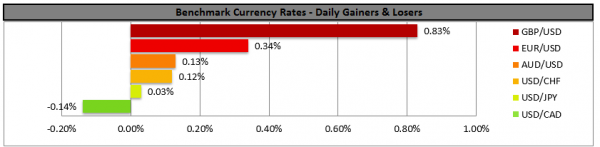

Cable rallied yesterday as the Tory party held a confidence vote for Theresa May’s leadership, yet she survived. The confidence vote was held in a secret ballot and Theresa May won the support of 200 of the 317 votes. The result stabilises Theresa May as the head of the Tory party for 12 months, however underscores the difficulty of passing her Brexit deal through the UK parliament, as a third of the Tory MPs could be voting against it. Analysts point out, that the result is not bad news as such, however does not fix Brexit and in that sense uncertainty continues. We could see the pound continuing to have some choppy trading as further Brexit headlines are expected.

Cable rose on the news breaking the 1.2555 (S1) resistance line (now turned to support) and the 1.2630 (R1) resistance level, however corrected below the latter, later on. As the pair broke the downward trendline incepted since Monday, we lift our bearish bias in favour of a sideways movement, however the pair could prove sensitive to Brexit fundamentals, which could in turn provide for some choppy trading. Should the pair find fresh buying orders along its path, we could see it breaking the 1.2630 (R1) once again and aim for the 1.2700 (R2) resistance level. On the other hand should the pair come under the selling interest of the market, we could see it breaking the 1.2555 (S1) and aim for lower grounds.

ECB Interest Rate Decision

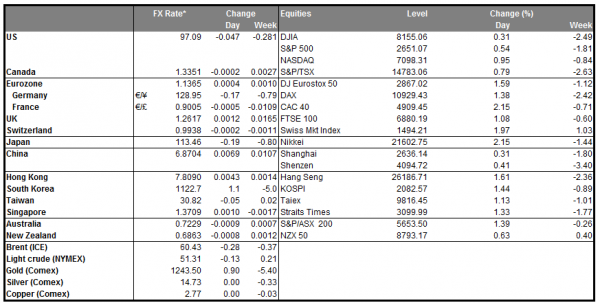

ECB is to announce its interest rate decision at 12:45 (GMT) today and is widely expected to remain on hold at 0.0%. Currently EUR OIS imply a probability for the bank to remain on hold of 96.19% and the bank’s past rhetoric supports such a notion. Should the bank remain on hold as expected we could see the market’s attention turning to the accompanying statement and Mario Draghi’s following press conference. The ECB is expected to announce the end of its massive QE program formally, however doubts remain as to whether such a scenario will materialize. The bank could be taking a rather dim view on the prospects of growth for the area and such an outlook could be raising the chances of its next step in curtailing stimulus being delayed. Please be advised that volatility for EUR pairs could continue throughout the following press conference of ECB’s president Mario Draghi (13:30, GMT).

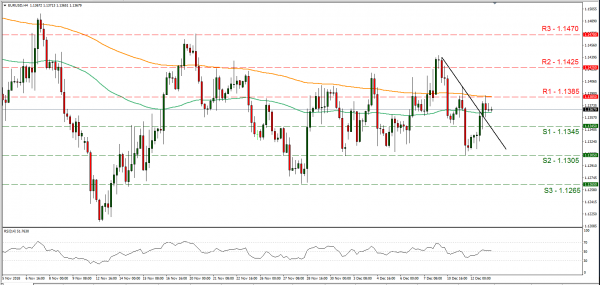

EUR/USD rose yesterday, breaking the 1.1345 (S1) resistance line (now turned to support) and tested the 1.1385(R1) resistance level before correcting lower. Technically it should be noted that the pair broke its downward trend line incepted since the 10th of December. Adding to that we could see the pair being sensitive to ECB’s interest rate decision and we see risks tilted to the bearish side for the pair. Should the bears reign over the pair’s direction we could see it breaking the 1.1345 (S1) support line and aim for the 1.1305 (S2) support barrier. Should on the other hand, the bulls be in charge again, we could see the pair breaking the 1.1385 (R1) resistance line and aim for the 1.1425 (R2) resistance hurdle.

In today’s other economic highlights:

In today’s European session, we get from Switzerland, SNB’s interest rate decision, from Norway, Norgesbank’s interest rate decision and from Turkey CBRT’s interest rate decision. All banks are expected to remain on hold, however a more dovish tone in the accompanying statement could be adopted by the SNB, while in contrast Norgesbank could prefer a more hawkish tone.

GBP/USD H4

Support: 1.2555 (S1), 1.2485 (S2), 1.2415 (S3)

Resistance: 1.2630 (R1), 1.2700 (R2), 1.2795 (R3)

EUR/USD H4

Support: 1.1345 (S1), 1.1305 (S2), 1.1265 (S3)

Resistance: 1.1385 (R1), 1.1425 (R2), 1.1470 (R3)