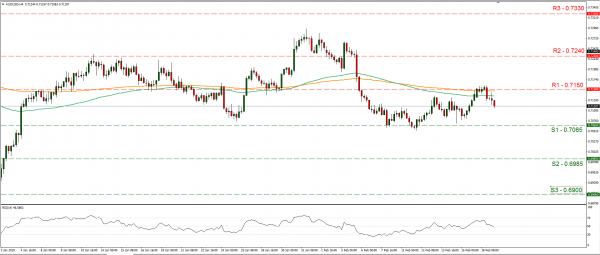

The RBA released the minutes of its last meeting, at which it showed a dovish stance. The minutes showed that RBA’s board saw significant uncertainties on the economic outlook and also examined scenarios at which the interest rate could rise as well as fall. Hence, we see the possibility of the next rate move going either way increasing. On the bright side the bank sees the labour market stronger than other economic data, yet that should be put to the test in the next days. Analysts point out the dovish elements in the meeting minutes, as RBA joins the dovish chorus of other central banks. Also they note that developments in the labour and property market, as well as household consumption remain key factors for interest rates. We could see the bank’s outlook weigh on the Aussie, yet financial releases about the labour market in the next few days could confirm or alter the AUD’s course. AUD/USD unsuccessfully tested the 0.7150 (R1) resistance line yesterday and subsequently dropped yesterday and during today’s Asian session. Technically the confirmation of the 0.7150 (R1) resistance line and the pair’s failure to break, could currently underscore the bearish momentum for the pair. Should the pair remain under the selling interest of the market, we could see it breaking the 0.7065 (S1) and aim for lower grounds. Should the pair’s long positions be favoured by the market though, we could see it having another test at the 0.7150 (R1) resistance line and should it break it, we could see it aiming for the 0.7240 (R2) resistance level.

EUR weakens as focus shifts to economy and the ECB.

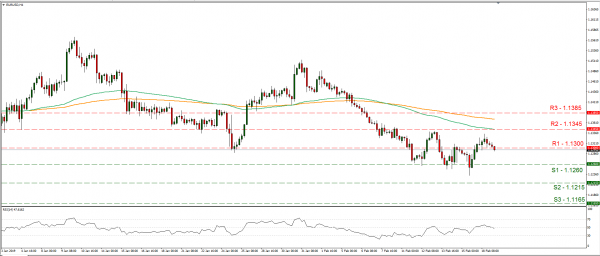

The common currency weakened yesterday mainly against the USD, as investors’ attention shifted towards the zone’s economy and central bank. The common currency weakened yesterday mainly against the USD, as investors’ attention shifted towards the zone’s economy and central bank. Analysts also predict that ECB staff could slash growth and inflation forecasts, yet at the same time there is still some time before such potential negatives are priced into the common currency. It should be noted that the yield of the German Bund has declined recently reflecting the uncertainty of the European economy. We expect the EUR to remain shaky in the next two days and financial releases to come this week could heavily influence the EUR’s direction. EUR/USD dropped yesterday, breaking just below the 1.1300 (S1) support line (now turned to resistance). We maintain our view for a sideways movement of the pair for the time being, as volatility remains low and the RSI reading, in the 4 hour chart, remains near the reading of 50 implying a rather indecisive market. Should the bears take over, we could see the pair aiming if not breaking the 1.1260 (S1) support line while if the bulls dictate the pair’s direction, we could see it breaking above the 1.1300 (R1) resistance line, aiming for the 1.1345 (R2) resistance level.

Today’s other economic highlights

During the European session today, we get Sweden’s CPI rate for January, UK’s employment data for December and Germany’s ZEW economic sentiment indicator for February. As for speakers, please note that ECB;s chief strategist Peter Praet will be speaking today.

AUD/USD H4

Support: 0.7065 (S1), 0.6985 (S2), 0.6900 (S3)

Resistance: 0.7150 (R1), 0.7240 (R2), 0.7330 (R3)

EUR/USD H4

Support: 1.1260 (S1), 1.1215 (S2), 1.1165 (S3)

Resistance: 1.1300 (R1), 1.1345 (R2), 1.1385 (R3)