. This has put the entire situation at risk. China has urged both Canada and the US to “rectify wrongdoing”.

The European and US futures are reacting negatively to this development as this will cloud the trade talk in the coming days. The selling pressure is so extreme for the US futures that it has made the CME group to pause trading. Money is clearly flowing out of the riskier assets to a safe haven. As a result, we are seeing the price of Gold and the Japanese yen strengthening. Treasuries 10-year yield has dropped to close enough to 2-year yield and this spurs a major qualm about the inversion of the curve.

Theresa May Can Defer Another Defeat

Back in the U.K., Theresa May is having the worst days of her political career and she has been advised by the cabinet ministers to save herself by delaying the parliament vote which is on the 11th of December. In the upcoming vote, it is widely expected that she will face a defeat. Time is running out and pressure is on and you can see that if you look at the Sterling-dollar pair. It is highly likely that the price may break below the 1.27 level, as we said yesterday. The chances are that we may see another 2-3% drop in sterling in the coming days as the Brexit deal gets voted down, but the chances of the UK coming out of the Brexit with no deal are still minimum. So, January could be the month when we could see Sterling recovering as much as 3% if Parliament comes back with a variant of the current deal.

Oil Cut Is Not The Major Question here

As for the commodity markets, it is the big day, it is all about OPEC. Qatar has decided to leave the cartel and this has left a blueprint for other countries to come out of Saudi monopoly. Remember, Saudi Arabia is the biggest swing producer among cartel members. Smaller producers like Libya have no meaningful say when the committee makes any decision. I think today’s meeting is not about production cut but a message which the cartel needs to send out the world. The question which needs to be answered is if the Cartel is still strong enough and most importantly if it can prevent the domino effect which is triggered by Qatar leaving the cartel.

In terms of production cut, it is widely expected that the OPEC and Russia will deliver on the production cut. The production cut could be as much as 1 million b/d as this is the number which matters the most when we factor in the refinery downtime due to their maintenance in the coming months.

On important dilemma which the cartel has is that it needs to also pay attention to president Trump’s tweet as well. He has already sent his message loud and clear; keep those taps running and don’t trigger any spike in the oil price. Thus, the OPEC may just have to adopt some sort of fuzzy solution to answer this.

In addition to this, what the committee will have to be careful is the ongoing threat which is coming from the global markets. It is a risk-off mode and investors are widely concerned about the prospectus of the global growth slowing down. Of course, this is an important factor for the oil demand and OPEC will have to justify their production cut with this equation and this why the final verdict coming out of the OPEC meeting could be fuzzy.