For the 24 hours to 23:00 GMT, the USD rose 0.29% against the CAD and closed at 1.3330.

On the macro front, Canada’s new housing price index unexpectedly slid 0.1% on a yearly basis in January, compared to a flat reading in the prior month. Market participants had envisaged the index to remain unchanged.

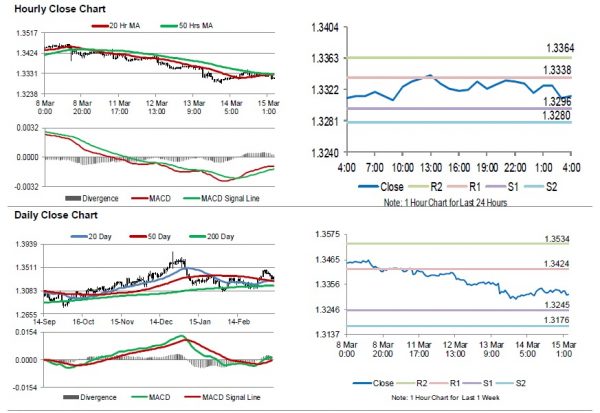

In the Asian session, at GMT0400, the pair is trading at 1.3313, with the USD trading 0.13% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.3296, and a fall through could take it to the next support level of 1.3280. The pair is expected to find its first resistance at 1.3338, and a rise through could take it to the next resistance level of 1.3364.

Trading trend in the Loonie today, is expected to be determined by Canada’s manufacturing shipments for January and existing home sales for February, slated to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.